Product categories

|

Reporting periods

|

||

|---|---|---|---|

| Name | Pillar | Earliest data | Latest data |

| IORP | Occupational (II) | 2000 | 2024 |

| Assurance Groupe - Branch 21 | Occupational (II) | 2002 | 2023 |

| Pension savings funds | Voluntary (III) | 2000 | 2024 |

| Personal pension insurance - Branch 21 | Voluntary (III) | 2002 | 2023 |

Résumé

Le système de retraite belge est constitué de trois piliers. Le premier pilier par répartition reste le plus important des trois piliers. Les retraités bénéficient d’un taux de remplacement moyen de 60.9% en 2022. Les piliers 2 et 3 constituent les pensions complémentaires professionnelles et individuelles basées sur les cotisations volontaires des individus. Le nombre d’individus couverts par les véhicules de placements dans ces deux piliers continue de croître (respectivement 85% et 68% de la population active couverte). Les véhicules de placements du pilier 2 sont gérés par des IRP ou des sociétés d’assurance. Les Belges ont accès à fonds d’investissement et à des produits d’assurance dans le cadre du pilier 3.

Sur une période de 25 ans (2000-2024), les fonds de pension gérés par les IRP (pilier 2) et les fonds d’épargne retraite (pilier 3) ont un rendement annualisé réel après charges de 1.4% et 0.9% respectivement.

Depuis 2016, le rendement garanti offert sur les nouvelles cotisations versées sur les contrats d’assurance groupe Branche 21 du pilier 2 ont été revus à la baisse et sont devenus en moyenne inférieurs à 3%. Le taux légal de rendement minimum garanti, calculé par Financial Services and Markets Authority (FSMA), s’élevait à 1,75% de 2016 à 2024. Ce taux a été relevé à 2,5% en 2025. En raison, du manque d’informations, il est plus difficile de fournir des informations détaillées et précises sur les rendements des contrats d’assurance vie groupe et assurance vie individuelle.

Summary

The Belgian pension system is divided into three pillars. The first pay-as-you-go (PAYG) pillar is still important among the three pillar and provides on average a replacement rate of 60.9% in 2022. Pillar II and Pillar III are both based on voluntary contributions. Numbers of individuals covered by pillar II and pillar III pension schemes continue to grow rapidly. Respectively 85% and 68% of the active population is covered by these pillars. In both pillar II and pillar III, pension scheme can take the form of a pension fund (managed by an institution for occupational retirement provision (IORP) in pillar II and by asset management companies in pillar III) or can be an insurance contract (Assurance Groupe contracts in pillar II and individual life-insurance contracts in pillar III).

Over a 25-year period (2000-2024), occupational pension funds managed by IORPs (pillar II) and pension savings funds (pillar III) have an annualised real performance after charges of 1.4% and 0.9% respectively.

Since 2016, the average guaranteed return on Assurance Groupe Branch 21 contracts decreased and became on average slightly under 3%. The legal minimum guaranteed rate of return, calculated by FSMA, was 1.75% from 2016 to 2024. This ratehas been risen to 2.5% from January 1st, 2025. Due to a lack of information, it is more difficult to provide return information on Assurance Groupe contracts and on individual life-insurance contracts subscribed in the framework of pillar III.

6.1 Introduction: The Belgian pension system

There are four types of vehicles for old age provision within the second and third Belgium pillars: pension funds managed by IORPs, Assurance groupe contracts within the second pillar and pension savings plans and long-term insurance products within the third pillar.

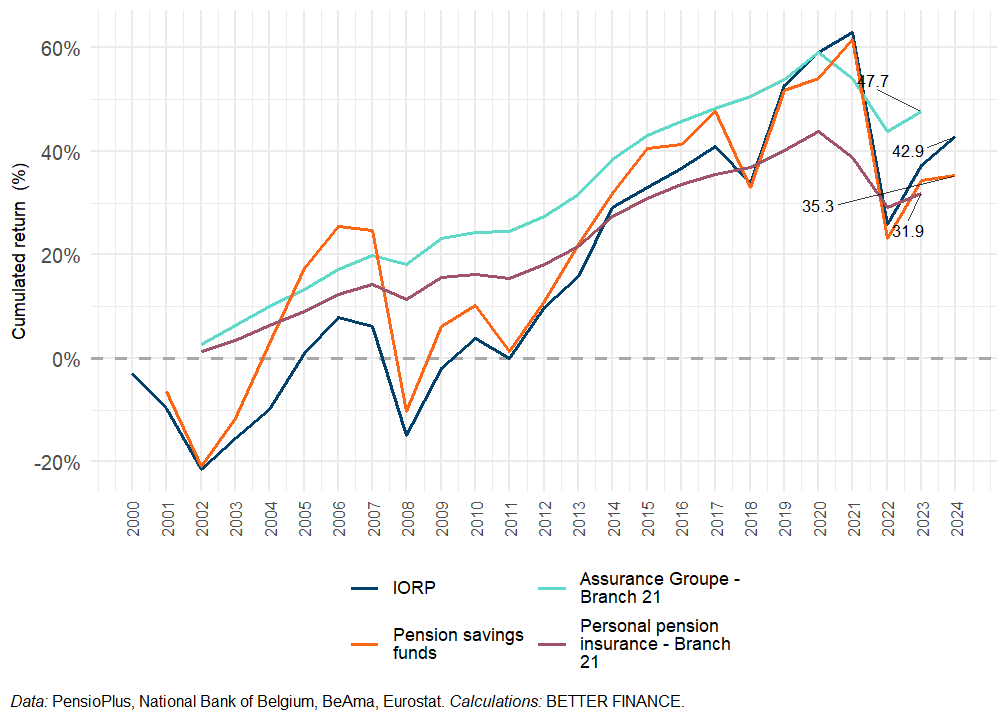

In the second pillar, pension savings plans managed by IORPs and those managed by asset management companies have similarities, notably in terms of returns. Their performance remains positive over the whole period from 2000 to 2024, with an annualised real return (after charges and before tax) of 1.55% and 0.9% respectively. These pension vehicles experienced 7 years of negative returns during the whole period (2000, 2001, 2022, 2008, 2011, 2018 and 2022).

There is little information regarding Assurance Groupe contracts and long-term insurance products within the third pillar. For the whole period (2002-2023) for which the data is available, Assurance Groupe Branch 21 offered an annualised net return of 4.17%. Individual life-insurance Branch 21 contracts offered an annualised net return of 3.63%. It is more difficult to obtain detailed information on return of Branch 23 contracts within the pillar II and III.

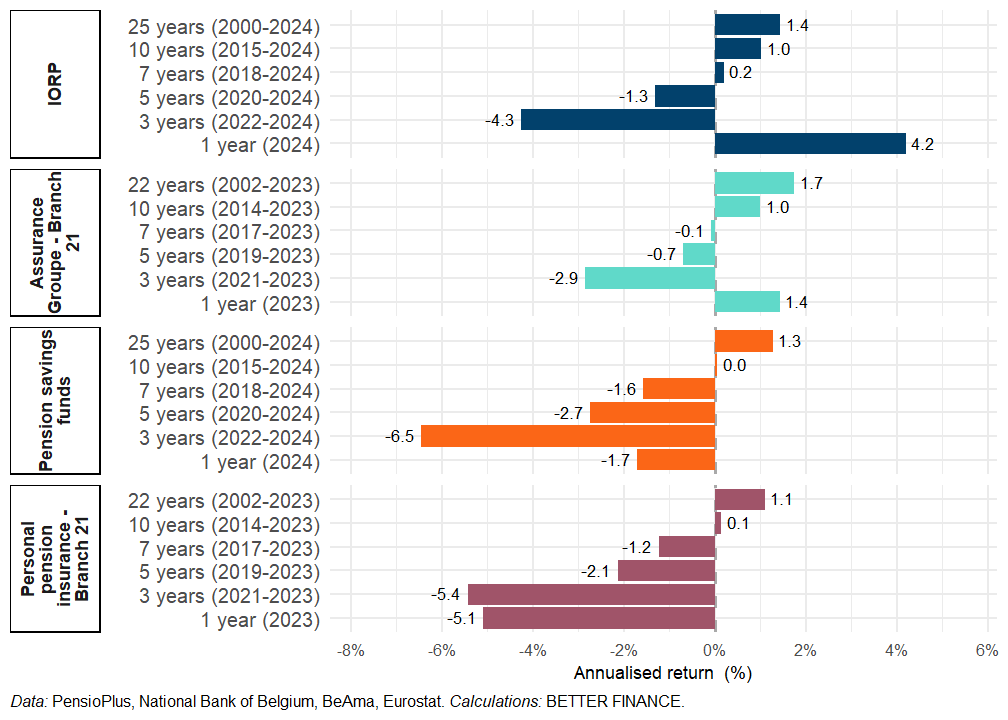

The annualised nominal, net, and real net rates of returns for the Belgium retirement provision vehicles are summarised in Table 6.1 are based on different holding periods: 1 year, 3 years, 5 years, 7 years, 10 years and since inception (2000 for pension funds and 2002 for insurance products).

Holding period

|

|||||||

|---|---|---|---|---|---|---|---|

| 1 year | 3 years | 5 years | 7 years | 10 years | Whole reporting period | to... | |

| IORP | 4.2% | -4.3% | -1.3% | 0.2% | 1.0% | 1.4% | end 2024 |

| Assurance Groupe - Branch 21 | 1.4% | -2.9% | -0.7% | -0.1% | 1.0% | 1.7% | end 2023 |

| Pension savings funds | -1.7% | -6.5% | -2.7% | -1.6% | 0.0% | 1.3% | end 2024 |

| Personal pension insurance - Branch 21 | -5.1% | -5.4% | -2.1% | -1.2% | 0.1% | 1.1% | end 2023 |

| Data: PensioPlus, National Bank of Belgium, BeAma, Funds’ annual reports, Assuralia, Eurostat; Calculations: BETTER FINANCE | |||||||

Pension system in Belgium: An overview

Pillar I — State pension

The Belgian Pillar I is organised as a PAYG pension system consisting of three regimes: a regime for employees in the private sector, one for the self-employed individuals and one for civil servants. The legal retirement age is 65 for both women and men. It used to be 60 for women until 1993 but was progressively increased to reach 65 in 2010. The Act of August 10th, 2015 increases the retirement age imposed by law to the age of 66 by 2025 and 67 by 2030. Pillar I pensions are PAYG systems based on career duration and income earned. A complete career equals to 45 working-years. The calculation of the retirement pension depends on the individual’s status, his/her career and his/her salary earned throughout his/her career. The amounts can therefore vary greatly from person to person. In 2022, the net replacement rate from the PAYG system for both men and women (with an average working wage) was 60.9%.

During the summer of 2025, the government has announced new measures that will gradually come into force as part of the pension reform, known as the ‘Arizona’ reform. Two main measures will be enter in force :

- A Bonus–Malus System :

- From January 1st, 2026, each year worked beyond the legal retirement age will earn a bonus, while early retirement leads to a penalty (malus).

- Bonus rates:

- 2% per year after legal retirement age.

- 4% per year between 2030 and 2035.

- 5% per year from 2035 onward.

- A malus applies if you retire early without meeting strict career requirements (e.g. 42 years of work with at least 35 years of 156 effective workdays per year, totalling at least 7020 days).

- A stricter definition of a “Year of Career” and limitations on assimilated periods

- A year of career now requires 156 days of actual work (up from 104 days)

- “Assimilated periods” (such as illness, parental leave, or unemployment) will be considered only up to a certain threshold in pension calculations:

- starting in 2027, only up to 40% of one’s career can be assimilated periods.

- this threshold will decrease by 5% annually, reaching 20% by 2031.

Pillar II — Funded pensions

Occupational pension plans are private and voluntary. This pillar exists for both employees and self-employed individuals. Employees can subscribe to occupational pension plans provided either by their employer (company pension plans) or by their sector of activity (sector pension plans). Company pension plans are traditionally dominant in the second pillar in comparison to sector pension plans. Self-employed individuals can decide for themselves to take part in supplementary pension plans.

An employer can set up a company pension plan for all its employees, for a group of employees or even for a single employee. In the case of sector pension plans, collective bargaining agreements (CBAs) set up the terms and conditions of pension coverage. Employers must join sector pension plans, unless labour agreements allow them to opt out. Employers who decide to opt out have the obligation to implement another plan providing benefits at least equal to those offered by the sector.

Company and sector pension plans can be considered as social pension plans when they offer a clause with solidarity benefits that provides employees with additional coverage for periods of inactivity (e.g. unemployment, maternity leave, illness). “Social pension plans” are becoming less and less prevalent, possibly because of the relatively high charges associated with these plans in comparison to pension plans without a solidarity clause.

Occupational pension plans are managed either by an IORP or by an insurance company. Insurance companies predominantly manage them.

The Supplementary Pensions Act reform entered into force as of January 1st, 2016. It amended the Act of August 10th, 2015, 2015 by introducing the alignment of the supplementary pension age and the legal pension age (respectively 65, 66 in 2025 and 67 in 2030). Supplementary pension benefits will be paid at the same time as the legal pension’s effective start. Previously, some occupational pension plans allowed early liquidation: lump sum payments or annuities from supplementary pension could be paid from the age of 60. Conversely, employees who decide to postpone their effective retirement when having reached the legal pension age, have the possibility to claim their supplementary pension or to continue to be affiliated to the pension scheme until their effective retirement.

Moreover, many supplementary pension plans provided financial compensations to offset the income loss employees may encounter when they end prematurely their career. As of January 1st, 2016, all these existing beneficial anticipation measures were abolished. Affiliates who reached the age of 55 years on December 31st, 2016 or before can still benefit from these existing measures.

At January 1st, 2023, approximatively 4470 million Belgians (85% of the active population) were covered by occupational pension plans(Autorité des Services et Marchés Financiers 2024a): 1

- 3830 million employees were covered either by their company or by their sector of activity;

- 338 082 self-employed individuals were covered by supplementary pension plans:

- 302 228 individuals were covered both by their company or by their sector of activity and by a supplementary pension plan dedicated to self-employed.

The number of Belgian citizens covered by occupational pension plans increased by 3% between 2023 and 2024.

Pillar III — Voluntary pension

The third pillar regroups individual private and voluntary pension products, which allow individuals to have tax reliefs from their contributions. There are two types of available products for subscription: pension savings funds managed either by banks or asset management companies and long-term savings products managed by insurance companies. This pillar is significant in Belgium when compared to other EU member states. The tax rate applied to accrued benefits from pension savings products (funds or insurance) was lowered from 10% to 8% in 2015, in order to encourage savings in third pillar products.2 The third pillar covered more than two thirds of the active population of Belgium, with 34% of workers subscribing to a life insurance retirement savings product (1.7 million Belgians) and 35.4% being covered by pension savings funds (1.8 million Belgians).

| Pillar I | Pillar II | Pillar III |

|---|---|---|

| State Pension | Funded pension | Voluntary pension |

| The Supplementary Pension Law (the Vandenbroucke Law) implemented in 2003 | ||

| SPFD (Federal Pensions Service) | IORPs and Insurance companies | Banks (pension savings fund) and Insurance companies (pension savings insurance and long-term savings plans) |

| Mandatory | Voluntary | Voluntary |

| Publicly-managed | Privately managed and Assurance Groupe contracts | Privately managed and life-insurance contracts |

| PAYG | Funded | Funded |

| Earnings-related public scheme with a minimum pension | DB / DC | |

| Individual retirement accounts | ||

| Quick facts | ||

| Number of old-age pensioners (as of January 1st, 2024): 2 626 106 | IORPs: 150 | Pension savings funds: 23 |

| Insurance companies: 24 | Life insurance retirement savings product | |

| Net average old-age pension (as of January 1st, 2024): EUR 1 701 | AuM: EUR 114.8 bln. (in 2022) | AuM: EUR 55.89 bln. (in 2023) |

| Gross Disposable Income per inhabitant in 2023: EUR 29 806 | Participants: 4.470 million | Participants: 3.8 million |

| Men and women\'s average replacement ratio: 60.9% (2022) | Coverage ratio: 85% of active population is affiliated with a pension product | Coverage ratio: 68% |

| Source: BETTER FINANCE (own composition). | ||

6.2 Long-term and pension savings vehicles in Belgium

Assets under management (AuM) in Belgium pension savings vehicles amounted to EUR 179.1 billion in 2023. Figure 6.1 represents the breakdown of assets under management of the different pension vehicles in Belgium from 2004 to 2023.

In 2023, 68.8% of AuM were managed in the framework of the second pillar (EUR billion). Assurance Groupe contracts remained predominant within the second pillar and represented 65.5% of outstanding amounts managed (EUR 81 billion). AuM in IORPs amounted to EUR 42.2 billion.

In the third pillar, pension vehicles are also managed either by a pension fund or by an insurance company. The share of pension savings funds represented 44.2% of asset under management within the third pillar in 2023.

Outstanding amounts of long-term pension savings, managed by insurance companies, amounted EUR 31.2 billion and represented 20% of individual life insurance outstanding amounts in 2023.

Second pillar: Occupational pension funds

The second pillar refers to occupational pension plans designed to raise the replacement rate. Savings in these plans are encouraged by tax incentives. This is based on the capitalisation principle: pension amounts result from the capitalisation of contributions paid by the employer and/or employee or by self-employed individuals in a pension vehicle. There are four types of occupational pension plans, managed by two kinds of financial intermediaries (IORPs and insurance companies):

- Company pension plans;

- Sector pension plans (CBAs);

- Pension Libre Complémentaire pour Indépendants (PLCI), Pension Libre Complémentaire pour Directeurs d’Entreprises (PLCDE) and Pension Libre Compémentaire pour les Indépendants Personnes Physiques (PLCIPP), that is, supplementary pension plans for self-employed individuals, company directors and an additional pension agreement for self-employed as individuals;

- Pension Libre Complémentaire pour Salariés (PLCS), that is, supplementary pension plan for employees.

The FSMA annually reports detailed information on institutions for occupational retirement provisions (IORPs, the EU law term for non-insurance regulated occupational pension products provider)3. Every two years, the FSMA also reports detailed information for all the other existing pension products within the second pillar.

Management of occupational pension plans

The management of occupational pension plans can be entrusted to an IORP or to an insurance company for Branch 21 and Branch 23 contracts.

Institutions for Occupational Retirement Provision (IORPs)

IORPs are asset management companies set up with the sole purpose of providing occupational retirement savings products under the form of investment funds, which can either be directly invested, through tailor-made portfolios, or which can be linked to other funds’ units (unit-linked).

FSMA reported the following data on IORPs in 2023 (as of January 1st, 2024):

- 145 occupational pension plans were managed by an IORP.

- Number of affiliates to IORPs increased to 2 514 661 against 2 409 231 in 2022.

- Based on the amount of reserves managed out of the total in Pillar II, IORPs had a market share of 34%, the rest being managed by insurance companies through Branch 21 and Branch 23 contracts.

Assurance Groupe (Branch 21 and Branch 23 contracts):

Occupational pension plans are predominantly managed by insurance companies. Such pension plans are called Assurance Groupe contracts and can be divided into two different types of contracts.

First, Branch 21 contracts are occupational plans, offering a guaranteed return on contributions made by employers and employees. From 2016, FSMA calculates and publishes each year, the rate applicable to the calculation of the minimum return guaranteed. Since 2016, this rate was set at 1.75% and remained unchanged. From January 1st, 2025, it increased to 2.50% (for more information see Section 6.5.1). The insurance companies who provide these contracts bear the risk and pay the guaranteed return in addition to a profit-sharing. All sector pension plans and all supplementary pension plans for self-employed individuals managed by insurance companies take the form of Branch 21 contracts. Most of company pension plans are also managed through Branch 21 contracts rather than Branch 23 contracts.

Second, Branch 23 contracts are unit-linked contracts and are invested mainly in investment funds and equity markets. Insurance companies do not offer a guaranteed return on contributions made into the plan. Their total returns depend on their portfolio composition. However, affiliates to Branch 23 contracts benefits from the legal minimum guaranteed return, which is the same to that of Branch 21 contracts (1.75% from 2016 and 2.50% from 2025). In case of a shortfall on the individual account when paying a benefit or a transfer of reserves, the employer must pay the difference. This kind of occupational plans are riskier for employers who bear the risk and are generally costlier.

In the second pillar, some company pension plans and some PLCI are managed through Branch 23 contracts. Reserves managed in Branch 23 contracts amounted EUR 7 billion in 2023, representing 9.5% of the total outstanding amounts managed within Assurance Groupe contracts (see Table 6.4).

| Year | IORP (1) | Assurance Groupe - Branch 21 (2) | Assurance Groupe - Branch 23 (3) | Total Assurance Groupe (2+3) | Total Pillar 2 (1+2+3) |

|---|---|---|---|---|---|

| 2004 | 11.7 | 29.9 | — | — | 41.6 |

| 2005 | 13.4 | 30.6 | 1.6 | 32.2 | 45.6 |

| 2006 | 14.3 | 33.5 | 1.7 | 35.2 | 49.5 |

| 2007 | 14.9 | 37.3 | 1.7 | 39.0 | 53.9 |

| 2008 | 11.1 | 39.0 | 1.4 | 40.5 | 51.6 |

| 2009 | 11.2 | 41.1 | 1.8 | 42.9 | 54.1 |

| 2010 | 13.9 | 44.1 | 1.8 | 45.9 | 59.8 |

| 2011 | 14.0 | 46.7 | 1.6 | 48.3 | 62.3 |

| 2012 | 16.4 | 47.9 | 1.7 | 49.6 | 66.0 |

| 2013 | 18.0 | 52.7 | 1.9 | 54.6 | 72.6 |

| 2014 | 20.7 | 55.8 | 2.1 | 57.9 | 78.6 |

| 2015 | 21.9 | 58.9 | 2.1 | 61.1 | 83.0 |

| 2016 | 26.8 | 60.2 | 2.4 | 62.6 | 89.4 |

| 2017 | 32.0 | 62.0 | 3.2 | 65.2 | 97.2 |

| 2018 | 31.4 | 63.7 | 3.7 | 67.4 | 98.8 |

| 2019 | 36.9 | 65.7 | 4.7 | 70.4 | 107.3 |

| 2020 | 39.7 | 68.4 | 5.2 | 73.6 | 113.3 |

| 2021 | 43.2 | 69.3 | 6.0 | 75.4 | 118.6 |

| 2022 | 37.0 | 72.3 | 5.5 | 77.8 | 114.8 |

| 2023 | 42.2 | 74.0 | 7.0 | 81.0 | 123.2 |

| Data: FSMA, National Bank of Belgium (NBB). | |||||

Description of occupational pension plans

The following sub-sections has be updated this year, thanks to FSMA’s bi-annual publications which include detailed information on the different types of occupational plans. The following information and figures reported were provided as of January 1st, 2024, and were extracted from FSMA’s bi-annual reports published in 2025. (Autorité des Services et Marchés Financiers 2025b) The different occupational pension plans are described by increasing market share in terms of individuals’ accrued reserves.

Company pension plans (EUR 65.6 billion)

Company pension plans are prevalent within the second pillar:

- The total individuals’ accrued reserves amounted to EUR 65.6 billion against 59.5 at end-2021and 53 billion at end-2019 75% of these reserves were managed by 18 insurance companies through Assurance Groupe Branch 21 or 23 contract (EUR 49.1 billion) and 25% were managed by 107 IORPs (EUR 16.5 billion).

- 2 327 442 employees were affiliated to a company pension plan. This is an increase of 9.5% from January 1st, 2022. The total number of employers that had set up one or more pension plans under a company pension scheme stood at 63 010 (4% more than on January 1st, 2022).

- The total number of employers who implemented a collective pension commitment for the benefit of their workers was 63 010. This is an increase of 4.7% compared to January 1st, 2022, when 60 160 employers set up a pension scheme (with one or more pension commitments). The number of company pension plans increased to130 436, against 123 454 in 2021, representing an increase of 4.9% in two years.

Private Supplementary Pensions for Company Director (PLCDE) (EUR 21.3 billion)

The Private Supplementary Pension for Company Director is a tripartite relation between the company (the organizer), who can implement a pension commitment for the benefit of its director(s) and the commitment is managed by a pension organisation (either insurance companies or IORPs). FSMA provides the following data on PLCDE at January 1st, 2024 (Autorité des Services et Marchés Financiers 2025a):

251 762 directors were affiliated to a PLCDE, against 246 227 in 2021. This is an increase of 2.2% from January 1st, 2022.

The total number of organisers who implemented an individual or collective pension commitment for the benefit of its director(s) was 232 137, against 223 913 at end-2021. This represented an increase of 3.7% from January 1st, 2022.

The total number of commitments dedicated to Director increased and reached 350 698, against 343 487. Most of commitments were Defined contributions (DC) (95%) and were dedicated for only one affiliate (98%).

The management of the pension commitments were managed quasi-exclusively by insurances companies (99.8%).

Total individuals’ accrued reserves amounted to EUR 21.3 billion and the contributions amounted to 1.05 billion euros. These reserves decreased by 0.4% when compared to January 1st, 2022.

Private Supplementary Pensions for self-employed individuals (PLCI) (EUR 11 billion)

In 2004, PLCIs—Private Supplementary Pensions for self-employed individuals—were integrated into the Supplementary Pensions Act. PLCIs enable self-employed individuals to get a supplementary and/or a survival pension at their retirement. Since 2004, self-employed individuals have the choice to contribute to supplementary pension plans. Moreover, they can henceforth choose the pension provider, either an IORP or an insurance company. They can switch from one provider to another during the accumulation period. Self-employed individuals can save up to 8.17% of their income, without exceeding a maximum annually indexed amount (EUR 4000.44 in 2025). These ceilings can be increased up to 9.40% and EUR 4602.71 when a social convention is subscribed. FSMA provided the following information at January 1st, 2024:

551 962 self-employed individuals were covered by supplementary pension plans (PLCI convention).

Total individuals’ accrued reserves amounted to EUR 11.1 billion, which increased by 12.5% since January 1st, 2022. 94.1% of PLCI conventions were managed by insurance companies, predominantly by Branch 21 contracts.

Self-employed individuals can also supplement their PLCI with several solidarity benefits, called social conventions (Institut National d’Assurance Maladie-Invalidité (INAMI) convention). Around a third of self-employed individuals who were affiliated to PLCI convention, were affiliated to a social convention at January 1st, 2024. These conventions offer benefits such as the funding of the PLCI in the case of inactivity and/or the payment of an annuity in the case of income loss.

Sector pension plans (EUR 6 billion) [^cc_belgium-4]

Sector pension plans are supplementary pension commitments set up on collective bargaining agreements and concluded by a joint committee or sub joint committee. In the joint committee/sub-committee, a sectoral organiser responsible for the pension commitment is appointed. At January 1st, 2024, FSMA provides the following information:

55 joint or sub joint committees offered occupational pension schemes to employees. No new pension schemes came into effect since 2022. In certain sector groups, such as distribution, textiles, and business services, sector pension schemes had still been introduced to a limited extent or not at all in 2023. The number of employees covered by a sector pension plan reached 2 570 149, which represents an increase of 10% when compared to January 1st, 2022.

There are 52 sector pension schemes available for subscription. The total individuals’ accrued reserves amounted to EUR 6billion. It represents an increase of around 30% over the last six years. More than half (58%)of these reserves were managed by 10 IORPs (EUR 3.5 billion) and a third by 7 insurance companies through Assurance Groupe Branch 21 or 23 contracts (EUR 2.5billion). 4

Convention for self-employed as individuals (PLCIPP) (EUR 208 million)

Since July 1st, 2018, self-employed individuals without a company, can subscribe a pension agreement for self-employed individual PLCIPP, whether combined or not with a PLCI. FSMA provides information on this new type of pension agreement at January 1st, 2024:

There were 7134 pension agreements which covered 6994 self-employed individuals. The number of individuals covered by a PLCIPP increased by 6% when compared to January 1st, 2022.

The total individuals’ accrued reserves amounted to 208 million euros. 54.2% of reserves are managed by Branch 21 contracts, 32.7% by combined Branch 21 / Branch 23 contracts, 6.3% by Branch 23 contracts and 6.8% by IORPs

The total amount of contributions amounted to 34.7 million euros in 2023. Contributions decreased by 26% compared to 2021.

Supplementary pension for employees (PLCS) (EUR 2.1 million)

Until March 2019, an employee could constitute an additional pension only if there is a pension plan within the company or the sector of activity which employs him/her. The legislator introduced a new form of pension constitution for employees on March 27th, 2019. If the employee does not constitute a supplementary pension with his/her employer or within his/her sector of activity, or if it is low, the employee can take the initiative to constitute an additional pension (PLCS). This supplementary pension has a limited success in terms of covered population, even if the total reserves increased significantly. FSMA published data as of January 1st, 2024:

- There were 1354 pension agreements which covered 1340 employees. The number of employees covered by a PLCS increased by 20% by two years. Most employees constituting pension rights under the PLCS signed only one agreement.

- The total accrued reserves amounted to EUR 4.3 million (against EUR 2.1 million as of January 1st, 2022).

- These pension agreements are managed by three insurance companies. 78% of reserves are managed by combined Branch 21/Branch 23 contracts and 13% by Branch 21 contracts and 9% by Branch 23 contracts.

Third pillar: pension savings products and long-term savings products (individual life insurance products)

The third pillar provides Belgians with individual private and voluntary pension products, which allow them to have tax reliefs from their contributions. Two types of products are available for subscription:

- Pension saving funds managed by asset management companies,

- Pension savings insurance (Branch 21 contracts) and long-term savings products (combined Branch 21 and Branch 23 contracts or only Branch 23 contracts) managed by insurance companies.

The third pillar is significant in Belgium when compared to other European Union member states. The tax rate applied to accrued benefits from pension savings products (funds or insurance) was lowered from 10% to 8% in 2015, in order to encourage savings in the framework of this pillar.5 The third pillar covered more than two thirds of the active population of Belgium, with 34% of workers subscribing to a life insurance retirement savings product (1.7 million Belgians) and 35.4% being covered by pension savings funds (1.8 million Belgians).

| Year | Net AuM in pension savings funds | Reserves managed in long-term pension products |

|---|---|---|

| 2003 | 7.4 | — |

| 2004 | 8.7 | — |

| 2005 | 10.3 | — |

| 2006 | 11.5 | — |

| 2007 | 11.8 | — |

| 2008 | 9.0 | — |

| 2009 | 11.1 | — |

| 2010 | 12.0 | — |

| 2011 | 11.2 | — |

| 2012 | 12.6 | — |

| 2013 | 14.4 | 27.0 |

| 2014 | 15.6 | 27.9 |

| 2015 | 16.9 | 29.8 |

| 2016 | 18.0 | 30.6 |

| 2017 | 19.6 | 31.3 |

| 2018 | 18.2 | 31.7 |

| 2019 | 21.3 | 32.0 |

| 2020 | 22.3 | 31.5 |

| 2021 | 25.6 | 31.8 |

| 2022 | 22.1 | 31.5 |

| 2023 | 24.7 | 31.2 |

| 2024 | 26.1 | — |

| Data: BEAMA, Assuralia. | ||

The Belgian pension savings funds market remains relatively concentrated since the launch of the first funds in 1987. The market grew significantly in the past few years. 21 products (18 Undertaking for Collective Investment in Transferable Securitiess (UCITSs) and 3 Alternative Investment Funds (AIFs) were available for subscription at end-2024. The net assets under management reached EUR 26.2 billion (+6% over a year). The net sales remained high and amounted to EUR 47 million in 2024.

6.3 Charges

Information regarding costs applied to occupational pension funds in Belgium is only provided by FSMA in its biannual reports on the various products available for employees and self-employed individuals. FSMA provides information on management fees. There is no information regarding other costs and charges like entry fees. Assuralia provides some information on the administration and management fees and fees on commissions.

For the first time, FSMA published a report on the costs within the second and the third pillars (see Autorité des Services et Marchés Financiers 2024b) in 2024. All data in this publication was reported for the whole year 2020. FSMA has published the update of this study for the whole year 2022.

Charges of Pillar II products: Few data available

Charges in IORPs

There is no general data or available information on IORP charges. The only available information was for sector pension funds managed by IORPs (Autorité des Services et Marchés Financiers 2025b): Total operating expenses reached 0.21% of reserves in 2023 (see Table 6.6)

| Year | Admin. and mgt. fees |

|---|---|

| 2010 | 0.16% |

| 2011 | 0.17% |

| 2012 | 0.19% |

| 2013 | 0.16% |

| 2014 | 0.14% |

| 2015 | 0.15% |

| 2016 | 0.15% |

| 2017 | 0.13% |

| 2018 | 0.15% |

| 2019 | 0.14% |

| 2020 | 0.18% |

| 2021 | 0.15% |

| 2022 | 0.21% |

| 2023 | 0.21% |

| Data: Funds’ annual reports Calculations: BETTER FINANCE. | |

| Note: Average fees of sectoral plans managed by IORPs | |

In the reporting for the year 2022, the breakdown between management fees and financial expenses is no longer available. Average weighted total fees of total provisions was 0.51%, with disparities depending on the type of pension Fees ranged between 0.45% for company pension funds and 1.29% for convention for self-employed as individuals (PLCIPP).

Charges in “Assurance Groupe” (Branch 21 contracts)

The only historical information on administration and management costs as well as commissions on a yearly basis is for Assurance Groupe contracts (Branch 21), reported by Assuralia (see Table 6.7).

| Year | Acquisition fees1 | Admin. and mgt. fees |

|---|---|---|

| 2002 | 1.20% | 1.21% |

| 2003 | 1.30% | 0.98% |

| 2004 | 1.20% | 0.84% |

| 2005 | 1.40% | 0.93% |

| 2006 | 1.20% | 0.90% |

| 2007 | 1.40% | 0.80% |

| 2008 | 1.50% | 0.83% |

| 2009 | 1.30% | 0.79% |

| 2010 | 1.50% | 0.72% |

| 2011 | 1.50% | 0.71% |

| 2012 | 1.50% | 0.71% |

| 2013 | 1.50% | 0.69% |

| 2014 | 1.60% | 0.68% |

| 2015 | 1.60% | 0.62% |

| 2016 | 1.60% | 0.60% |

| 2017 | 1.80% | 0.59% |

| 2018 | 1.40% | 0.59% |

| 2019 | 1.50% | 0.57% |

| 2020 | 1.50% | 0.57% |

| 2021 | 1.30% | 0.57% |

| 2022 | 1.20% | 0.59% |

| 2023 | 1.20% | 0.65% |

| 1 % of premiums | ||

| Data: Assuralia Calculations: BETTER FINANCE. | ||

In 2022, FSMA reported average weighted entry fees were 2.95% for Branch 21 contracts and 1.98% for Branch 23 contracts and the weighted average current costs were respectively 0.05% and 2.02%. In Branch 23 Group Insurances (Assurance Groupe), charges can be higher: in addition to contract fees other fees related to underlying “units” (typically investment funds) may apply.

Charges of Pillar III products: More transparent than Pillar II products

Pension savings funds

Historical data on charges for pension savings funds is difficult to obtain for investors. Key Information Documents (KIDs) must provide investors with information on all charges related to the funds on a yearly basis, but for UCITSs only, not for other investment funds.

Using the prospectus of the 236 available pension savings funds for subscription in the Belgian market, the following average yearly charges were calculated in 2024:

- Entry fees: 2.30% of initial investment;

- Management fees: 1.06% of AuM;

- Total Expenses Ratio represented on average 1.35% of AuM;

- No exit fees.

Table 6.8 summarises the TER of 23 available funds for subscription in the Belgium market since 2013. Charges remained quite stable in 2024 when compared to previous years. One could notice that information regarding costs were more detailed in KIDs or factsheets available on providers’ website, with more information on how the different costs impact the return of investments depending on duration. There is much information on the different type of costs.

| Year | Entry fees1 | Admin. and mgt. fees | Total Expense Ratio |

|---|---|---|---|

| 2013 | 2.20% | 1.00% | 1.23% |

| 2014 | 2.20% | 1.00% | 1.24% |

| 2015 | 2.20% | 1.00% | 1.29% |

| 2016 | 2.81% | 0.93% | 1.26% |

| 2017 | 2.21% | 0.94% | 1.26% |

| 2018 | 2.32% | 0.93% | 1.24% |

| 2019 | 2.37% | 0.95% | 1.28% |

| 2020 | 2.38% | 0.95% | 1.28% |

| 2021 | 2.29% | 0.95% | 1.29% |

| 2022 | 2.24% | 1.02% | 1.38% |

| 2023 | 2.24% | 1.04% | 1.37% |

| 2024 | 2.30% | 1.06% | 1.35% |

| 1 % of contributions | |||

| Data: Funds’ annual reports Calculations: BETTER FINANCE. | |||

Pension savings insurance (Branch 21 contracts) / Long-term savings products (Branch 21 and Branch 23 contracts combined)

Assuralia provides us with historical data on administration and management costs as well as entry fees and other commissions paid for individual life insurance contracts. Data, for Branch 23 individual life insurance contracts, most likely do not include fees charged on the underlying units (investment funds).

| Year | Acquisition fees1 | Admin. and mgt. fees |

|---|---|---|

| 2002 | 3.65% | 1.20% |

| 2003 | 3.35% | 1.80% |

| 2004 | 3.15% | 1.40% |

| 2005 | 2.65% | 0.50% |

| 2006 | 4.05% | 0.50% |

| 2007 | 4.40% | 0.45% |

| 2008 | 5.40% | 0.55% |

| 2009 | 5.70% | 0.45% |

| 2010 | 5.25% | 0.40% |

| 2011 | 5.30% | 0.40% |

| 2012 | 4.75% | 0.40% |

| 2013 | 6.80% | 0.45% |

| 2014 | 6.50% | 0.50% |

| 2015 | 7.00% | 0.45% |

| 2016 | 6.85% | 0.45% |

| 2017 | 7.10% | 0.50% |

| 2018 | 6.90% | 0.50% |

| 2019 | 6.85% | 0.45% |

| 2020 | 7.50% | 0.45% |

| 2021 | 7.80% | 0.50% |

| 2022 | 7.60% | 0.54% |

| 2023 | 7.10% | 0.61% |

| 1 % of premiums | ||

| Data: Assuralia Calculations: BETTER FINANCE. | ||

FSMA reported average weighted entry fees of 6.05% for Branch 21 and of 2.78% for Branch 23 contracts in 2022. Average weighted current costs were lower than entry fees and represented 0.07% of provisions for Branch 21 contracts and 2.28% of provisions for Branch 23 contracts.

6.4 Taxation

Taxation of occupational pension plans (pillar II)

Regarding the second pillar in Belgium, the tax regime for the whole saving period is an Exempt Exempt Taxed (EET) model. Employees are not taxed during the first two phases that constitute the process of savings via a pension scheme: contribution and accrued interests are not taxed. Employees are taxed during the third phase on the benefits’ payment.

Employees pay two taxes on their benefits:

- A solidarity contribution varying up to a maximum of 2% of the benefits depending on the retiree’s income;

- INAMI contribution of 3.55% of the benefits.

In addition, benefits from occupational pension plans are taxed depending on how they are paid out:

- A lump sum payment;

- Periodic annuities;

- A life annuity issued from invested benefits.

| Benefits paid before the legal pension | Benefits paid at the same time as the legal pension | ||

|---|---|---|---|

| Benefits from employee\'s contributions | Benefits from employer\'s contributions | Benefits from employee\'s contributions | Benefits from employer\'s contributions |

| 16.5% for contributions made before 1993 | 60 years old: 20% | 16.5% for contributions made before 1993 | 10% if the employee remains employed until legal pension age (65 years old) |

| 10% for contributions made since 1993 | 61 years old: 18% | 10% for contributions made since 1993 | |

| 62–64 years old: 16.5% | |||

| + local tax | + local tax | + local tax | + local tax |

| Source: Assuralia, Wikifin.be. | |||

Lump sum payment

In the case of a lump sum payment, the taxation of benefits depends on the beneficiary’s age and who contributed to the plans (employer or employee). Since July 2013, the rules detailed in Table 6.10 are applied to taxation on benefits from occupational pension plans. Before July 2013, benefits from employer’s contributions were taxed at the flat rate of 16.5% regardless the beneficiary’s age at the time of the payment of the benefits. The local tax can vary from 0% to 10%, with an average of 7%.

Periodic annuities

Periodic annuities are considered as an income and are taxed at the applicable progressive personal income tax rate.

Converting the accumulated capital into a life annuity

An employee can convert the lump sum payment into a life annuity. In this case, the INAMI contribution and the solidarity contribution must be paid according to the rules applied to the lump sum payment. Then the retiree must pay a withholding tax of 15% on the annuity each year.

Taxation of Personal pension savings products (pillar III)

Regarding the third pillar in Belgium, the tax regime for the whole saving period is an EET model with a limited ceiling on contributions during the first phase for pension savings products and with a limited ceiling on the maximum tax benefit depending on the level of the saver’s yearly earnings for long-term savings products (see below and Table 6.11).

Tax relief on contributions during the accumulation phase:

From 2012 to 2018, a tax relief rate equal to 30% of the contributions was applied, regardless of the taxpayer’s income. In 2018, to further promote contributions into pension savings products (fund or life-insurance contracts), a two - tax relief system was introduced. The amount of the individual contribution determines the tax relief, depending on two annual ceilings. Despite high inflation, the two ceilings on contributions to benefit from tax relief was frozen from 2020 to 2023. They increased in 2024 and 2025. Individuals can make contributions into pension savings products up to these two annual ceilings in 2025:

- For any contribution less or equal to EUR 1050, individuals can still benefit from a 30% tax relief rate. This may result in a maximum tax relief of EUR 315 per year.

- If the individual chooses to save above EUR 1050 and informs the provider of the product, he/she can benefit from a tax relief rate equal to 25%. The maximum contribution cannot exceed EUR 1350, with a maximum tax-relief of EUR 337.5. This tax relief rate is more advantageous only if the individual saves at least EUR 1260. Otherwise, the individual will benefit from a smaller tax advantage than if he/she opts for the first ceiling.

The tax relief of pension savings products is “stand-alone.” Taxpayers can claim tax relief for only one contract even if they make contributions to several products.

Final taxation on the accumulated pension rights:

Since January 1st, 2015, the final taxation on the accumulated capital was lowered from 10% to 8% and still depends on the beneficiary’s age at the time of the subscription. From 2015 onwards, a part of the taxation is levied in advance (except in case of early retirement before the age of 60). From 2015 to 2019, the pension reserves (per December 31st, 2014) were subject to a tax of 1% each year, which constituted an advance on the final tax due.

As of January 1st, 2026, Belgium will introduce a 10% tax on capital gains from financial assets. The tax will apply to realised gains only, with the value of assets as of December 31st, 2025 serving as the reference point. An annual exemption of EUR 10 000 will apply, with limited carry-forward options available. Retirement savings products within pillars 2 and 3 will be exempt from this tax.

| Subscription to pension savings products before the age of 55 | |

|---|---|

| Benefits paid before the age of 60 | The accumulated capital is taxed under the personal income tax system. |

| At the age of 60 | 8% of the accumulated capital is levied (excluding participation to annual earnings); |

| The taxation is based on a theoretical return of 4.75%; | |

| The saver can continue investing and enjoying tax relief until the age of 64; | |

| The accumulated capital is no longer taxed after the 60th birthday of the beneficiary. | |

| Subscription to pension savings products at the age of 55 or after | |

| Benefits paid before the age of 60 | The accumulated capital is taxed under the personal income tax system. |

| Benefits paid between the age of 60 and 64 | The accumulated capital is taxed at the rate of 33%. |

| At the age of 65 or after (i.e., when the contract reaches its 10th anniversary) | 8% of the accumulated capital is levied (excluding participation to annual earnings); |

| The taxation is based on a theoretical return of 4.75%; | |

| To benefit from this lower taxation, the beneficiary has to stay at least 10 years in the fund and make at least five contributions. | |

| Source: Assuralia, Wikifin.be. | |

6.5 Performance of Belgian long-term and pension savings

Real net returns of Belgian long-term and pension savings

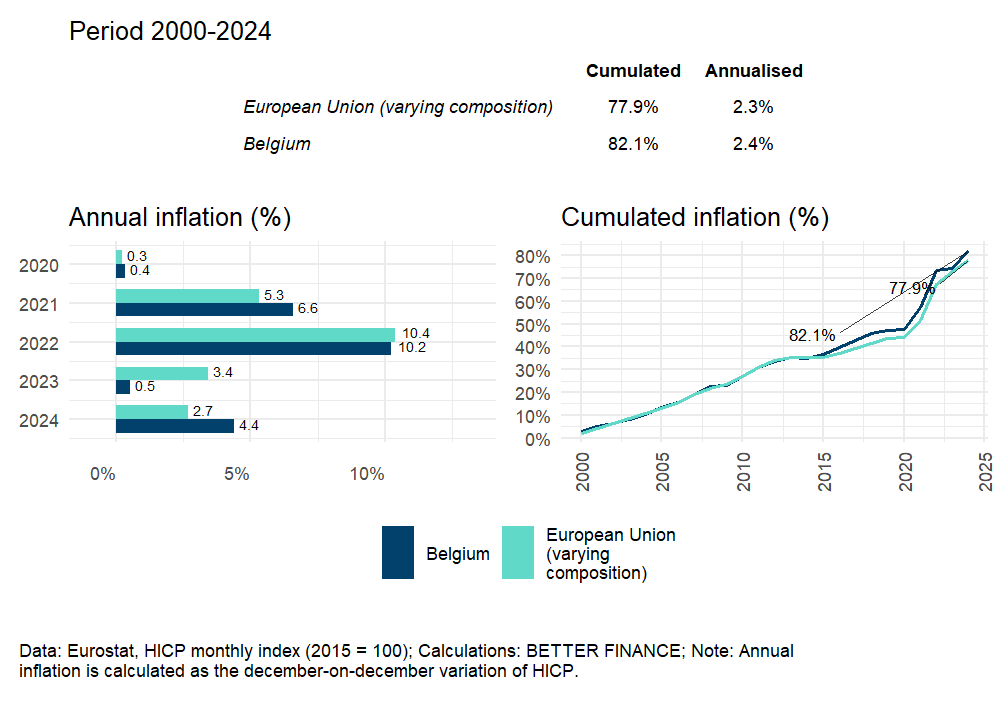

The evolution of inflation in Belgium used to follow the evolution of inflation in the EU. As in all European countries, the inflation started to increase in 2021 in Belgium, with the outbreak of the war between Ukraine and Russia and the increase in energy prices. The inflation continued to rise and sky-rocketed and became higher than the average EU inflation in 2021 (6.59% against 5.31%). It reached a similar level in 2022 (10.21% against 10.39%). In 2023, the inflation rate declined to reach 0.5%, thanks to a decrease in energy prices. In 2024, rising energy prices fuelled inflation in Belgium, which was higher than inflation in European Union (EU).

Pillar II: IORPs and Assurances Groupe contracts

The returns of occupational pension plans depend on how they are managed, either by an IORP or by an insurance company. From 2004 to 2015, all DC plans managed either by IORPs or insurance companies through Branch 21 contracts were required to provide an annual minimum return of 3.75% on employees’ contributions and 3.25% on employers’ contributions. The Supplementary Pensions Act reform entered into force as of January 1st, 2016, to ensure the sustainability and social character of the supplementary pensions. The level of the minimum guaranteed return for both employer and employee contribution is set each year according to economic rules considering the evolution of government bond yields in the future:

- the new guaranteed return must be within the range of 1.75% to 3.75%;

- the new guaranteed return represents 65% of the average of 10-year government bonds rates over 24 months, rounded to the nearest 25 basis points to prevent it from fluctuating too frequently.

In addition, the alignment of the supplementary pension age and the legal pension age (respectively 65, 66 in 2025 and 67 in 2030) may affect negatively the minimum guaranteed return offered to employees. When the affiliate reaches the age of 60, his/her occupational pension plan is extended until he/she reaches the age of 65. During the extension period, employers and pension product providers have to agree on the rules to apply in terms of the minimum guaranteed return.

Occupational pension plans managed by IORPs

In 2023, among the 150 pension plans managed by an IORP7, 126 had a promise of returns (Defined benefits (DB)) or were hybrid plans (Cash Balance, DC+ rate), 24were DC plans. While newly opened plans are always DC plans, a large part of assets are still managed in plans offering promises of returns.

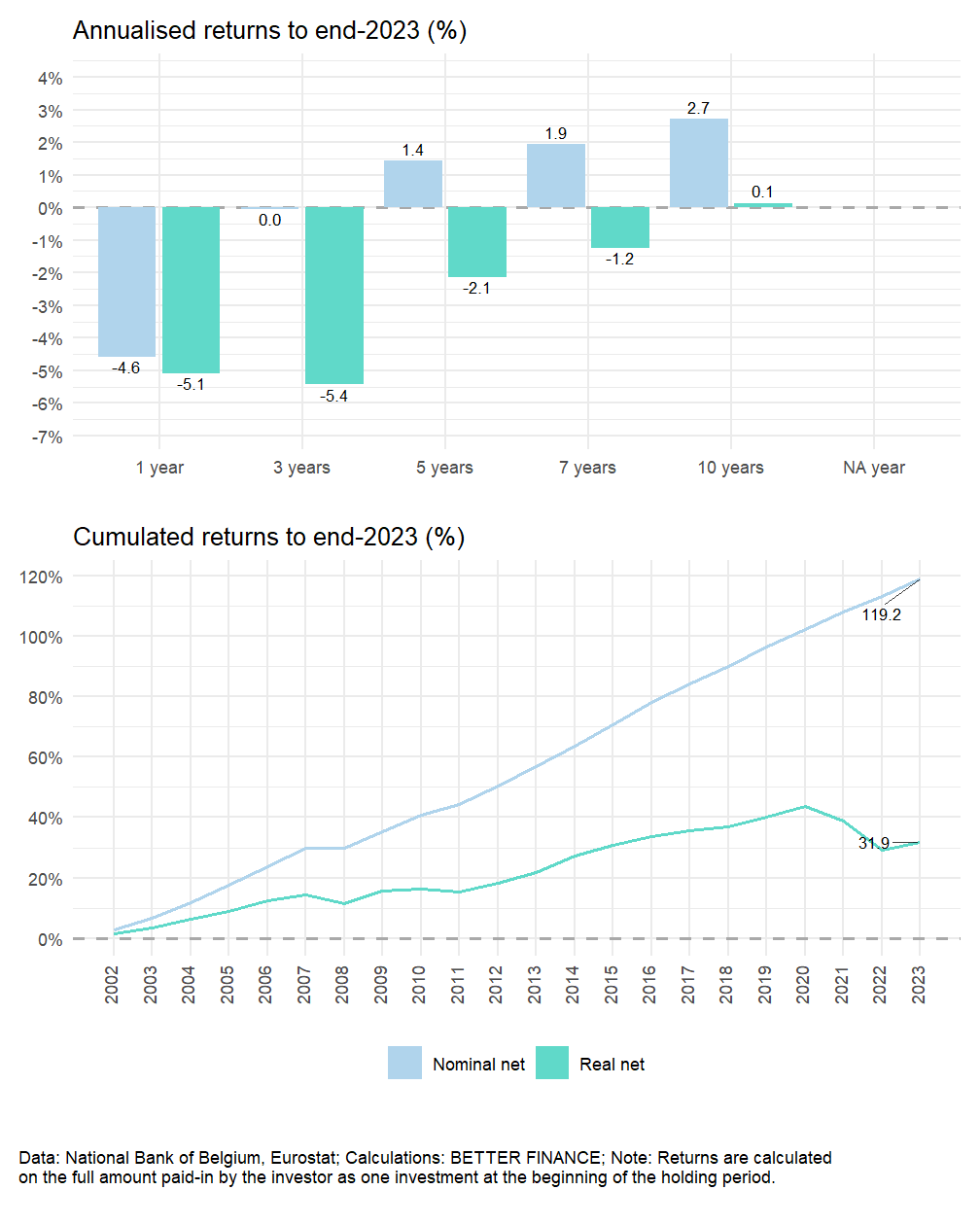

PensioPlus, the Belgium’s occupational pension plans association reported an average return of 8.79% in 2024. This represents the gross average weighted returns after charges of occupational pension plans that participated in the annual financial and economic survey of PensioPlus in 2024.8 PensioPlus reported the nominal and real net returns of IORP since 1985. These funds experienced 9 years of negative returns over 39 years.

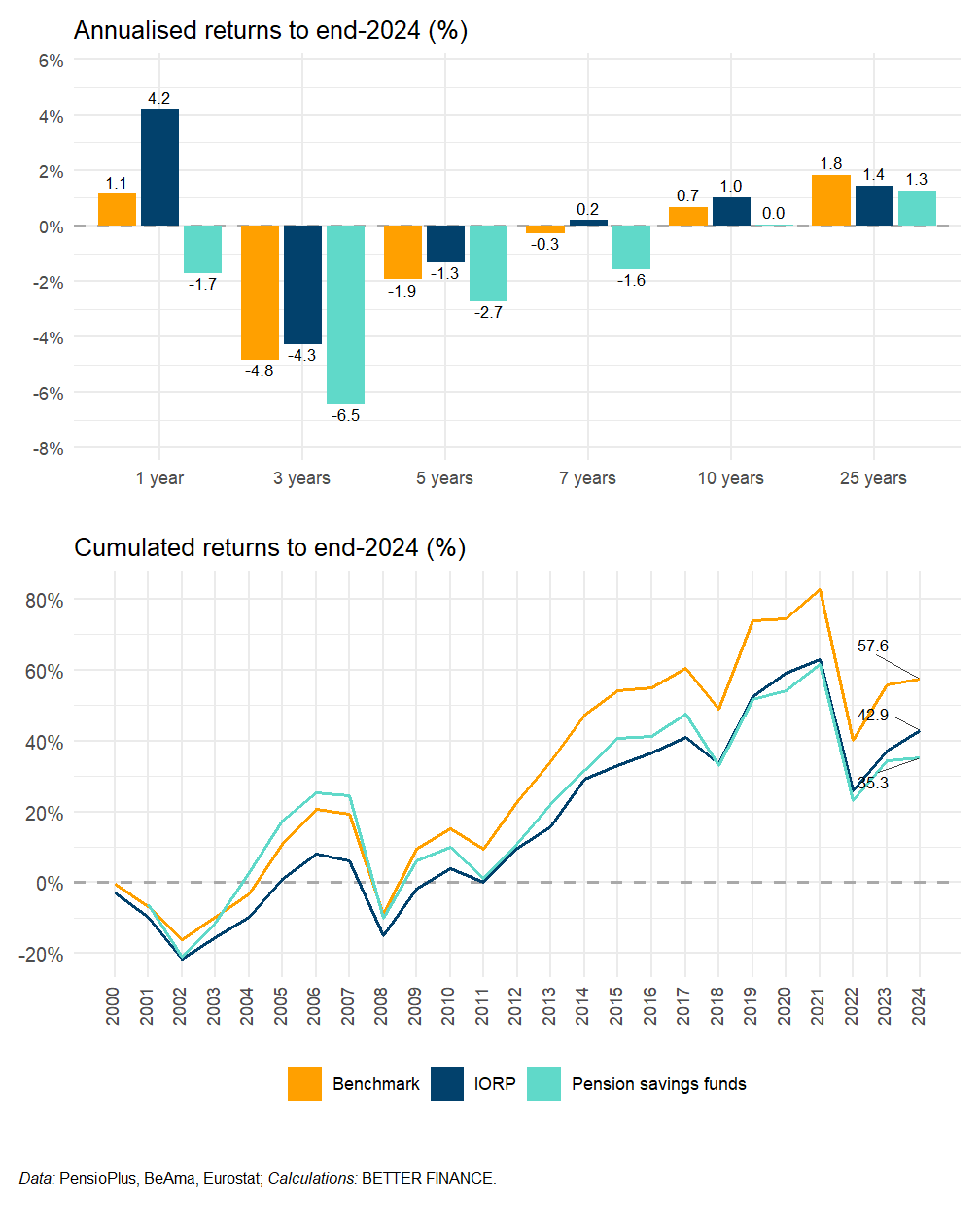

Over a 25-year period (2000-2024), occupational pension plans managed by IORPs experienced negative nominal returns before charges five times: in 2001, 2002, 2008, 2018 and in 2022. Over this time-period, their annualised nominal and real net returns are positive, respectively 3.9% and 1.4%.

PensioPlus reported the average asset allocation of IORP at end-2024, as follows: 49.5% in fixed-income 35.9% in equities, , 4% in asset allocation funds, , 2.6% in cash, 2.2% in real estate and 5.8% in other asset classes. The proportion of fixed income assets still represented the largest part of assets and remained stable while the proportion of equities increased slightly. (see Figure 6.4).

In the second pillar, most of pension products are managed by insurance companies through Assurance Groupe Branch 21 contracts.

Assuralia used to reports net returns after charges in percentage of the total reserves of Assurance Groupe Branch 21 contracts in its annual report this report, until 2014.9

In 2025, FSMA reported some information on returns in its bi-annual report on sector pension, company pension andPLCS. It reported an average net return of 1.87% for sector pension funds managed through Assurance Groupe contracts in 2023 as in 2022 against 1.96 in 2021, 2.02% in 2020, 2.18 in 2019. [see@fsma2025pensioncomplementairesalaries[. The downward trend that has been observed for several years is confirmed. The same assessment is observed for PLCI conventions.

The minimum guaranteed return of PLCI varied between 0% and 4.75%. Some conventions subscribed before July 1st, 1999, offer a guaranteed return of 4.75% on past and future premiums. A self-employed individual who subscribes to a PLCI convention had on average a return of 2.2% on his/her contracts in 2023 (against 1.68% in 2022, 2.36% in 2021, 2.5% in 2019, 2.64% in 2017 and 2.75% in 2015). It corresponded to an average guaranteed return of 1.36% and a participation to benefits equal to 0.59%.

With the decline in the return on the Belgian 10-year government bonds since 2011, insurance companies were forced to decrease the guaranteed minimum return offered to new contributions on Assurance Groupe Branch 21 contracts. However, insurance companies continue to guarantee the previous returns on the past contributions until the retirement. Past reserves continue to have guaranteed returns range from 3.25% to 4.75%.

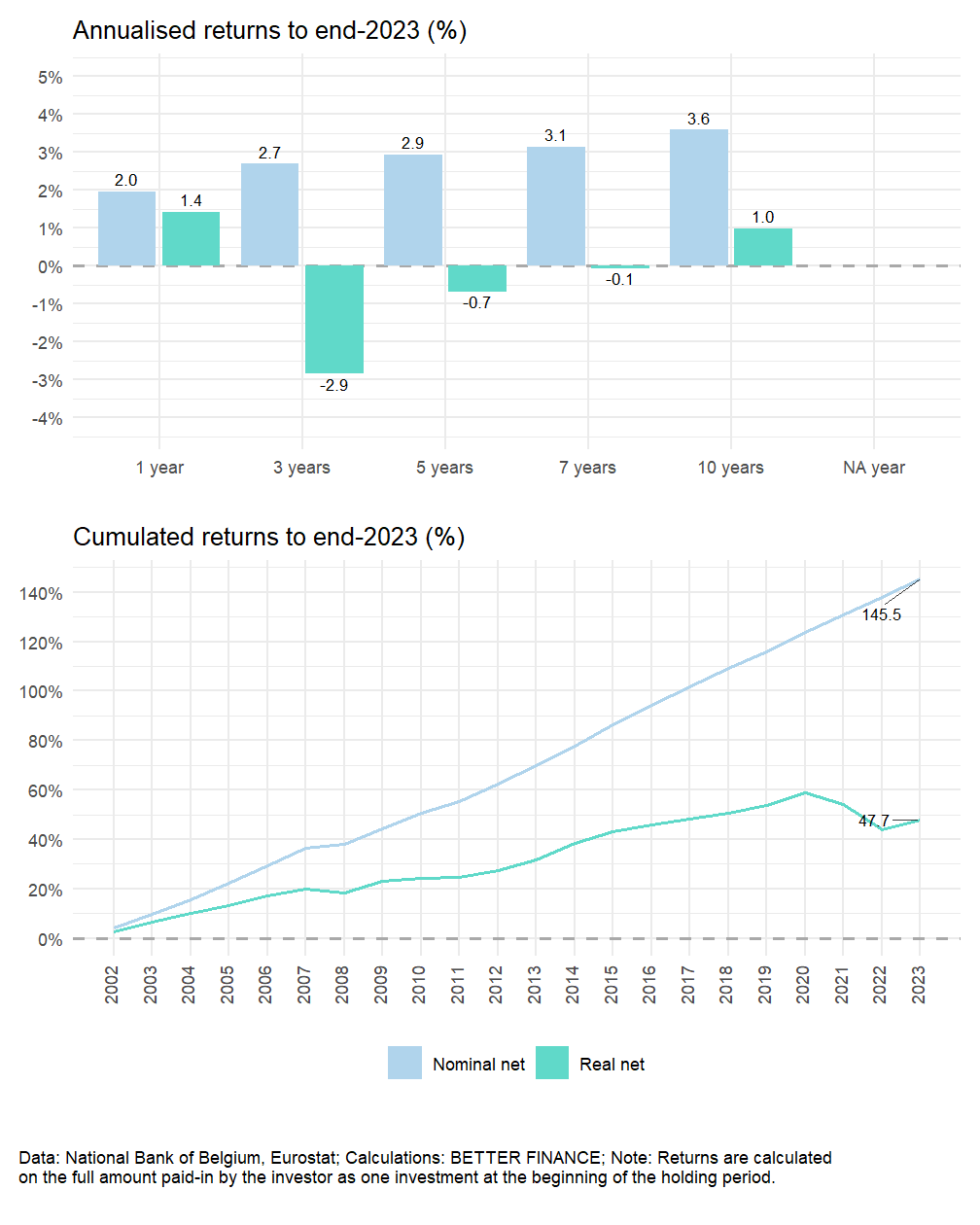

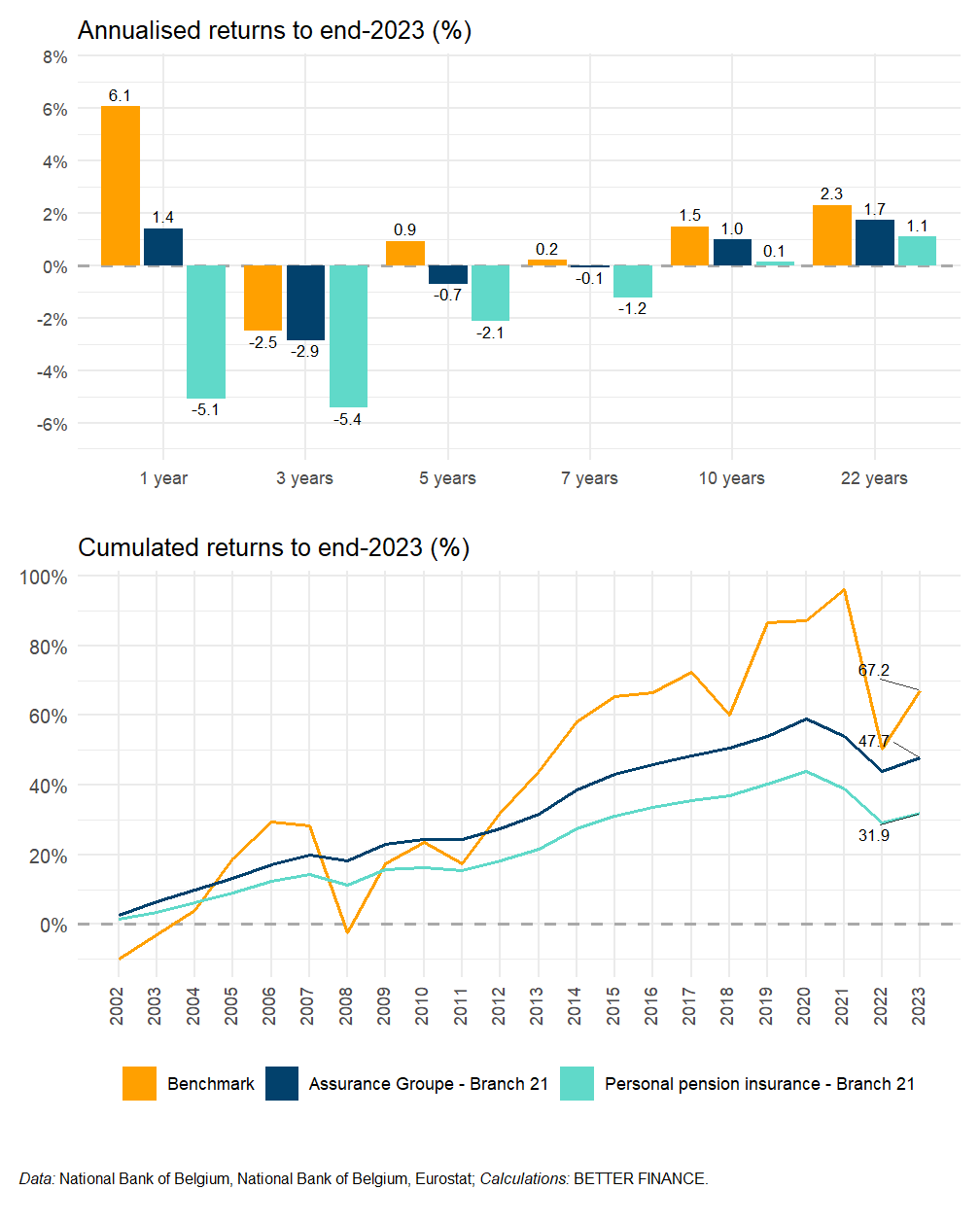

Since last year, we tried to compute returns of Assurance Groupe Branch 21 by using data provided by the National Bank of Belgium, who publishes statistics of direct life insurance operations in Belgium each year. We compute the ratio of financial remuneration received on investments made by insurance companies over their provisions. For the period 2007-2014, our results we very close to Assuralia’s data. It gives an insight of how Assurance Groupe Branch 21 evolved over 2002-2023. (see Figure 6.5)

Over the period 2002-2023, the annualised net and real returns of Assurance Groupe Branch 21 contracts are positive, respectively 4.17% and 1.79%.

Occupational pension plans managed by insurance companies (Branch 23 contracts)

Returns on Assurance Groupe Branch 23 contracts are variable and depend on the performance of underlying assets. These contracts experienced negative returns in 2011, 2018 and probably in 2022. Their net average returns are very close to those of occupational funds managed by IORP (around -4% in 2018). Since 2015, Assuralia no longer provides information on the returns of Assurance Groupe Branch 23 contracts.

Insurance companies do not offer guaranteed return on these contracts. However, affiliates benefit from the legal guaranteed minimum return on their contributions, which is currently equal to 1.75% since 2016 and until the end of 2024. From 2025, this rate increased to 2.5%. When the affiliate claim for its pension rights, if the final payment is less than the amount including the minimum guaranteed return, the employer must pay the difference.

Pillar III: Personal pension savings products (pension savings plans and long-term insurance products)

Pension savings funds managed by asset management companies

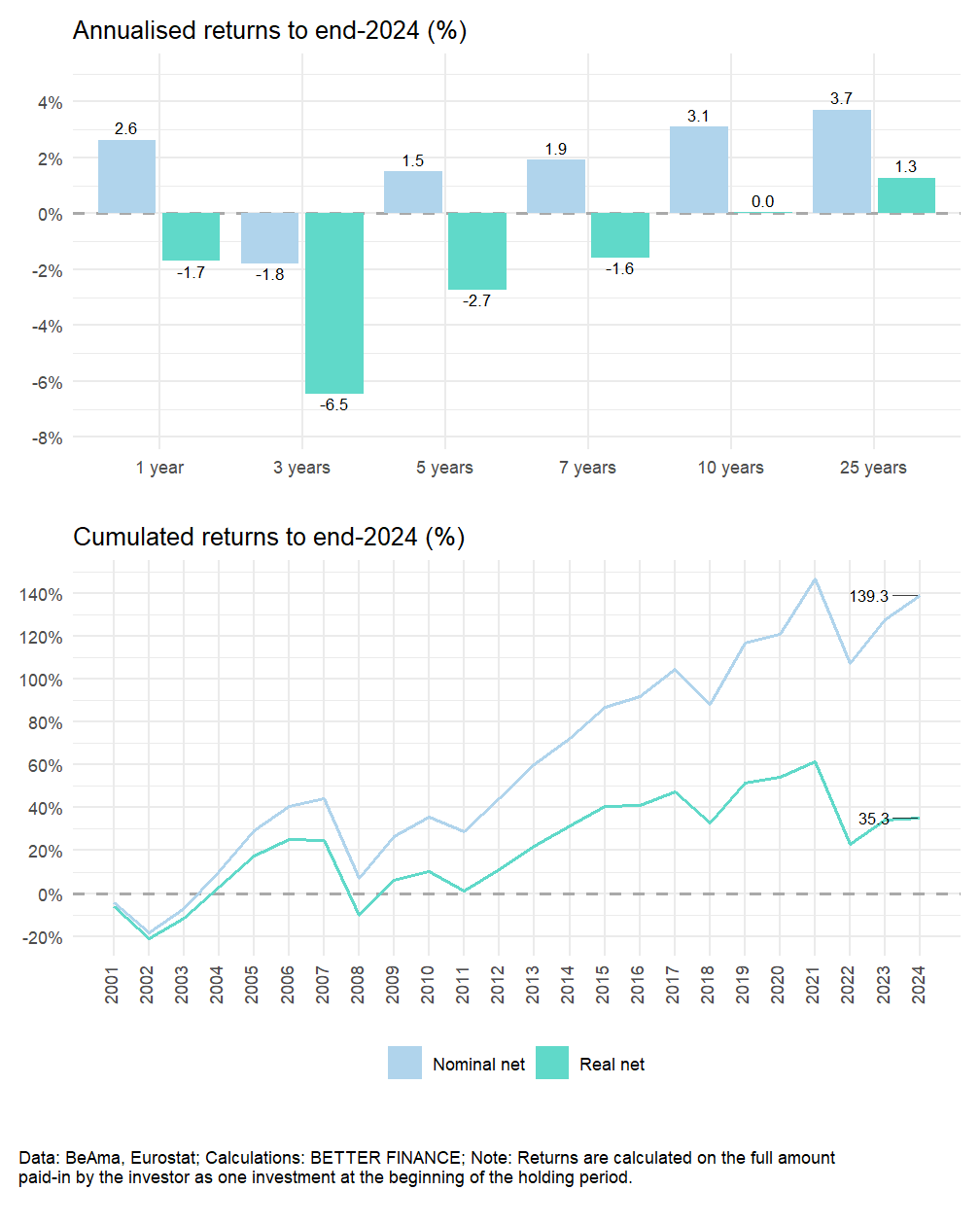

The Belgian Asset Managers Association (BEAMA) provides quarterly data on pension savings funds. The most recent data regarding their returns was on an annual basis at end-2024. These average returns were calculated based on the average returns of all available funds in the market, after expenses but before taxation and inflation.

Annual returns are also available in the prospectus of each pension savings fund provided by the asset management company that commercialises the fund. In general, there is no available information on returns before 2002 in the fund prospectuses. The following figures (see Figure 6.6) show the average returns of all available funds for subscription in the Belgian market from 2000 to 2024. Pension savings plans and pension plans managed by IORPs have a performance that evolved similarly. In 2024, pension savings funds performed less pension plans managed by IORPs(5.03% against 8.79%).

Pension savings plans experienced negative performance in the same years (2002, 2008, 2011, 2018 and 2022). High inflation impacted negatively the annualised real net returns Unlike occupational pension plans, these pension savings funds are not obliged to pay a guaranteed return to retirees. Over the 25-year period (2000-2024), they delivered relatively similar annualised nominal and real returns to that of occupational pension plans managed by acrpl{iorp}, respectively 3.4% and 0.9%.

Pension savings insurance (Branch 21 contracts)

To prepare their retirement, Belgian can also subscribe voluntarily pension savings insurance or long-term savings products. Pension savings insurance consists in investing in individual life-insurance Branch 21 contracts with a guaranteed capital. Long-term savings products combine Branch 21 contracts and unit-linked Branch 23 contracts, which are called Branch 44 contracts. Assuralia used to report net returns after charges in percentage of the total reserves managed through Branch 21 and Branch 23 contracts, until 2014. This information gave an insight into returns of reserves invested within the third pillar.

However, since 2015 Assuralia no longer provides on pension savings insurance and long-term savings products in its annual publication. For individual life-insurance Brach 21 contracts, as for Assurance Groupe Branch 21 contracts, we used statistics of direct life insurance operations in Belgium to compute the ratio of financial remuneration received on investments made by insurance companies over their provisions (see Section 6.5.1.1.2).

Over the whole period from 2002-2023, the net annualised return is positive to 3.63% for Branch 21 contracts. The high inflation in 2021 and 2022 impacted negatively the annualised real return, which is 1.27% over 22-year period.

Figure 6.7 represents the returns of Belgian insurance products (Branch 21 and 23) dedicated to prepared retirement. It is the average nominal and real net returns of Branch 21 and Branch 23 contracts from 2002 to 2014.

Figure 6.8 and Figure 6.9 summarise the annualised returns of Belgian long-term and pension vehicles over varying holding periods and show their cumulated returns. Performance of IORPs and pension savings funds within the third pillar evolved similarly over the time. Despite some years with negative performance, these products offered a positive real net return in a long-term period (25 years) which are quite low, respectively 1.55% and 0.9%.

Information on returns of insurance products within the second and third pillar are fragmented. It is more difficult to see their real performance in the long run. It is interesting to remind that Assurance Groupe products offered a guaranteed minimum return (see above).

Do Belgian savings products beat capital markets?

In the long run IORPs (pillar II) and pension savings plans (pillar III) evolved in the same way. Large parts of their assets are invested in equities and in bonds, it is interesting to compare their evolution with a benchmark portfolio with equal holdings of equity and bonds (see Table 6.12 and methodology in the introductory chapter of this report). Both IORPs and pension savings funds have the same trend as the benchmark over the period 2000-2024. Nevertheless, the benchmark and pension savings plans had almost the same performances from 2003 to 2007 (see Figure 6.10). Then, the gap of cumulative performance increased. From 2018 onwards the gap widened, as the benchmark’s performance increased faster. The gap of cumulative performance between the IORPs and the benchmark is less important. Thus, the annualised returns of IORPs are higher than that of the benchmark over varying periods, except over the whole period. Over the period 2002-2024, the annualised return of IORPs is lower of 0.29 percentage point. While the annualised return of pension savings plans is lower of 0.9 percentage point.

| Equity index | Bonds index | Start year | Allocation | |

|---|---|---|---|---|

| IORP | STOXX All Europe Total Market | Barclays Pan-European Aggregate Index | 2000 | 50%–50% |

| Assurance Groupe - Branch 21 | STOXX All Europe Total Market | Barclays Pan-European Aggregate Index | 2002 | 50%–50% |

| Pension savings funds | STOXX All Europe Total Market | Barclays Pan-European Aggregate Index | 2000 | 50%–50% |

| Personal pension insurance - Branch 21 | STOXX All Europe Total Market | Barclays Pan-European Aggregate Index | 2002 | 50%–50% |

| Data: STOXX, Bloomberg; Note: Benchmark porfolios are rebalanced annually. | ||||

6.6 Conclusions

Belgians are encouraged to save for their retirement in private pension vehicles. In 2003, the implementation of the Supplementary Pensions Act defined the framework of the second pillar for sector pension plans and supplementary pension plans for self-employed individuals. The number of employees covered by occupational pension plans keeps rising as well as the number of self-employed individuals covered by supplementary pension plans.

Measures to guarantee the sustainability and social character of the supplementary pensions were enforced in January 2016:

The guaranteed minimum return on contribution was lowered to 1.75% for both employee and employer contributions. According to an economic formula considering the evolution of government bond yields in the future, this return has been risen to 2.5% from January 1st, 2025,

The supplementary pension age and the legal pension age were aligned;

Over a 25-year period (2000-2025), occupational pension funds managed by IORPs (pillar II) and pension savings funds (pillar III) have a real annualised return before taxation of 1.55% and 0.9% respectively. A benchmark composed of 50% of equities and 50% of bonds overperformed both IORPs and pension savings funds over the whole period. High inflation impacted negatively the performance of both products.

It is quite difficult to find information on returns of pension vehicles managed by insurance companies. Neither FSMA, nor Assuralia provide regularly information on these pension products. For a Belgian it is difficult to obtain clear information on returns of his/her pension products even on his/her personal on-line account at mypension.be. The final remuneration can vary from one provider to another depending on the agreement made with employers, notably regarding the guaranteed minimum return.

Acronyms

- AIF

- Alternative Investment Fund

- AuM

- assets under management

- BEAMA

- Belgian Asset Managers Association

- CBA

- collective bargaining agreement

- DB

- Defined benefits

- DC

- Defined contributions

- EET

- Exempt Exempt Taxed

- EU

- European Union

- FSMA

- Financial Services and Markets Authority

- INAMI

- Institut National d’Assurance Maladie-Invalidité

- IORP

- institution for occupational retirement provision

- KID

- Key Information Document

- PAYG

- pay-as-you-go

- PLCDE

- Pension Libre Complémentaire pour Directeurs d’Entreprises

- PLCI

- Pension Libre Complémentaire pour Indépendants

- PLCIPP

- Pension Libre Compémentaire pour les Indépendants Personnes Physiques

- PLCS

- Pension Libre Complémentaire pour Salariés

- UCITS

- Undertaking for Collective Investment in Transferable Securities

Data presented in this publication were provided by the DB2P who manages the supplementary pensions database. It collects data related to supplementary pension plans such as individualised acquired pension rights of employees, self-employed individuals, and civil servants.↩︎

Data presented in this publication were provided by the DB2P who manages the supplementary pensions database. It collects data related to supplementary pension plans such as individualised acquired pension rights of employees, self-employed individuals, and civil servants.↩︎

Article 6(1) of Directive (EU) 2016/2341 of the European Parliament and of the Council of 14 December 2016 on the activities and supervision of institutions for occupational retirement provision (IORPs) (recast), O.J. L354/37.↩︎

All data provided comes from plans for which information is available.↩︎

The lowering of the tax rate does not apply to long-term savings products.↩︎

Two new savings pension funds were launched in 2024 and available for subscription.↩︎

The 150 pension plans include both IORPs for the first and second pillars↩︎

The participants to the annual Pensio’s Plus survey represented 88% of the market share in terms of asset under management in 2024.↩︎

In November 2024, Assuralia published its annual report including Statistics for the whole year 2023.↩︎