Product categories

|

Reporting periods

|

||

|---|---|---|---|

| Name | Pillar | Earliest data | Latest data |

| Pillar II Funded pensions | Occupational (II) | 2004 | 2024 |

| Pillar III Voluntary private pensions | Voluntary (III) | 2004 | 2024 |

Santrauka

Lietuva priėmė tipišką Pasaulio banko daugiapakopę sistemą, kurioje pay-as-you-go (PAYG) pakopa (valstybinė pensija, I pakopa) vis dar atlieka dominuojantį vaidmenį užtikrinant senatvės pensininkų pajamas. Nuo 2019 m. pradėtos kaupti santaupos II pakopoje kaupiamos per gyvenimo ciklo pensijų fondus, kuriuose investavimo rizika keičiama keičiant portfelio struktūrą pagal dalyvių amžių. Nuo 2019 m. valdymo mokestis už kaupimą II pakopos gyvavimo ciklo fonduose palaipsniui mažinamas nuo 0,8 proc. 2019 m. iki 0,42 proc. 2024 m. Turto išsaugojimo fonde valdymo mokestis bus tik 0,2 %. Apskritai 2023 m. pensijų fondų veiklos rezultatai abiejose pakopose buvo iš esmės teigiami visose turto klasėse. Teigiama 2023 m. grąža bendrą privalomosios II pakopos pensijų fondų veiklos rezultatą vėl perkėlė į teigiamos realiosios grąžos teritoriją per analizuojamą laikotarpį. Savanoriškoji III pakopa išlieka neigiamos realiosios grąžos teritorijoje daugiausia dėl didesnių mokesčių.

Summary

Lithuania adopted the typical World-Bank multi-pillar system, where the PAYG pillar (state pension, Pillar I) still plays the dominant role in ensuring the income for old-age pensioners. Started in 2019, accumulating savings in Pillar II takes place via life-cycle pension funds, which change investment risk via changes in the portfolio structure on the basis of participants’ age. Since 2019, management fee for accumulating in Pillar II life-cycle funds is being gradually reduced from 0.8% in 2019 down to 0.42% in 2024. For the asset preservation fund, the management fee will be just 0.2%. Overall, pension funds’ performance in both pillars was broadly positive in 2024 across all asset classes. Positive returns in 2024 have moved the overall performance of mandatory Pillar II further into the positive real returns territory over the analysed period. Voluntary Pillar III switched from negative real returns territory into the positive one mainly due to the exceptional returns in 2024.

14.1 Introduction: The Lithuanian pension system

There were no major changes in the pension system in Lithuania in 2024. However, in 2025 the parliament approved major changes in Pillar II following the move from Estonia in 2021. Announced changes include an opt-out from second pillar, possibility to withdraw savings accumulated in the second pillar, the possibility to suspend contributions indefinitely, the possibility to increase individual contributions on top of 3% (with state contributions of 1,5%) and the abolishment of auto-enrolment. This would decrease the participation rate and significance of the Pillar II system for future generations and increasing the pressure on the state PAYG pillar.

In 2024, pensions were further increased by 11%. The average old-age pension increased to EUR 598.1 (SoDra 2025).

The performance of private pensions (mandatory as well as voluntary) was positive in 2024 both in nominal and real terms mainly due to broad positive market returns.

Holding period

|

|||||||

|---|---|---|---|---|---|---|---|

| 1 year | 3 years | 5 years | 7 years | 10 years | Whole reporting period | to... | |

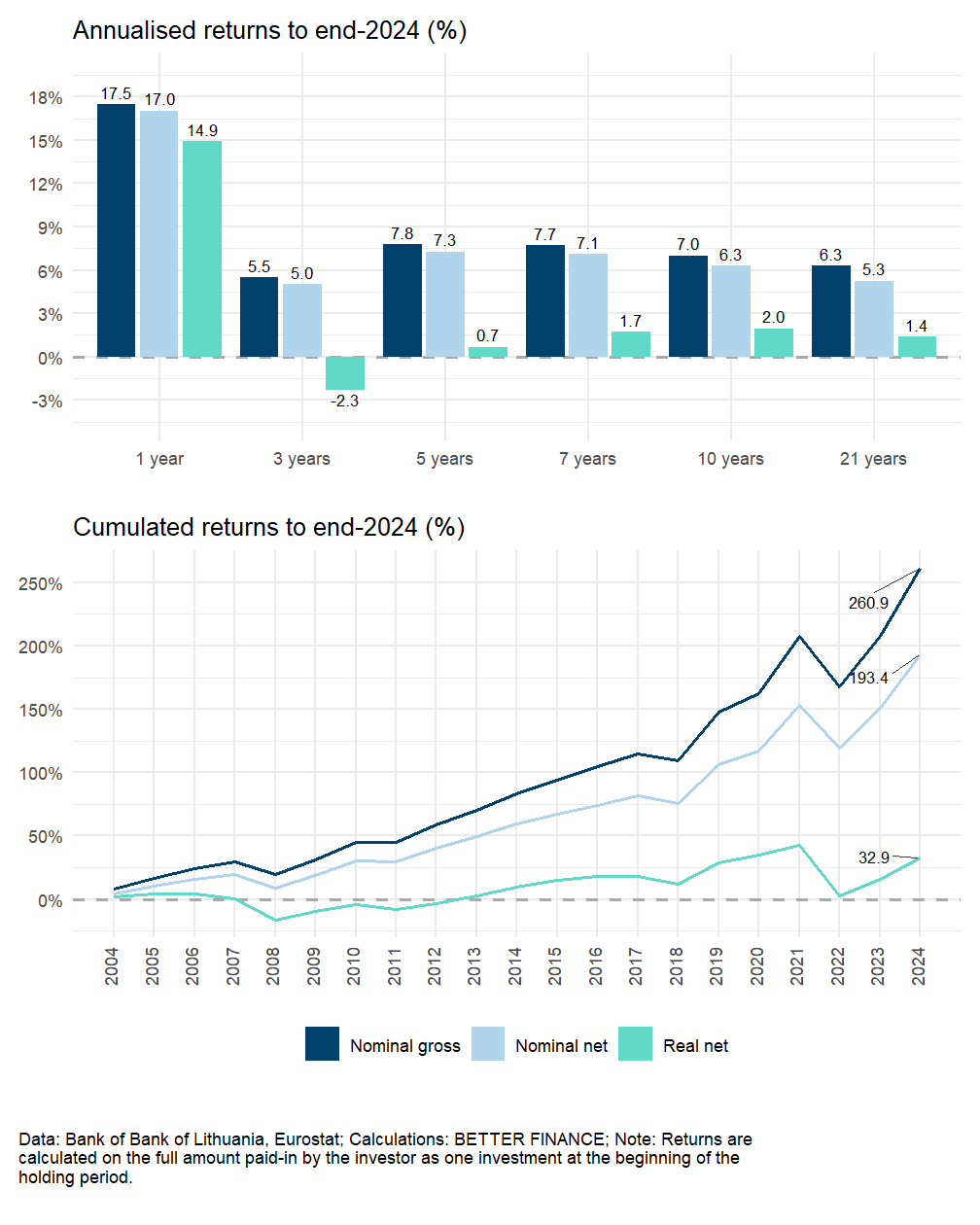

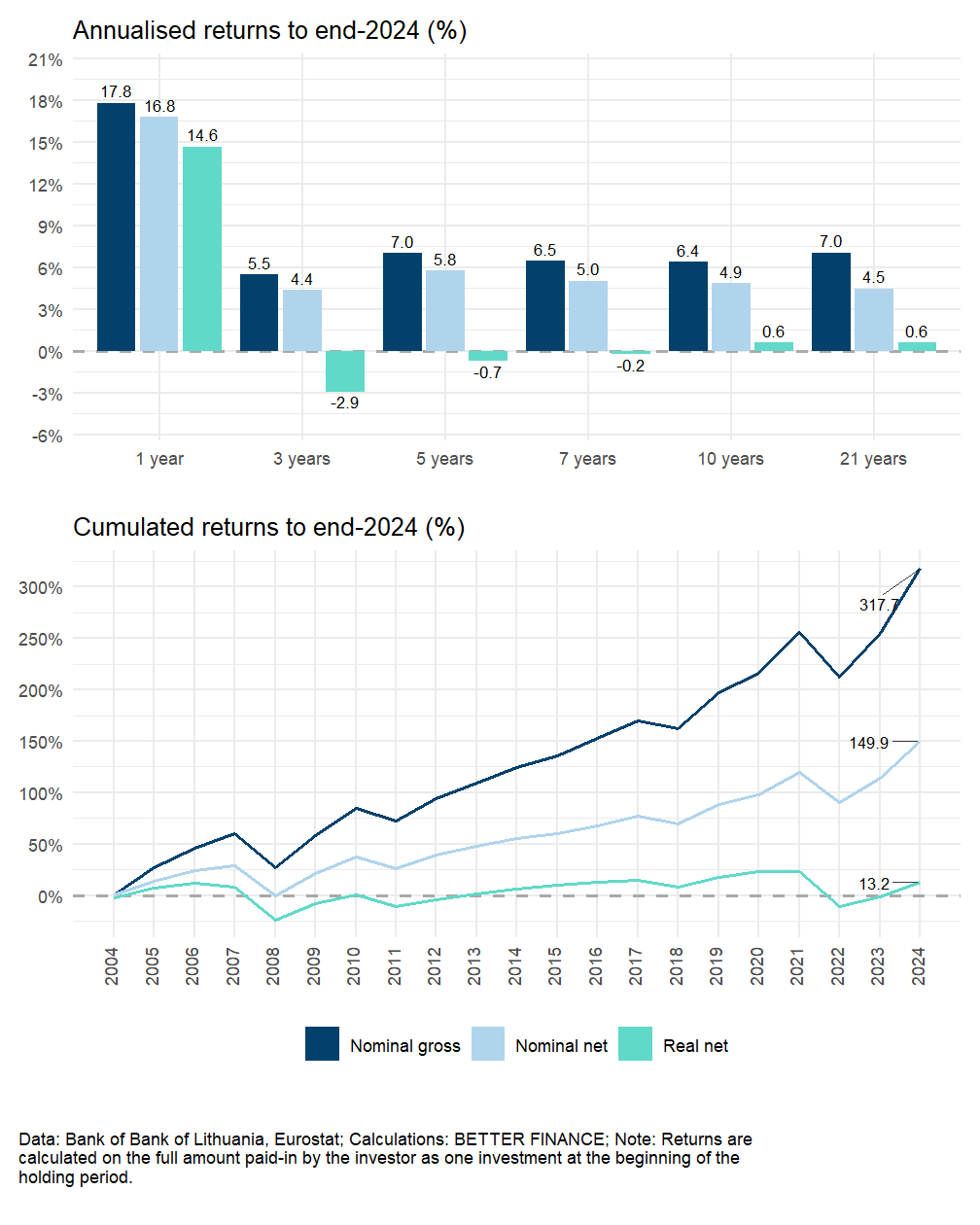

| Pillar II Funded pensions | 14.9% | -2.3% | 0.7% | 1.7% | 2.0% | 1.4% | end 2024 |

| Pillar III Voluntary private pensions | 14.6% | -2.9% | -0.7% | -0.2% | 0.6% | 0.6% | end 2024 |

| Data: Bank of Bank of Lithuania, Official Statistics Portal, Eurostat; Calculations: BETTER FINANCE | |||||||

Lithuania has undertaken a pension reform in 2004, which was renewed in 2013. This was the reason to establish private pension funds.

Pension system in Lithuania: An overview

Currently, the Lithuanian pension system provides three distinct sources of accumulation for retirement funds – so-called pension pillars (Bitinas 2011):

- 1st pillar (Pillar I) — State social insurance funds organized as a PAYG pension scheme. State social pension is financed from social insurance contributions paid by people who are currently working.

- 2nd pension pillar (Pillar II) — funded pension scheme mandatory for all economically active citizens under the age 40 with opt-out operated by the private pension accumulation companies offering life-cycle pension funds in form of personal savings scheme. The part of State social insurance fund is redirected from the PAYG scheme (until 2019). On top of social insurance contributions, savers are obliged to co-finance the individual retirement accounts with additional contributions tied to their salary.

- 3rd pension pillar (Pillar III) — voluntary private funded pension scheme. Accumulation can be managed by private funds or life-insurance companies.

Lithuania’s statutory social insurance pension system is financed at a general rate of 39.5% (without Social insurance for accidents at work and occupational diseases insurance), while 25.3 percentage points (22.3 percentage points (p.p.s) + 3 p.p.s employee) is paid towards the Social insurance for pensions (Pillar I).

The State social insurance pension system was reformed in 1995 introducing the insurance principle, extending the requirement for contributory years, abolishing early retirement provisions and increasing the retirement age. However, Pillar II was introduced by law in 2002 and started functioning effectively in 2004 when the first contributions of participating individuals started to flow into the pension funds. Supplementary voluntary pension provision (Pillar III) is possible through either pension insurance or special voluntary pension funds (these started operating in 2004, although the law was adopted in 1999). The voluntary pillar can take two different forms: Defined contributions (DC), if supplemental contributions are invested into pension funds or unit-linked life insurance or Defined benefits (DB) when purchasing a classic life insurance product. Contributions to the system may be made by the individual or his employer.

| Pillar I | Pillar II | Pillar III |

|---|---|---|

| State Pension | Funded pension | Voluntary pension |

| Law on State Social Insurance Pensions | Law on the Reform of the Pension System; Law on Pension Accumulation | Law on the Supplementary Voluntary Pension Accumulation |

| State Social Insurance Fund institutions | pension accumulation companies (PACs) | |

| Mandatory | Quasi-mandatory / Voluntary | |

| Publicly managed | Privately managed pension funds | |

| PAYG | Funded | |

| Pointing System (DB scheme based on salary) | DC | |

| Individual personal pension accounts | ||

| Quick facts | ||

| Nb. of old-age pensioners: 630 700 | Administrators: 6 | Administrators: 4 |

| Average old-age pension: EUR 598.1 | Funds: 48 | Funds: 21 |

| Average income (gross): EUR 1906.7 | AuM: EUR 9 123.8 mln. | AUM: EUR 407.98 mln. |

| Average replacement ratio: 31.37% | Participants: 1 428 438 | Participants: 118 066 |

| Nb. of insured persons: 1 532 200 | Coverage ratio: 93.23% | Coverage ratio: 7.71% |

| Data: Own compilation based on SoDra, Bank of Lithuania and Official Statistics Portal, 2025. | ||

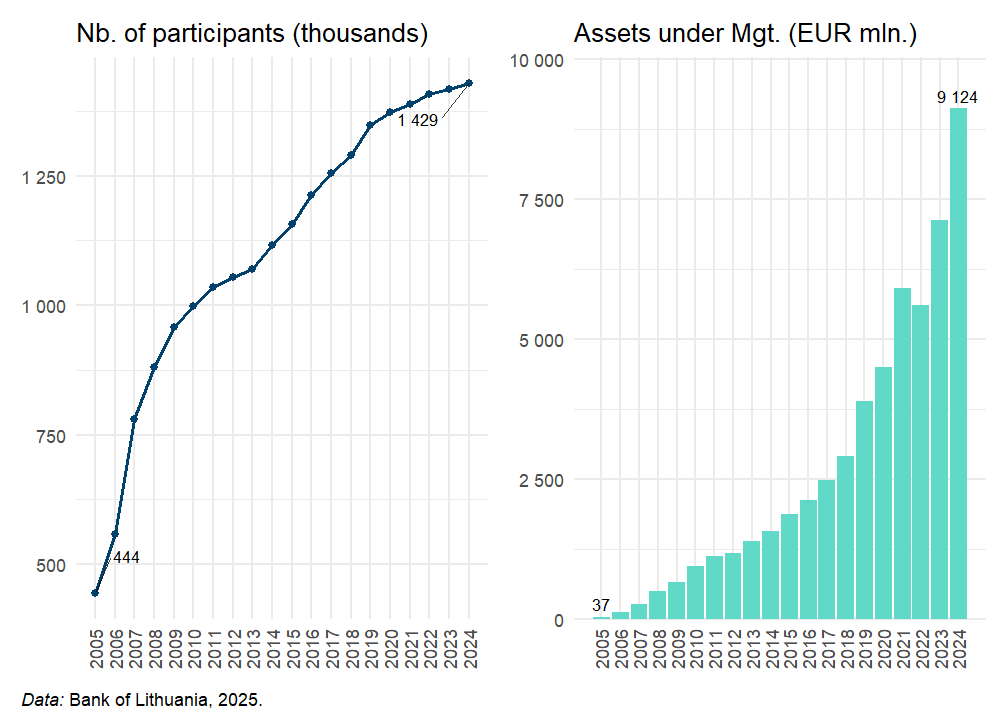

The overall coverage of Pillar II, measured as a ratio between the number of participants and the economically active population (number of insured persons in Pillar I), was more than 93% in 2024, while Pillar III covered only 7% of the economically active population. Thus, we can expect that future pension income stream will be influenced mostly by Pillar II pensions, while Pillar III will generate an insignificant part of individuals’ income during retirement.

First pillar: State pensions

The first pillar of the Lithuanian pension system is organized on the pay-as-you-go (PAYG) principle of redistribution, being funded on an ongoing basis, functioning on the pointing system, and taking into account the duration of the vesting period and the level of salary (insurable income) from which the contributions are paid.

The old-age pension is the main type of state social security in old age. Individuals who meet the requirements for age and for the pension social insurance record are entitled to the old-age pension, i.e.:

- the person has reached the established old-age pension age (64 years and 8 months for men and 64 years and 4 months for women in 2024). Since 2012, the retirement age has been rising gradually by 2 months a year for men and 4 months a year for women until reaching the statutory retirement age of 65 for both men and women by 2026;

- has the minimum record of pension social insurance established for old-age pension (has paid the pension social insurance contributions for at least 15 years).

The pension social insurance record is the period in which the obligatory pension social insurance payments are made or must be made either by the person themselves or on his/her behalf. Starting from 2018, the obligatory pension social insurance record requirement increased. In 2024, the mandatory record is at least 33 years and 6 months and will be increased by 6 months every subsequent year until it reaches 35 years in 2027.

A new version of the Law on Social Insurance Pensions came into force on 1 January 2018. The pension system was reformed by changing the pension calculation structure, introducing pension points and setting the indexation rules. A social insurance pension will consist of the general (\(GP\)) and individual parts (\(IP\)). The old-age pension is equal to the sum of the general and the individual parts of pension.

The general part (\(GP\)) of the old-age pension takes into account only the duration of insured period. The general part (\(GP\)) of pension is calculated according to the formula: \[GP= \beta \times B\] where:

- \(\beta\) represents the ratio of the insurance record of the person and the obligatory insurance record effective in the year of the pension entitlement (for example, if the obligatory insurance record at year of retirement is 35 years and the person’s insurance record is 40 years, then the value of \(\beta\) is 40/35 = 1.1429); and

- \(B\) represents the basic pension (in EUR).

The individual part of pension is based on pension point system. Pension points system for the determination of the individual part of pension was introduced on 1 January 2018. Each insured person will receive a certain number of pension points for the amount of pension social insurance contributions paid during the year. If the amount of pension social insurance contributions deducted from the person’s income during the year for the individual part of pension is equal to the amount of the annual pension contribution determined on the basis of the average pay (salary) during the year, the person will acquire one pension point. A larger or a smaller amount paid will result, accordingly, in a larger or smaller number of pension points. However, the total number of pension points acquired during one year may not exceed 5. The pension points acquired will be summed up and multiplied by the pension point value. The individual part of pension is calculated according to the formula: \[IP = V \times p\] where:

- \(V\) is the number of pension points accumulated by the person during the entire working career;

- \(p\) is the pension point value (in EUR).

For example, if a person’s salary during the whole career (40 years) was equal to the average salary in the economy (1 point), then the person can acquire 40 \(\times\) 1 point = 40 points. If the value of one pension point at moment of retirement is, for example, EUR 10, then the individual part of old-age pension is: 40 \(\times\) 10 = EUR 400.

Old-age pensions are indexed every year. Starting from 1 January every year, the values of the basic pension, the value of pension points and the basic amount of widows’/widowers’ pensions, used for the granting and determining social insurance pensions, will be indexed based on the average 7-year wage fund growth rate.

The indexing coefficient (IC) is calculated on the basis of the change in the wage fund during the past three years, the year for which the IC is being calculated, and three prospective years. The IC is applied provided that, upon its application, the pension social insurance costs in the year of indexation do not exceed social insurance revenues and the projected pension social insurance costs for the next year do not start exceeding the social insurance revenues projected. If, without indexation, the pension social insurance revenues in the year of indexation exceed the pension social insurance costs, the IC is calculated in such a way that the pension social insurance expenses for pension indexing would not exceed 75% of the pension social insurance contribution surplus planned for the year of indexation in case if no indexation is performed.

Indexation of pensions will not be performed if the determined IC is smaller than 1.01 and/or if the change in the gross domestic product at comparative prices and/or in the wage funds, expressed in percentage terms, is negative in the year for which the IC is being calculated and/or for next calendar year. If no indexation is performed, the values of December of previous year are applied.

In general, we can say that the Pillar I pensions will be subject to the automatic adjustment mechanism ensuring the balance of the State Social Insurance fund over the longer period.

SoDra has launched the indicative retirement calculator, 1 where an individual can assess his projected old-age pension including the expected (projected) Pillar II savings.

Second pillar: Funded pensions

Lithuania’s private pensions system (Pillar II) is based on the World Bank’s multi-pillar model. Pillar II pension scheme can be characterized as an accumulation of a redirected part of social insurance contributions towards individual retirement accounts managed by private pension accumulation companies offering and managing private pension funds. All persons with income, from which state social insurance contributions are calculated on a mandatory basis to receive pension, and yet to reach retirement age may become fund participants. The contribution to Pillar II pension funds consists of three parts: a social-security contribution (currently paid to SoDra), salary contribution and an additional pension contribution from the State Budget.

Pillar II can be characterized as a fully funded scheme, with quasi-mandatory participation, distinct and private management of funds, based on personal accounts and on the DC philosophy with no minimum return guarantees.

Since 2004, when the Pillar II was effectively launched, the number of participants as well as assets under management (AuM) has grown rapidly and currently, more almost 94% of working population is covered by the scheme and more than 9 billion € are managed by 6 pension accumulation companies (PACs) (see Figure 14.1).

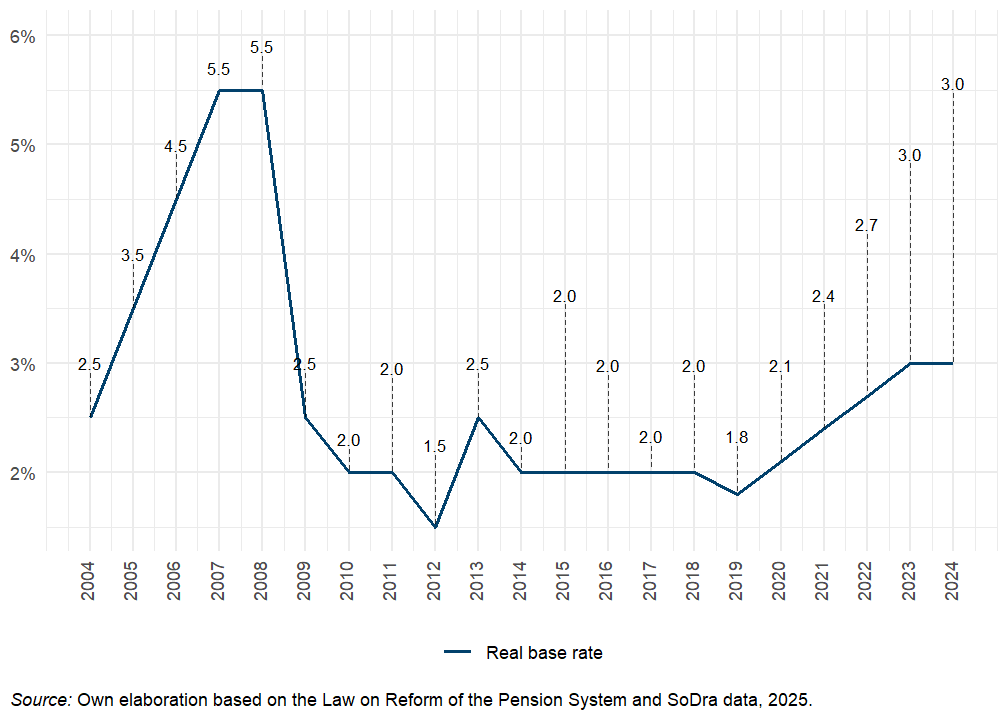

The pension contributions towards the Pillar II are part of the participant’s state social insurance contribution rate. Originally, the level of contributions (“base rate”) was set at final level of 5.5% of insurable income. This level should have been reached in 2007. The base rate in 2004 was 2.5%, in 2005 3.5%, in 2006 it was 4.5%, and since 2007 5.5% of the participants’ income, from which the state social insurance contributions are calculated. However, it should be noted that there have been significant changes to the Pillar II set-up because of the financial crisis and the following public finance deficits. As a result, the mechanism and level of paid contributions have changed. Since 2014, the level of contributions has remained stable, while participants have been required to match redirected contributions from the social insurance with additional individual contributions and the state must match the individual contributions of savers from the state budget. Under the new system, the “base rate” for Pillar II contributions is 2%, and existing savers can make a further 1% in contributions, matched by a state subsidy of 1% of gross average wages. These both additional contribution rates rose to 2% a piece since 2016. Under Lithuania’s current “maximum accumulation” scenario, Pillar II savings during the years of 2016 till 2019 are funded by the so-called “2+2+2” system: 2% of social security system contributions, with an additional 2% of additional payment from a salary of a saver, matched by a state contribution based on the previous year’s average state wages.

Since 2019 reform, the new contribution system has been established. The formula for Pillar II pension accumulation in pension funds has changed. As of 2024, all Pillar II participants will accumulate according to the formula “3% + 1.5%” (a contribution by the participant of 3 per cent of their gross wage plus a contribution by the state of 1.5 per cent of the average wage in the country the year before last). Those who accumulated maximally will move to the new formula as of 2019 automatically, while those who accumulated minimally will in 2021 accumulate according to the formula “1.8% + 0.3%” (a participant contribution of 1.8 per cent of one’s gross wage plus a state contribution of 0.3% of the average wage in the country the year before last) and then their contributions will increase gradually, by 0.3 percentage points each year, until their accumulation formula reaches “3% + 1.5%”. New changes in the Pillar II contributions have been announced in 2025, effective from 2026, that allow to suspend or increase the contributions above 3%.

The contributions to Pillar II are recorded on individual personal pension account at selected providers — PACs. Contributions and accumulated savings are invested by the companies into managed pension funds. PACs can manage multiple pension fund based on a “life-cycle” approach. PACs must obtain licenses from market regulator and supervisory body, which is the Bank of Lithuania.

Third pillar: Voluntary private pensions

Lithuania’s voluntary supplementary private pensions system (Pillar III) is also based on the World Bank’s multi-pillar model and effectively started in 2005. It is also a fully funded system, based on personal accounts and on the DC philosophy. Pillar III pension funds refer to supplementary voluntary pension accumulation. Funds are transferred by participants themselves or by their employers.

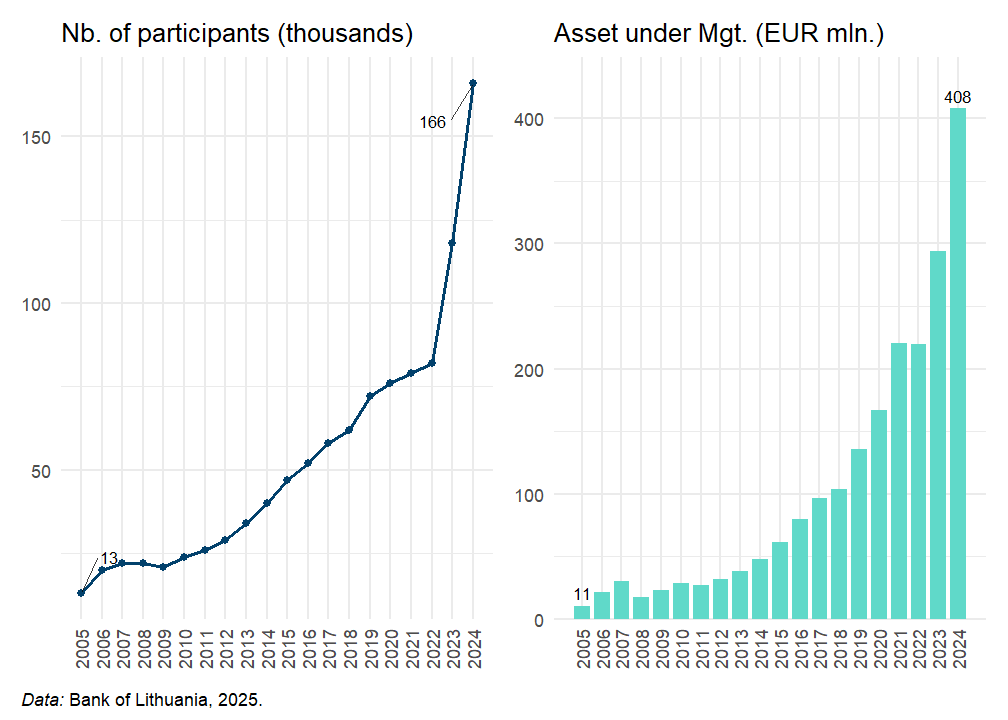

Even if the set-up of the pillar is very similar to the Pillar II set-up, the attractiveness of the financial products offered by supplementary pension asset managers is very low. Number of participants (savers) and assets under management in Pillar III providers are presented in Figure 14.3.

Pillar III is organized in a way that pension providers (Voluntary Supplementary Pension Accumulation Management Companies) offer pension funds on a basis of typical mutual funds. At the end of 2024, 21 supplementary voluntary pension accumulation funds operated in Lithuania were managed by 4 managing companies as Swedbank has entered the market in 2019 by offering 3 new supplementary voluntary pension funds (2 mixed and 1 equity based) and SEB introduced one mixed fund (SEB pensija 50+) in 2020. In 2022, new equity funds SEB index were introduced. In 2024, assets managed by funds have increased to EUR 408 million. Number of participants accumulating their pension in Pillar III pension funds amounted to 118 066.

14.2 Long-term and pension savings vehicles in Lithuania

Second pillar: Funded pensions

As indicated above, each provider (PAC) has to offer 7 life-cycle funds and 1 capital preservation fund. Currently, 48 pension funds are offered by 6 management companies.

| Fund name | Inception date |

|---|---|

| Life-cycle pension funds, 1996-2002 | |

| Luminor 1996–2002 tikslinės grupės pensijų fondas | 02.01.2019 |

| INVL pensija 1996–2002 | 02.01.2019 |

| SEB 1996–2002 metų tikslinės grupės pensijų kaupimo fondas | 28.12.2018 |

| Swedbank pensija 1996–2002 | 01.03.2018 |

| Allianz Y3 1996–2002 tikslinės grupės pensijų fondas | 02.01.2019 |

| Life-cycle pension funds, 1989-1995 | |

| Luminor 1989–1995 tikslinės grupės pensijų fondas | 02.01.2019 |

| INVL pensija 1989–1995 | 02.01.2019 |

| SEB 1989–1995 metų tikslinės grupės pensijų kaupimo fondas | 28.12.2018 |

| Swedbank pensija 1989–1995 | 01.03.2018 |

| Allianz Y2 1989–1995 tikslinės grupės pensijų fondas | 02.01.2019 |

| Life-cycle pension funds, 1982-1988 | |

| Luminor 1982–1988 tikslinės grupės pensijų fondas | 02.01.2019 |

| INVL pensija 1982–1988 | 02.01.2019 |

| SEB 1982–1988 metų tikslinės grupės pensijų kaupimo fondas | 28.12.2018 |

| Swedbank pensija 1982–1988 | 01.03.2018 |

| Allianz Y1 1982–1988 tikslinės grupės pensijų fondas | 02.01.2019 |

| Life-cycle pension funds, 1975-1981 | |

| Luminor 1975–1981 tikslinės grupės pensijų fondas | 02.01.2019 |

| INVL pensija 1975–1981 | 02.01.2019 |

| SEB 1975–1981 metų tikslinės grupės pensijų kaupimo fondas | 28.12.2018 |

| Swedbank pensija 1975–1981 | 01.03.2018 |

| Allianz X3 1975–1981 tikslinės grupės pensijų fondas | 02.01.2019 |

| Life-cycle pension funds, 1968-1974 | |

| Luminor 1968–1974 tikslinės grupės pensijų fondas | 02.01.2019 |

| INVL pensija 1968–1974 | 02.01.2019 |

| SEB 1968–1974 metų tikslinės grupės pensijų kaupimo fondas | 28.12.2018 |

| Swedbank pensija 1968–1974 | 01.03.2018 |

| Allianz X2 1968–1974 tikslinės grupės pensijų fondas | 02.01.2019 |

| Life-cycle pension funds, 1961-1967 | |

| Luminor 1961–1967 tikslinės grupės pensijų fondas | 02.01.2019 |

| INVL pensija 1961–1967 | 02.01.2019 |

| SEB 1961–1967 metų tikslinės grupės pensijų kaupimo fondas | 28.12.2018 |

| Swedbank pensija 1961–1967 | 01.03.2018 |

| Allianz X1 1961–1967 tikslinės grupės pensijų fondas | 02.01.2019 |

| Life-cycle pension funds, 1954-1960 | |

| Luminor 1954–1960 tikslinės grupės pensijų fondas | 02.01.2019 |

| INVL pensija 1954–1960 | 02.01.2019 |

| SEB 1954–1960 metų tikslinės grupės pensijų kaupimo fondas | 28.12.2018 |

| Swedbank pensija 1954–1960 | 01.03.2018 |

| Allianz B 1954–1960 tikslinės grupės pensijų fondas | 02.01.2019 |

| Asset preservation pension funds | |

| Luminor turto išsaugojimo fondas | 02.01.2019 |

| INVL pensijų turto išsaugojimo fondas | 02.01.2019 |

| SEB turto išsaugojimo pensijų kaupimo fondas | 28.12.2018 |

| Swedbank turto išsaugojimo pensijų fondas | 01.03.2018 |

| Allianz S turto išsaugojimo pensijų fondas | 02.01.2019 |

| Source: Bank of Lithuania, 2023. | |

The structure of savers, assets under management and market share of four group of pension funds according their investment strategy is presented in Table 14.5.

| Investment strategy | AuM (EUR mln.) | Market share (% of total AuM) | Nb. of participants (thousands) | Market share (% of total participants) |

|---|---|---|---|---|

| Life-cycle pension funds, 1996-2002 | 230.81 | 3.24% | 119 | 8.37% |

| Life-cycle pension funds, 1989-1995 | 801.51 | 11.25% | 235 | 16.60% |

| Life-cycle pension funds, 1982-1988 | 1 372.61 | 19.26% | 309 | 21.79% |

| Life-cycle pension funds, 1975-1981 | 1 627.19 | 22.84% | 250 | 17.60% |

| Life-cycle pension funds, 1968-1974 | 1 553.91 | 21.81% | 231 | 16.29% |

| Life-cycle pension funds, 1961-1967 | 1 197.52 | 16.81% | 203 | 14.31% |

| Life-cycle pension funds, 1954-1960 | 211.58 | 2.97% | 36 | 2.54% |

| Asset preservation pension funds | 130.56 | 1.83% | 23 | 1.60% |

| TOTAL | 7 125.72 | 100.00% | 1 418 | 100.00% |

| Data: Bank of Lithuania, 2024. | ||||

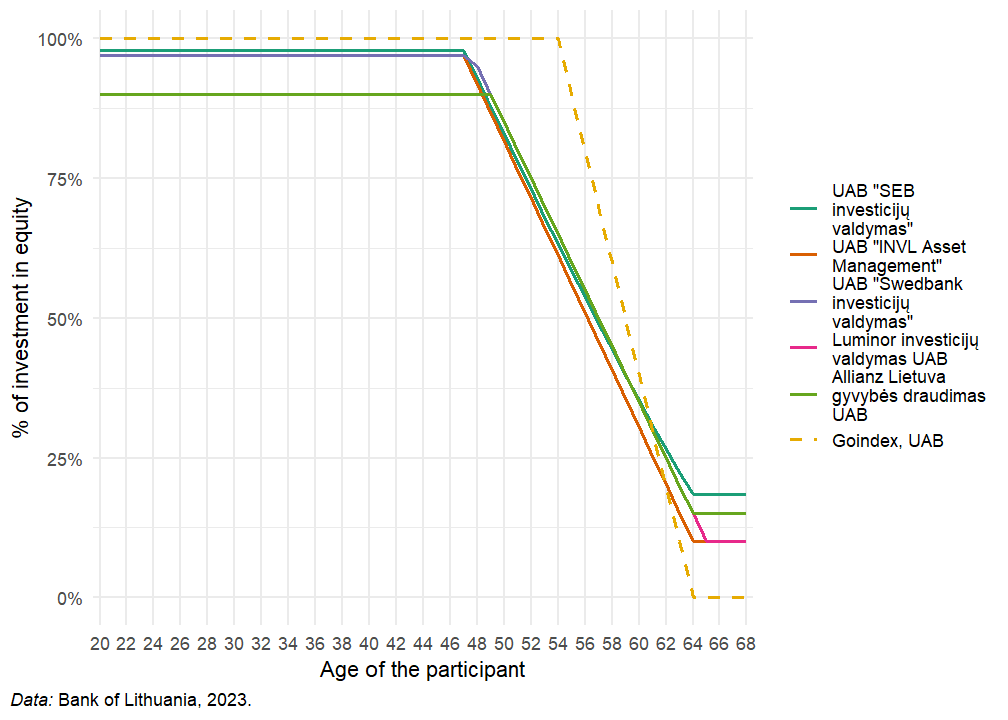

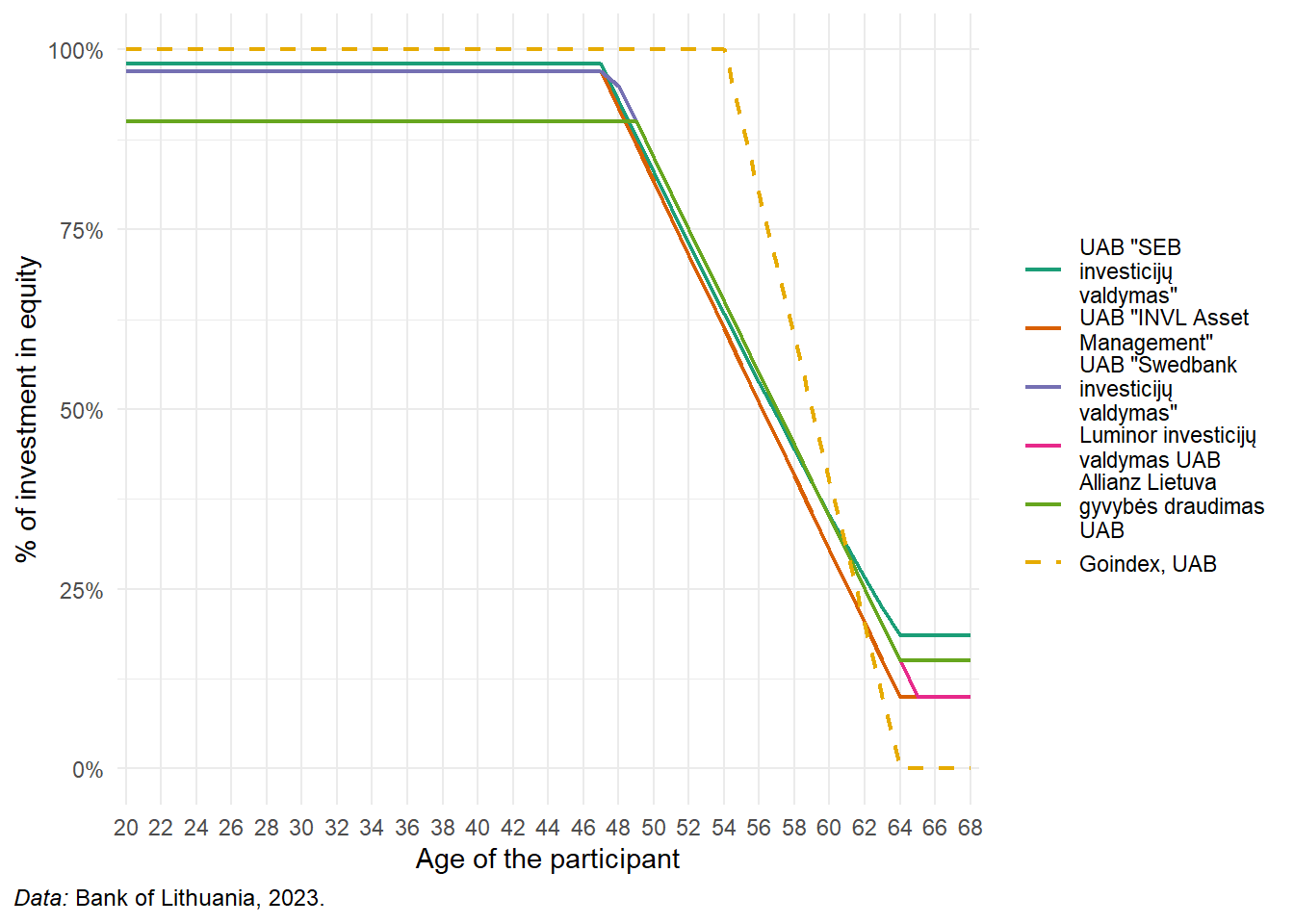

There are no strict quantitative limitations on financial instruments. However, the management company has to ensure risk management principles and avoid concentration risk. Introduction of life-cycle pension funds since 2019 was accompanied by the presentation of asset allocation that follows the age of participants. Almost all pension asset management companies has introduced the same life-cycle investment strategy (see Figure 14.4).

The portfolio structure of Pillar II pension funds is presented in Figure 14.5. The reform in 2019 delivered significant increase of equities in pension funds’ portfolios due to the introduction of “life-cycle” strategies via target-date funds.

It can be seen that dominant financial instruments in Pillar II pension funds’ portfolios are the equities and government bonds. The 2019 reform aimed at balancing the remaining saving horizon with the asset allocation has brought significant rise in equity based allocations (from 44% in 2019 to 78% of all assets in 2024) and this adjusted portfolio structure should preserve rather large portion of equities in pension funds’ portfolios.

Third pillar: Voluntary private pensions

The Lithuanian Pillar III allows licensed asset management companies (licensing process similar to typical Undertaking for Collective Investment in Transferable Securitiess (UCITSs) providers) to offer as many voluntary pension funds as they prefer. At its inception, there were only 5 pension funds offered by 3 providers. Currently (at the end of 2024), there are 6 providers offering 21 voluntary pension funds.

The market share according to the AuM and number of participants is presented in (tab:LT_LT6?).

There are no specific quantitative limitations on financial classes or instruments. However, the investment strategy of the pension fund must include the procedure and areas for investment of pension assets, risk assessment methods, risk management principles, risk management procedures and methods used, and the strategic distribution of pension assets according to the duration and origin of the obligations relating to pension accumulation contracts. The management company must review the investment strategy of the pension fund at least every 3 years. Pillar III pension funds’ portfolio structure is presented in Figure 14.6 (data available since 2013). Unfortunately, the Lithuanian national bank do not provide data on individual Pillar III pension funds’ portfolio structure since 2021, just share of investment in stocks. The data on the portfolio structure of the Pillar III pension funds as a whole have been extracted from the financial statements of the pension funds on an aggregate basis provided by the State data agency, Statistics Lithuania.

Equities and equity based UCITSs account for 64% of the Pillar III pension funds’ portfolios, while the government bonds account for 27%. Pillar III pension funds can be therefore characterized as a fund-of-funds.

14.3 Charges

Charges of Pillar II funded pensions

Major reform introduced in 2018 brought significant drop in Pillar II charges. The reform introduced instant cut in fees and gradual decrease from 1% in 2018 to 0.5% in 2020 with further slight decrease in the following years.

| Year | Total ongoing charges | Total Expense Ratio |

|---|---|---|

| 2004 | 3.35% | 3.35% |

| 2005 | 2.31% | 2.31% |

| 2006 | 1.63% | 1.63% |

| 2007 | 0.97% | 0.97% |

| 2008 | 1.18% | 1.18% |

| 2009 | 1.08% | 1.08% |

| 2010 | 0.11% | 0.11% |

| 2011 | 1.10% | 1.10% |

| 2012 | 0.99% | 0.99% |

| 2013 | 0.97% | 0.97% |

| 2014 | 1.02% | 1.02% |

| 2015 | 1.00% | 1.00% |

| 2016 | 1.00% | 1.00% |

| 2017 | 0.91% | 0.91% |

| 2018 | 0.86% | 0.86% |

| 2019 | 0.72% | 0.72% |

| 2020 | 0.65% | 0.65% |

| 2021 | 0.52% | 0.52% |

| 2022 | 0.52% | 0.52% |

| 2023 | 0.45% | 0.45% |

| 2024 | 0.42% | 0.42% |

| Data: Official Statistics Portal Calculations: BETTER FINANCE. | ||

The year 2024 brought further decrease in the fees and charges for Pillar II pension funds. Introduction of low-cost passively managed target date funds and entry of new player Goindex may spur new pressure on the fees and the year 2024 did bring further downward trend in costs and charges, but at a lower pace.

Charges of Pillar III voluntary private pensions

The fee structure of the Pillar III pension funds is more complex. Management companies charge various entry fees, in which case the calculation of the overall impact of fees on accumulated assets is harder to obtain. Table 14.8 compares fees of Pillar III pension funds in Lithuania.

| Year | Total ongoing charges | Total Expense Ratio |

|---|---|---|

| 2004 | 0.39% | 0.39% |

| 2005 | 12.37% | 12.37% |

| 2006 | 6.38% | 6.38% |

| 2007 | 5.01% | 5.01% |

| 2008 | 2.73% | 2.73% |

| 2009 | 2.50% | 2.50% |

| 2010 | 2.99% | 2.99% |

| 2011 | 2.07% | 2.07% |

| 2012 | 1.83% | 1.83% |

| 2013 | 2.10% | 2.10% |

| 2014 | 1.89% | 1.89% |

| 2015 | 2.06% | 2.06% |

| 2016 | 2.01% | 2.01% |

| 2017 | 1.40% | 1.40% |

| 2018 | 1.63% | 1.63% |

| 2019 | 1.94% | 1.94% |

| 2020 | 1.42% | 1.42% |

| 2021 | 1.44% | 1.44% |

| 2022 | 1.27% | 1.27% |

| 2023 | 1.05% | 1.05% |

| 2024 | 1.03% | 1.03% |

| Data: Official Statistics Portal Calculations: BETTER FINANCE. | ||

In most cases, additional costs, that are charged on the pension fund’s account and not directly visible to the savers are the audit fees and custodian (depository) fees. On average, they account for 0.25%, and 0.055% respectively.

Comparing the Pillar II and Pillar III pension funds’ fees, it is obvious, that even if the management and investment strategies are very similar, the fee structure and overall level of fees in Pillar III is more than double the fees in Pillar II.

14.4 Taxation

Lithuania applies an Exempt Exempt Exempt (EEE) regime for the taxation of Pillar II pension accounts. Employee contributions are tax-deductible even if they are higher than required (3% + 1.5%). Investment income on the level of the pension fund is tax-exempt. Pension benefits paid out during retirement are tax-exempt from a personal income tax as the old-age income is considered as a part of social system.

A similar tax regime is applied on the Pillar III savings, but there are some ceilings on contributions and withdrawals.

Regarding the contribution phase, there is a tax-refund policy, which means that the contributions of up to 25% of gross earnings, the income tax (15%) is returned. Therefore, we can conclude that the contribution phase is a “E” regime.

Positive returns on accumulated savings are tax-exempt, so the investment phase is an “E” regime.

Regarding the withdrawal (pay-out) phase, pension benefits paid from Pillar III voluntary funds can be received at any age and are levied with 15% income tax, but become tax-free if a person:

- holds savings in a Pillar III pension fund for at least 5 years and reaches the age of 55 at the time of payment of the benefit (and the pension savings agreement was concluded before ); or

- holds savings in a Pillar III pension fund for at least 5 years and reaches the age which is five years earlier than the threshold for the old-age pension at the time of payment of the benefit (if the pension savings agreement was concluded after ).

Under the optimum set-up, the EEE tax regime can be achieved on Pillar III savings.

| Product categories |

Phase

|

Fiscal Regime | ||

|---|---|---|---|---|

| Contributions | Investment returns | Payouts | ||

| Pillar II Funded pensions | Exempted | Exempted | Exempted | EEE |

| Pillar III Voluntary private pensions | Exempted | Exempted | Taxed | EET |

| Source: BETTER FINANCE own elaboration, based on INSERT NAME. | ||||

14.5 Performance of Lithuanian long-term and pension savings

Real net returns of Lithuanian long-term and pension savings

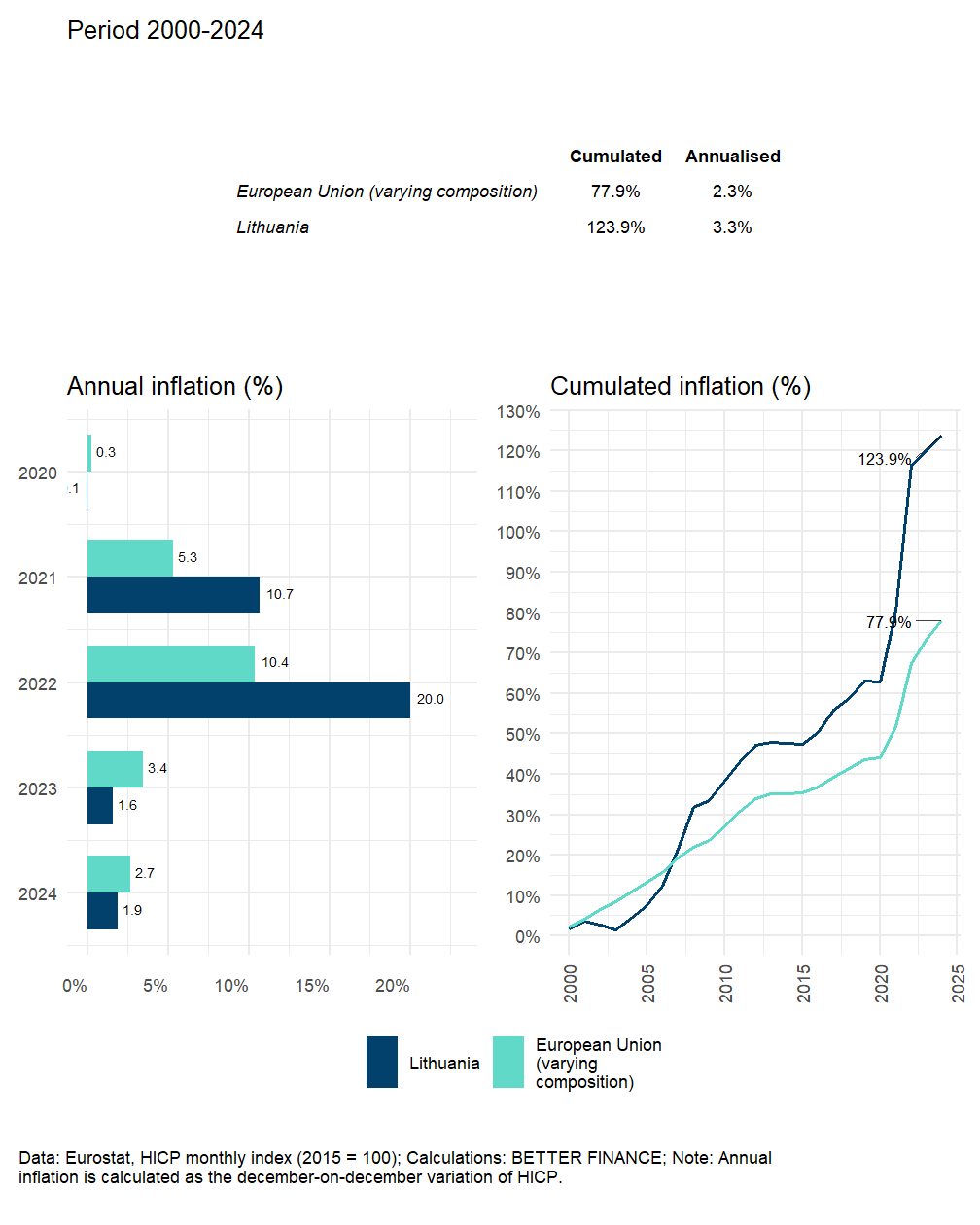

Before inspecting the real net returns of Lithuanian pension funds, the inflation for the last 25 years is presented in Figure 14.7. The inflation has doubled the price level during the last 25 years and considering the small financial market where most of the savings are invested globally, the real returns might by negatively influenced by higher inflation in Lithuania during the analysed period.

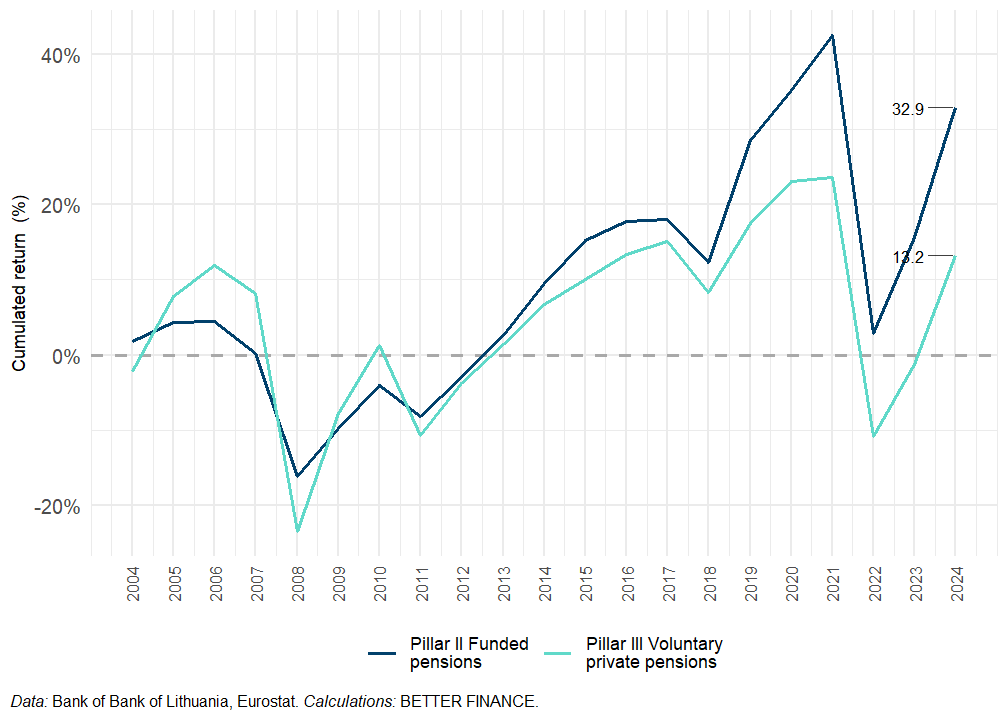

Pension returns of Pillar II pension funds differ according to the life-cycle investment strategy applied. When comparing the returns, it should be noted that the major changes in Pillar II regarding the introduction of the target date funds and reallocation of savers into these funds based on the birth year in 2019 could influence the direct comparison of pre-2019 returns and the returns of the funds beyond the year 2019.

When inspecting particular pension funds within each group, only minor changes in performance were observed between the years 2019 and 2024.

Pillar III pension funds’ performance is presented according to their investment strategy, where 3 groups are formed.

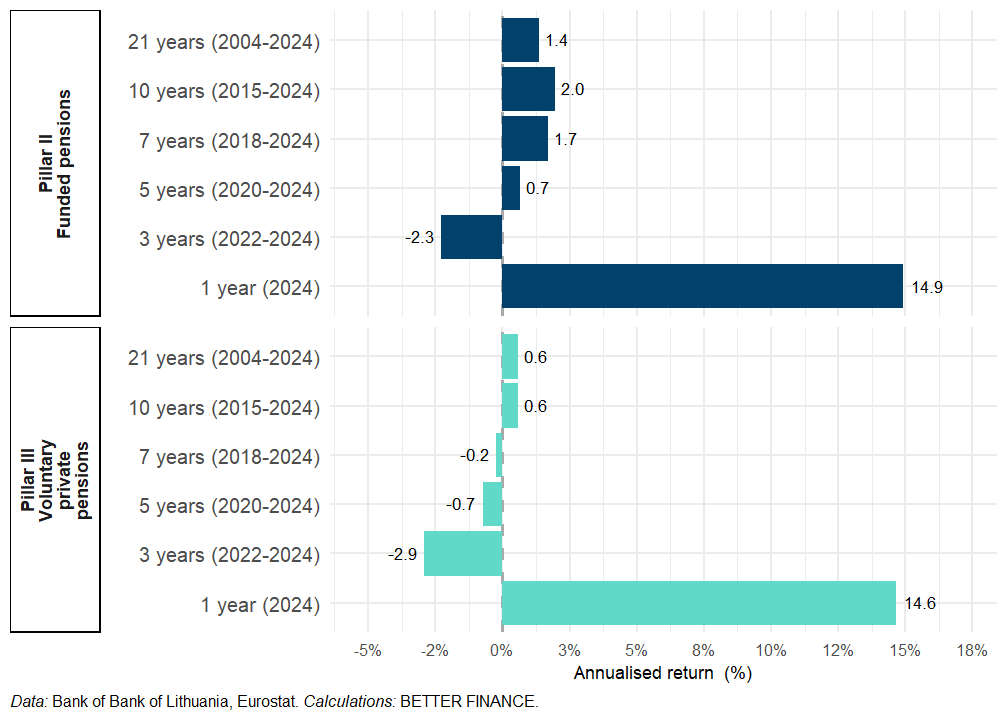

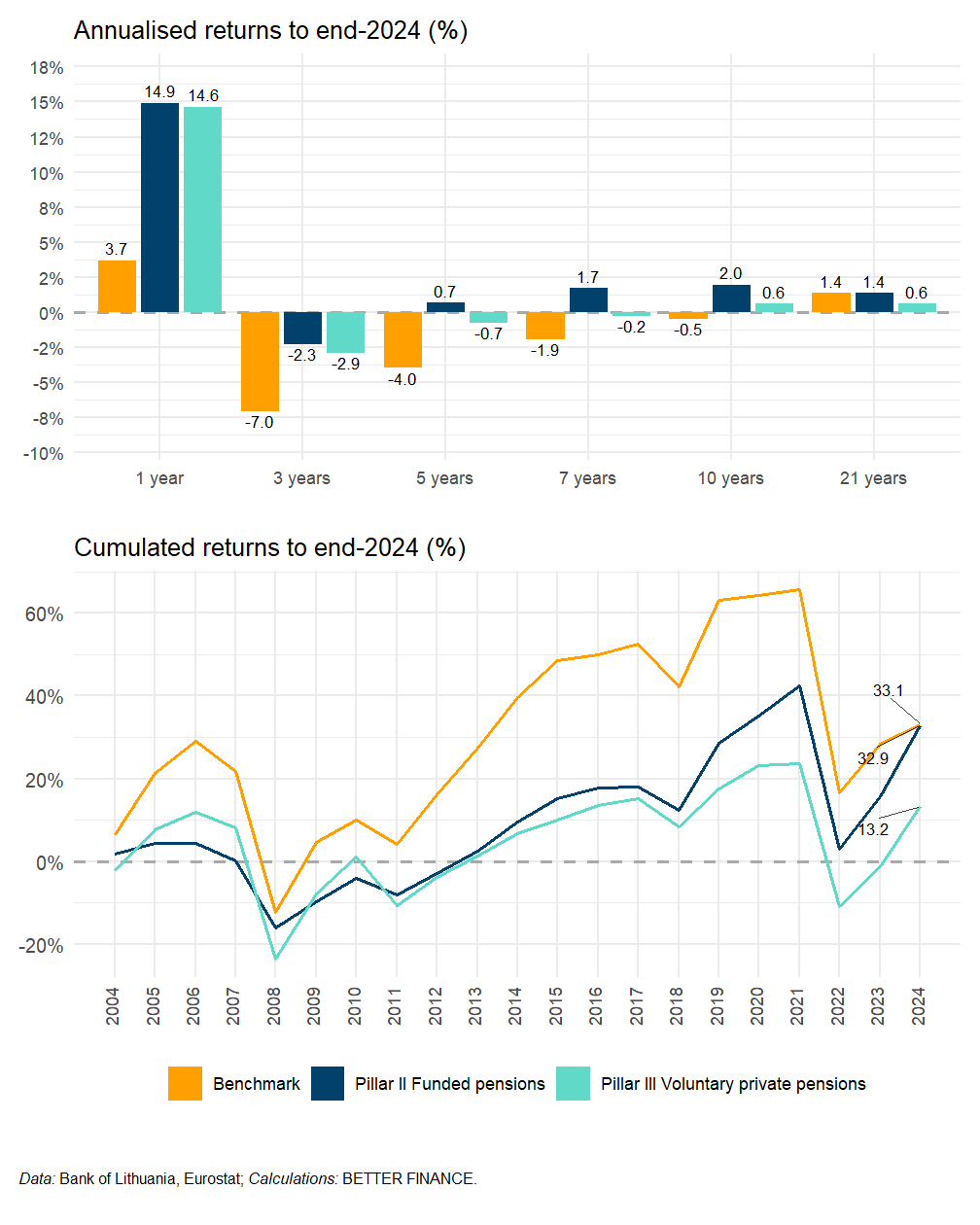

Real annual and cumulative returns of pension vehicles in Lithuania are presented in Figure 14.8 and Figure 14.9.

Performance of Pillar II and Pillar III pension funds is quite similar, while the higher fees of Pillar III pension funds drags the after fees returns lower and into negative territory in real terms.

Do Lithuanian savings products beat capital markets?

In this section, we compare the performance of the mandatory and voluntary pension funds in Lithuania to the performance of relevant capital market benchmarks. By analysing the portfolio structure of pension funds, we have selected the a balanced benchmark portfolio (50% equity–50% bonds) based on two pan-European indices.

| Equity index | Bonds index | Start year | Allocation | |

|---|---|---|---|---|

| Pillar II Funded pensions | STOXX All Europe Total Market | Barclays Pan-European Aggregate Index | 2004 | 50%–50% |

| Pillar III Voluntary private pensions | STOXX All Europe Total Market | Barclays Pan-European Aggregate Index | 2004 | 50%–50% |

| Data: STOXX, Bloomberg; Note: Benchmark porfolios are rebalanced annually. | ||||

We can conclude that Lithuanian pension vehicles are not able to beat the market benchmark, even though Pillar II funded pensions are getting very close other the 21 years of our period of analysis. Detailed analysis of the particular pension funds’ performance could show that more aggressive pension funds are able to stay in positive real returns over the analysed period.

14.6 Conclusions

Considering the wider factors, it is safe to say that the decreasing labour force and the implementation of the automatic balancing mechanism within the PAYG pillar will lead to a lower replacement ratio generated from Pillar I pensions. Therefore, Lithuania can be seen as a strong advocate of private pension savings where the pillars will grow on importance.

Reforms in the area of PAYG scheme supported with the funded pension schemes that have been adopted in 2018 and effective since 2019 are started shifting the preferences of the Lithuanian savers to rely more on their private funded pension schemes.

Real net performance of the Pillar II as well as Pillar III pension funds after the negative returns in 2022 were overall positive in 2023 and 2024. Pillar II stayed in positive real return territory over the entire analysed period. Pillar III scheme, which cannot compete to the similar and cheaper peers in Pillar II, moved from a negative territory to a positive one over the analysed period especially due to positive returns in 2024.

The latest changes in the contributory mechanism, where additional individual contributions towards Pillar II are promoted and tax deductible, puts more pressure on Pillar III fund managers due to the growing crowding-out effect.

Introduction of life-cycle investment style into the Pillar II since 2019 created significant differences between the portfolio structure of pension funds within both pillars, which leads to the conclusion that Pillar III with more conservative approach will need to find its competitiveness against promoted Pillar II funds.

Lithuania has a favourable tax treatment of private pension savings, where in both cases an EEE tax regime is applied.

Latest changes in the Pillar II, adopted in 2025, however spur some doubts on the future significance of Pillar II for future pensioners.

Acronyms

- AuM

- assets under management

- DB

- Defined benefits

- DC

- Defined contributions

- EEE

- Exempt Exempt Exempt

- IC

- indexing coefficient

- PAC

- pension accumulation company

- PAYG

- pay-as-you-go

- UCITS

- Undertaking for Collective Investment in Transferable Securities

- p.p.

- percentage point