Product categories

|

Reporting periods

|

||

|---|---|---|---|

| Name | Pillar | Earliest data | Latest data |

| Mandatory pension funds | Occupational (II) | 2003 | 2024 |

| Voluntary pension funds | Voluntary (III) | 2011 | 2024 |

Kopsavilkums

Fondēto pensiju shēmas savas pastāvēšanas laikā ir piedzīvojušas negatīvu vidējo ienesīgumu pat tad, ja pensiju fondu portfelis obligāto pensiju pīlārā ir bijis konservatīvi orientēts. II pīlāra pensiju fondi 2022. gadā uzrādīja vidēji negatīvu nominālo ienesīgumu -14,13% apmērā, savukārt III pīlāra fondi arī uzrādīja vidēji negatīvu nominālo ienesīgumu -14,63% apmērā. Kopumā pozitīva attīstība bija vērojama II pīlāra tirgū, kur pasīvi pārvaldīto fondu ieviešana veicināja turpmāku komisijas maksu samazināšanos. Maksa ir samazinājusies arī III pīlārā, tomēr III pīlāra pensiju fondu sarežģītā maksu struktūra un joprojām augstākas maksas būtiski ietekmē gaidāmos uzkrātos ieguvumus.

Summary

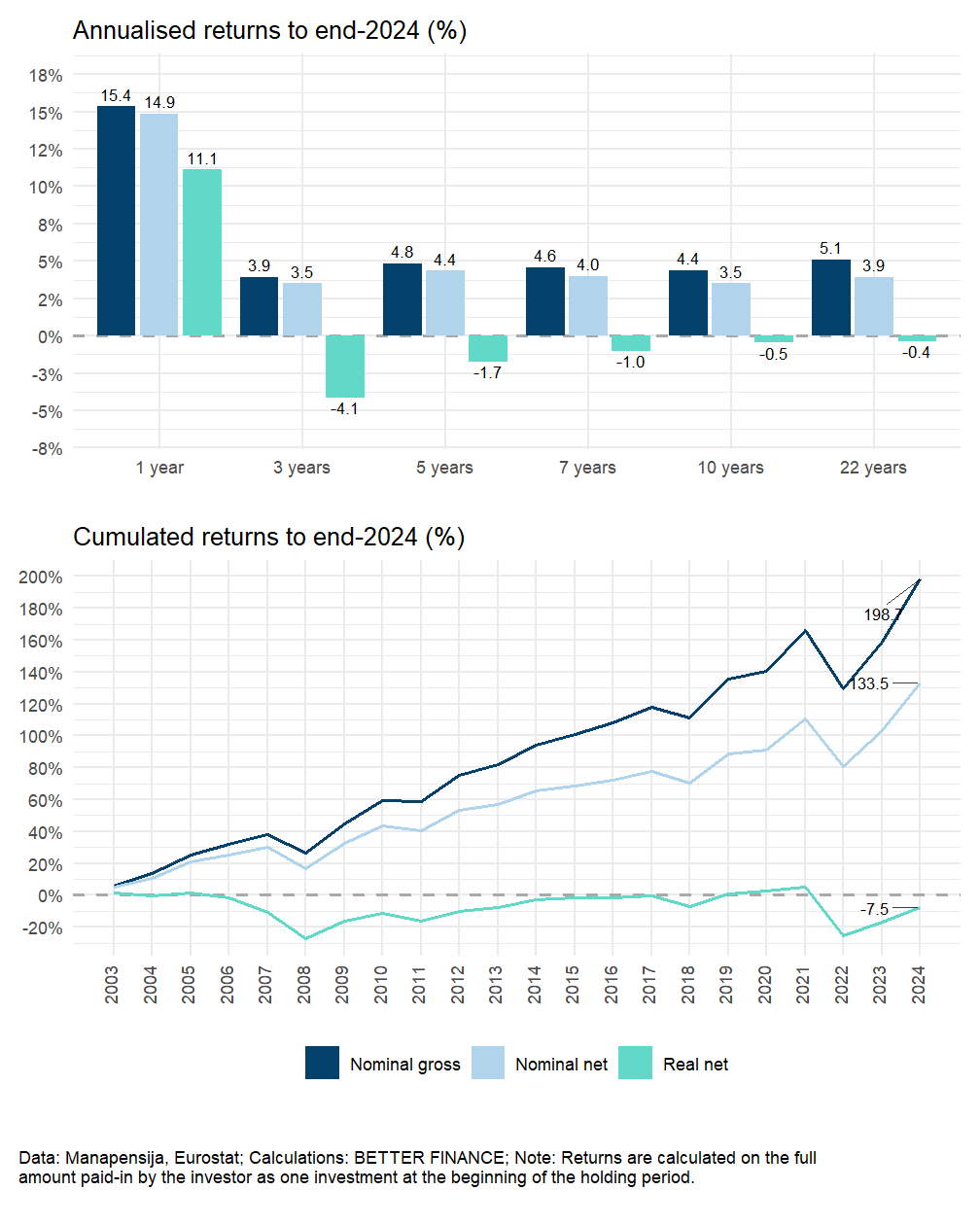

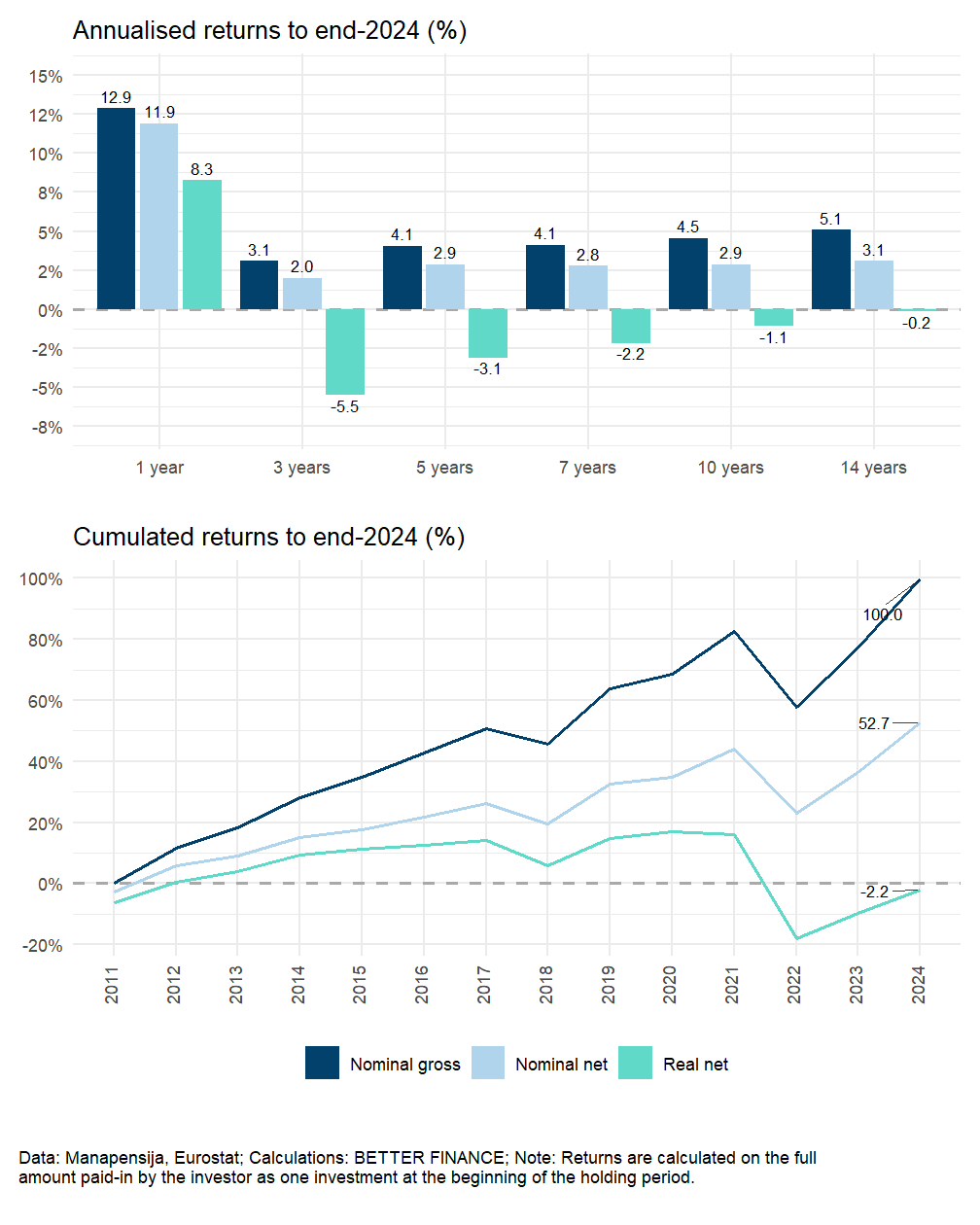

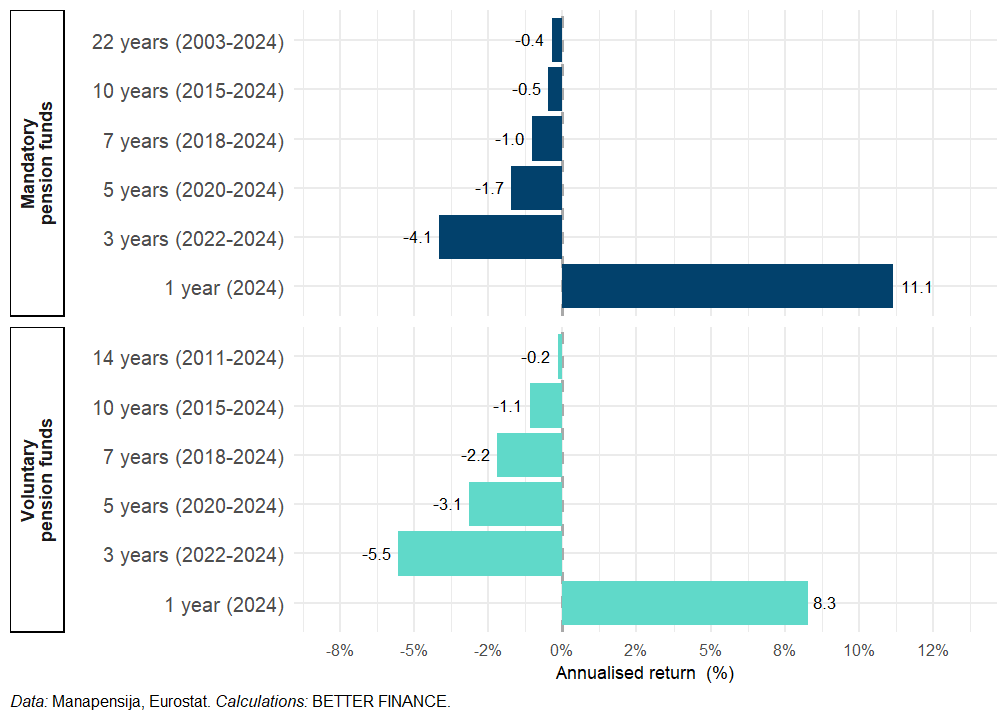

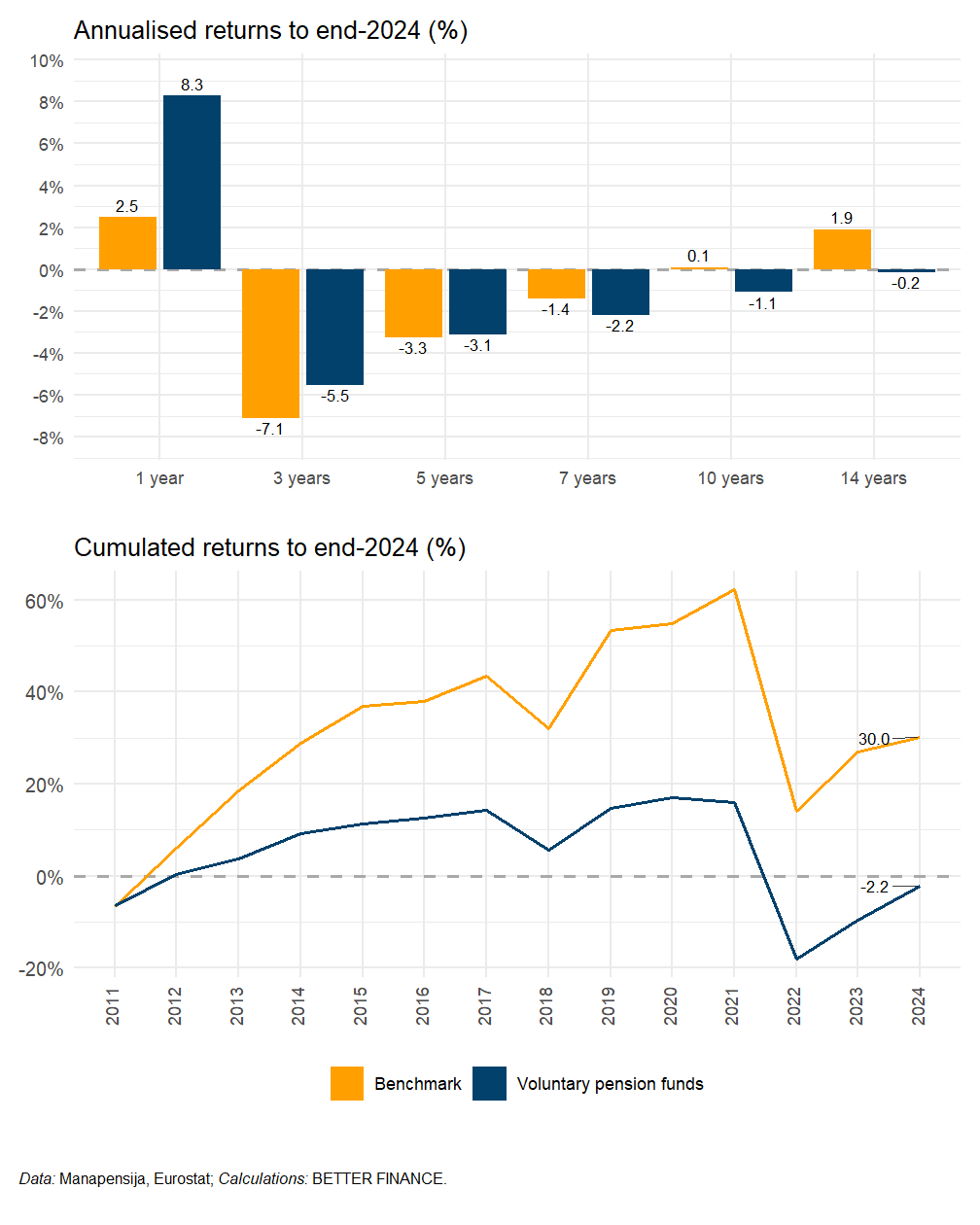

Funded pension schemes have experienced negative average annualized returns during their existence even when the portfolio of pension funds in mandatary pension pillar has been conservatively oriented. Pillar II pension funds recorded on average positive real returns of 11.14% in year 2024, while Pillar III funds delivered also on average positive real return of 8.27%. Overall positive development could have been seen on the Pillar II market, where the introduction of passively managed funds contributed to decrease of fees during last 5 years to an average of 0.48% per annuum (p.a.). The fees have further decreased also in the Pillar III, but still preserve complex fee structure. Higher fees of around 1.0% p.a. in Pillar III pension funds play a significant role on the expected accumulated benefits.

13.1 Introduction: The Latvian pension system

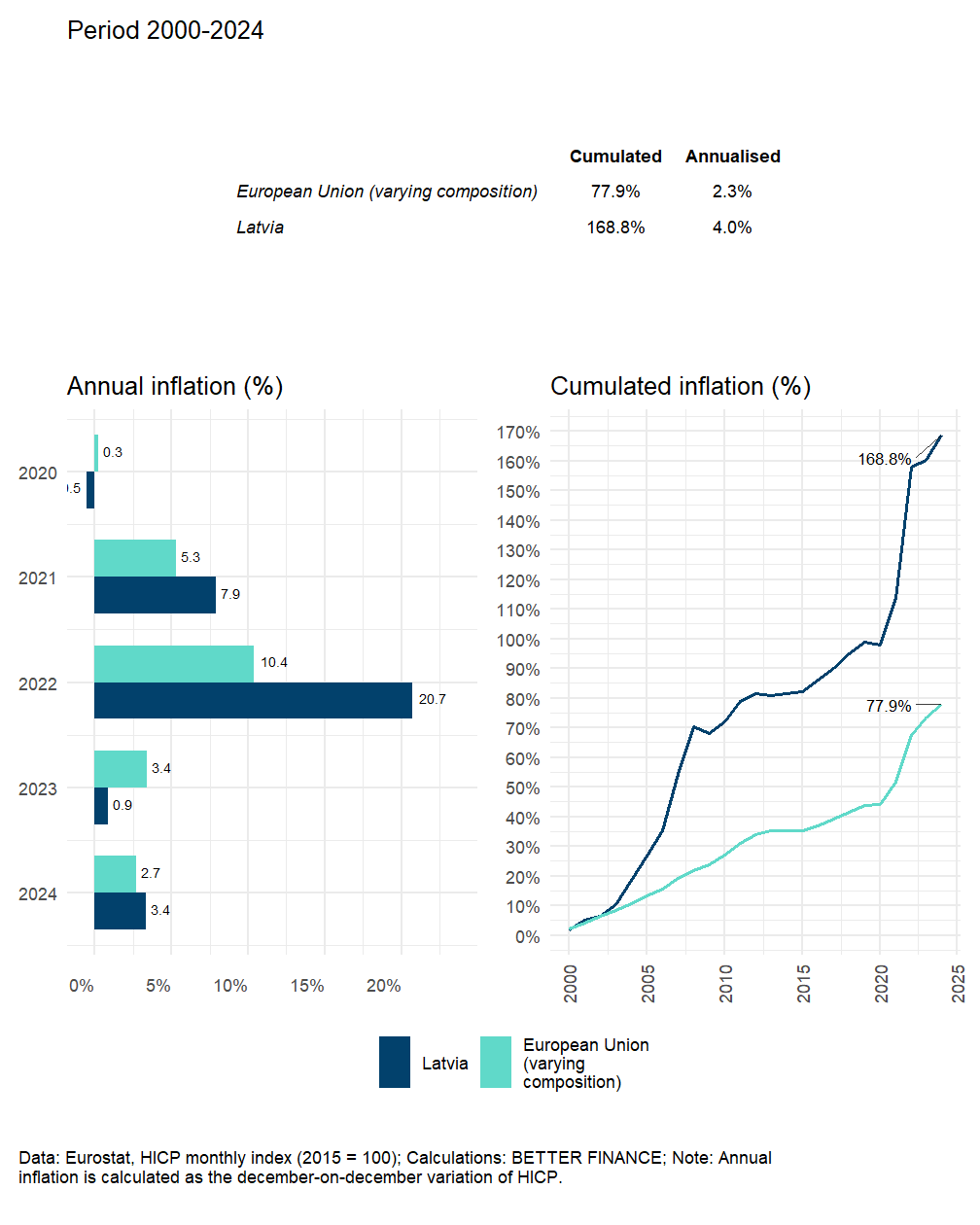

There have been no major changes in the pension system in Latvia announced in 2024. Since July 1st, 2024, the SSIA provides 2nd pension pillar fund managers with information about the members whose assets they manage, so that the fund managers can provide personalised advice to fund members in relation to whether they have chosen the best investment plan for their age and needs. The performance of private pensions (mandatory as well as voluntary) was overall positive in 2024 both in nominal and real terms mainly due to the pick-up of the world markets despite still elevated inflation in Latvia compared to the EU average.

Holding period

|

|||||||

|---|---|---|---|---|---|---|---|

| 1 year | 3 years | 5 years | 7 years | 10 years | Whole reporting period | to... | |

| Mandatory pension funds | 11.1% | -4.1% | -1.7% | -1.0% | -0.5% | -0.4% | end 2024 |

| Voluntary pension funds | 8.3% | -5.5% | -3.1% | -2.2% | -1.1% | -0.2% | end 2024 |

| Data: Manapensija, Eurostat; Calculations: BETTER FINANCE | |||||||

Latvia has improved significantly its mandatory part of funded pension system. Together with its notional defined contribution (NDC) scheme for pay-as-you-go (PAYG) pillar, mandatory funded part as well as NDC part form a well-designed pension system that motivates individuals to contribute as there is a clear connection between paid contributions and expected pension benefits. However, voluntary part of the pension system still suffers from very complicated fee structure, high fees and low transparency.

Pension system in Latvia: An overview {sub:LV_intro_overview}

Latvia is currently operating a multi-pillar pension system based on three pension pillars. The reform followed World Bank recommendations on creating a pension system with unfunded PAYG and funded pension pillars. Since 2001, the Latvian multi-pillar pension system includes:

- Pillar I (state compulsory PAYG pension scheme);

- Pillar II (mandatory state funded pension scheme) which is financed by a part of the social insurance contributions diverted from Pillar I;

- Pillar III (voluntary private pension scheme).

The introduction of the multi-pillar pension system has aimed its overall functionality on a different approach to each pension pillar operation, but with the overall objective of ensuring an adequate pension for individuals under the demographic risks of an aging society, as well as the pension system’s overall future financial stability.

The reform of the Latvian pensions system started in 1995, when it was decided to implement the three-pillar pension system. Firstly, the shift from the old Soviet-styled PAYG pension system to the notional defined contribution pension scheme (NDC PAYG Pillar I) was carried out. The new law on state pensions was adopted by the Parliament in November 1995 and came into force on January 1st, 1996. The state mandatory-funded pension scheme (Pillar II) started operating in July 2001. The private pension funds (Pillar III) have been operating since 1998.

| Pillar I | Pillar II | Pillar III |

|---|---|---|

| State Pension | Funded pension | Voluntary pension |

| Mandatory | Mandatory | Voluntary |

| NDC PAYG | Funded | |

| Financed by social insurance contributions | DC (financed by social insurance contributions) | |

| Publicly managed | Privately (and publicly) managed pension funds | Privately managed pension funds |

| Benefits paid via State Social Insurance Agency | Financed by social insurance contributions Individual pension accounts |

Financed by individual voluntary contributions Two types of pension plans:

|

| Coverage: Generally entire Latvian population | Coverage: Generally entire working population | 37.31% |

| Quick facts | ||

| Nb. of economically active citizens: 1 057 492 | Administrators: 7 | Administrators: 7 |

| Nb. of old-age pensioners: 436 900 | Funds: 34 | Funds: 16 |

| Avg. old-age pension: EUR 550 | AuM: EUR 8 778 mln. | AuM: EUR 896 mln. |

| Avg. salary: EUR 1 488 | Participants: 1.309 mln. | Participants: 0.430 mln. |

| Avg. replacement ratio: 36.96% | ||

| Data: Own composition based on Official Statistical Portal, 2025. | ||

From the point of view of individual savers, the Latvian pension system combines two aspects: personal interest in building wealth (based on a level of contributions and the length of the saving period) and intergenerational solidarity.

The Latvian NDC PAYG-based pension Pillar I has been effectively introduced by a partial reform in January 1996 and represents a mandatory scheme for all economically active persons who make social insurance contributions calculated from a monthly gross salary (income). Paid contributions are used for the payment of old age pensions to the existing generation of pensioners. Pillar I is organized as a NDC scheme, where the notional value of career contributions is recorded on each contributor’s personal account. Prior to claiming pension benefits, the pension capital recorded on individual NDC account is recalculated in accordance with the laws and regulations at the time when the individual accesses his/her pension.

Pension Pillar II is in fact a state-organized Pillar I-bis, meaning that part of the individually paid social contributions are channelled to Pillar II and recorded on individual pension accounts. Monthly contributions are invested into individually chosen investment plans (pension funds) managed by private pension fund management companies. Pillar II was launched in July 2001 and completed the multi-pillar-based pension reform in Latvia.

Pillar III was launched in July 1998 and is organized as a private voluntary pension scheme. It accumulates individual contributions, as well as employer contributions made on the behalf of individual employees, to the selected voluntary pension fund.

State old-age pension (Pillar I) should guarantee the minimum income necessary for subsistence. It is based on an NDC PAYG principle of redistribution, i.e. the social tax paid by today’s employees covers the pensions of today’s pensioners. However, the amount of paid contributions for each saver are recorded on individual accounts.

The statutory retirement age in Latvia in 2024 is 64 years and 9 months both for men and women.1 However, the law stipulates a gradual increase of the retirement age by three months every year until the general retirement age of 65 years is reached in 2025. Early pension is possible in Latvia if two conditions are met: (1) an individual in 2024 reaches the age of at least 62 years and 9 months (gradually rising by three months a year until 2025) and (2) an individual contributed for a period of at least 30 years.

Old-age pension is based on the insured’s contributions, annual capital growth adjusted according to changes in the earnings index, and average life expectancy. Old age pension is calculated by considering two parameters:

- \(K\) — accumulated life-time notional pension capital, which is an accrued amount of paid contributions since the introduction of NDC system (January 1st, 1996) until the pension granting month. However, during the transition period to a full the NDC system, these two aspects are also taken into account:

- average insurance contribution wage from 1996 until 1999 (inclusive);

- insurance period until January 1st, 1996;

- \(G\) — cohort unisex life-expectancy at the time of retirement.

Annual old-age pension (\(P\)) is calculated as follows: \[P = \frac{K}{G}\]

It can be said that the Latvian NDC PAYG Pillar I has shifted in a direction where the average gross replacement ratio is lower than 35%. The average income replacement ratios for old-age pension in Latvia are shown in Table 13.4.

| Indicator / Year | Average Old-age pensions | Average Gross Monthly Wages and Salaries | Gross Replacement Ratio | Average Net Monthly Wages and Salaries | Net Replacement Ratio |

|---|---|---|---|---|---|

| 2003 | EUR 92 | EUR 274 | 33.6% | EUR 196 | 46.9% |

| 2004 | EUR 101 | EUR 300 | 33.7% | EUR 214 | 47.2% |

| 2005 | EUR 115 | EUR 350 | 32.9% | EUR 250 | 46.0% |

| 2006 | EUR 137 | EUR 430 | 31.9% | EUR 308 | 44.5% |

| 2007 | EUR 158 | EUR 566 | 27.9% | EUR 407 | 38.8% |

| 2008 | EUR 200 | EUR 682 | 29.3% | EUR 498 | 40.2% |

| 2009 | EUR 233 | EUR 655 | 35.6% | EUR 486 | 47.9% |

| 2010 | EUR 250 | EUR 633 | 39.5% | EUR 450 | 55.6% |

| 2011 | EUR 254 | EUR 660 | 38.5% | EUR 470 | 54.0% |

| 2012 | EUR 257 | EUR 685 | 37.5% | EUR 488 | 52.7% |

| 2013 | EUR 259 | EUR 716 | 36.2% | EUR 516 | 50.2% |

| 2014 | EUR 266 | EUR 765 | 34.8% | EUR 560 | 47.5% |

| 2015 | EUR 273 | EUR 818 | 33.4% | EUR 603 | 45.3% |

| 2016 | EUR 280 | EUR 859 | 32.6% | EUR 631 | 44.4% |

| 2017 | EUR 289 | EUR 926 | 31.2% | EUR 676 | 42.8% |

| 2018 | EUR 314 | EUR 1 004 | 31.2% | EUR 742 | 42.3% |

| 2019 | EUR 340 | EUR 1 076 | 31.6% | EUR 793 | 42.8% |

| 2020 | EUR 367 | EUR 1 143 | 32.1% | EUR 841 | 43.6% |

| 2021 | EUR 432 | EUR 1 277 | 33.8% | EUR 939 | 46.0% |

| 2022 | EUR 528 | EUR 1 373 | 38.4% | EUR 1 006 | 52.4% |

| 2023 | EUR 514 | EUR 1 536 | 33.4% | EUR 1 119 | 45.9% |

| Data: Central Statistical Bureau of Latvia, 2024. | |||||

A Minimum old-age pension mechanism is effective in Latvia. The minimum amount of the monthly old-age pension cannot be less than the state social security benefits with an applied coefficient tied to the years of service (insurance period):

- persons with insurance period up to 15 years: 1.1;

- persons with insurance period from 21 to 30 years: 1.3;

- persons with insurance period from 31 to 40 years: 1.5;

- persons with insurance period starting from 41 years: 1.7.

Minimum amount of old-age pension is determined by applying a coefficient of 1.1 to the calculation base of the minimum old-age pension and increasing the amount by 2 % of the calculation base of the minimum old-age pension for each additional year beyond the insurance period required for the old-age pension (currently 15 years).

The minimum old-age pension is calculated using the basic state social security benefit multiplied by the respective coefficient that is tied to the number of service (working) years (see Table 13.5).

| Years of service (insurance period) | Min. old-age pension since Jan. 2022 |

|---|---|

| Insurance length 15 years | EUR 172.70 |

| Insurance length 30 years | EUR 219.80 |

| Insurance length 40 years | EUR 251.20 |

| Insurance length 50 years | EUR 282.60 |

| Data: Ministry of Welfare, 2025. | |

Starting from July 1st, 2024, the amount of the minimum old-age pension shall be determined by applying a coefficient of 1.1 to the minimum old-age pension calculation base of EUR 171 (EUR 206 for persons with disabilities from childhood) and EUR 3.42 for each subsequent year over 15 years of service. If the person’s insurance period in Latvia is:

- at least 15 years, the amount of the minimum old-age pension cannot be less than EUR 188.10 (EUR 171 x 1.1) and for persons with disabilities since childhood EUR 226.60 (206 x 1.1);

- 16 years and more, the amount of the minimum old-age pension is determined by raising it by EUR 3.42 for each year of insurance; for persons with disability from childhood – by EUR 4.12 for each year of insurance.

The amount of the minimum old-age pension is determined on the day of granting (recalculation) the pension, as well as by reviewing the calculation basis of the minimum old-age pension.

Pillar II pension scheme was launched on July 1st, 2001. As of that date, a portion of every individual’s social contributions are invested into the financial market and accumulated on their Pillar II personal account. Everyone who is socially insured is entitled to be a participant of the Pillar II scheme as long as the person was not older than 50 years of age on July 1st, 2001. Participation in the second tier is compulsory for those who had not reached the age of 30 on July 1st, 2001 (born after July 1st, 1971).

Gradually all employees will participate in Pillar II. Persons who were between the ages of 30 and 49 (born between and ) at the time when the scheme was launched could and still can join the system voluntarily. Administration of Pillar II contributions are made by the State Social Insurance Agency, which collects and redirects 20% old-age pension insurance contributions between the NDC and FDC pillar pension scheme individual accounts. According to the Law on State Funded Pension, the State Social Insurance Agency also performs additional tasks connected to the Pillar II administration.

The Ministry of Welfare, according to the Law on State Funded Pension, performs the supervision of the funded pension scheme and has the right to request and receive an annual account from the State Social Insurance Agency regarding the operation of the funded pension scheme. Total redistribution of old-age pension contributions between Pillar I and Pillar II of the pension scheme are shown in Table 13.6.

| Years | Pillar I (NDC) | Pillar II (FDC) |

|---|---|---|

| 2001-2006 | 18% | 2% |

| 2007 | 16% | 4% |

| 2008 | 12% | 8% |

| 2009-2012 | 18% | 2% |

| 2013-2014 | 16% | 4% |

| 2015 | 15% | 5% |

| 2016 and ongoing | 14% | 6% |

| Data: Manapensija and State Social Insurance Agency, 2024. | ||

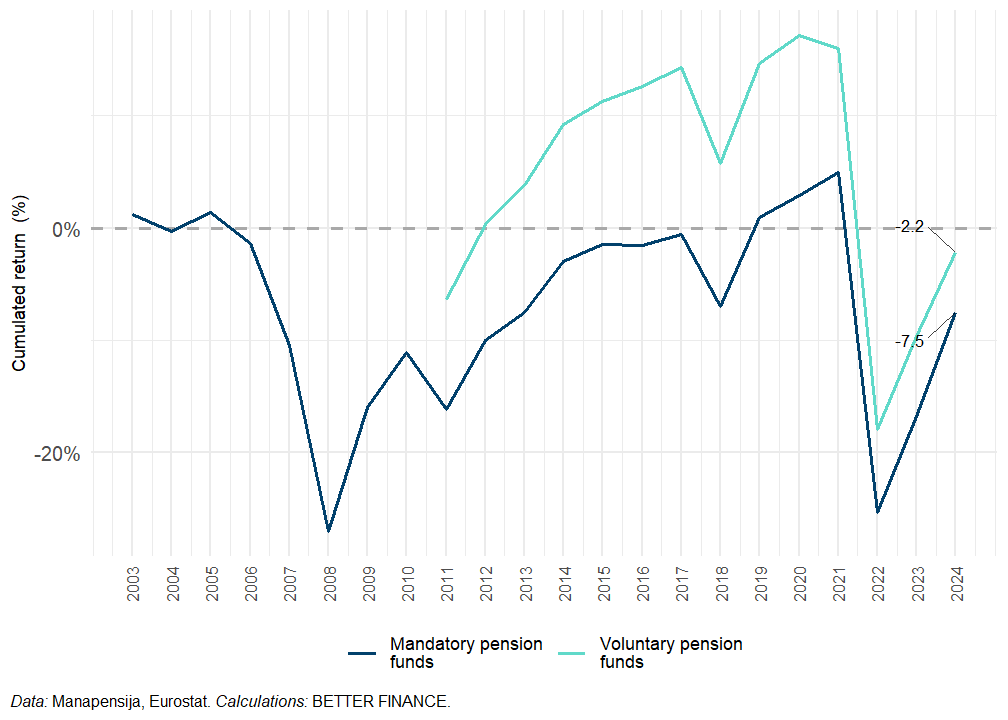

Contributions into Pillar II were raised continuously with the adopted reforms. However, during the financial crisis, the contributions into Pillar II were reduced to 2% with gradual growth since 2012. It should be mentioned that the largest part of contributions (8% of salary) had flown into the pension fund in 2008, right at the top and before the crash of financial markets. This has significantly influenced the performance of funds, which is analysed in the sub-section dedicated to pension returns. Investing is performed by a third party: licensed fund managers.

Upon retiring, Pillar II participants will be able to make a choice: either add the accumulated pension capital to Pillar I and receive both pensions together or to entrust the capital accumulated in Pillar II to the insurance company of their choice and buy a single annuity.

Several changes have been made in the management of accumulated savings on personal accounts of Pillar II participants. Private fund managers are involved in managing Pillar II contributions and assets and today participants of Pillar II are in the position to choose their fund manager themselves. The private fund managers offer to invest the pension capital and into corporate bonds, shares and foreign securities. Participants of the system are entitled to change their fund manager once a year and, in addition, investment plans within the frame of one fund manager can be changed twice a year. Operation of private fund managers is supervised by the Finance and Capital Market Commission.

In 2019, the Parliament has adopted changes in Pillar II, where since January 2020, a saver could define any person, to which the accumulated capital on personal account can be inherited directly.

Voluntary private pension scheme, or pension Pillar III, was launched in July 1998, and it gives the opportunity to create additional voluntary savings in addition to the state organized Pillar I and II. Contributions that individuals and/or the employer regularly pay into the pension fund are invested in different securities, depending on the chosen investment strategy.

The Law on Private Pension Funds foresees that Latvian commercial banks, insurance companies and legal persons have the right to establish a private fund. Assets are invested by private pension funds with the aim not only to maintain the value of savings, but to increase it over a long-time period. There are generally two types of voluntary private pension funds in Latvia divided based on their investment risk level:

- open voluntary pension funds (34 operational in Pillar II and 16 in Pillar III in 2024) – high, medium and low risk level

- closed voluntary pension funds (only one operating in Latvia in 2024).

Pension scheme participants can subscribe to a pension scheme by entering directly into a contract with an open pension fund or via their employer. Pension scheme participants can participate in a pension scheme through the intermediation of their employer if the employer has entered into a collective contract with an open or closed pension fund. A collective contract with a closed pension fund may be entered into only in such cases when the relevant employer is also one of the founders (stockholders) of the same closed pension fund. Acknowledging the fact that employers might enter into collective agreement with employees and establish the pension scheme, voluntary private pension funds might be recognized as a collective pension scheme.

According to the Law on Private Pension Funds, accumulated pension capital in private pension funds can be accessed by individuals when they reach the age of 55. In order to receive the Pillar III accrued pension, an individual must submit an application to the respective pension fund. The supervisory authority for all voluntary private pension funds in Latvia is the Financial and Capital Markets Commission.

13.2 Long-term and pension savings vehicles in Latvia

Mandatory pension funds are the only pension vehicles allowed for the Pillar II funded pension scheme. Funded pension scheme is a state-organized set of measures for making contributions, administration of funds contributed and payments of pensions which (without increasing the total amount of contributions for old age pensions) - provides an opportunity to acquire additional pension capital by investing part of the pensions’ contributions in financial instruments and other assets.

On the other hand, voluntary pension funds for the Pillar III private pension scheme are less strictly regulated. The law on Private Pension Funds provides a wide range of possibilities to organize and manage private voluntary pension funds. The law prescribes the accumulation of pension benefits (both in the specified contribution scheme and in the specified pay-out scheme), the types of private pension funds, the basis for activities thereof, the types of pension schemes, the rights and duties of pension scheme participants, the management of funds, the competence of holders of funds, and state supervision of such activities. There are two types of private pension funds in the Latvian voluntary private pension pillar:

- closed, for fund founders’ (corporate) staff;

- open, of which any individual may become a participant, either directly or through an employer.

This distinction between private pension funds is rather significant, as closed private pension funds (only one operating in Latvia in 2024) could be recognized as a typical occupational pension fund. However, open private voluntary pension funds are more personal ones. Pillar III pension vehicles (voluntary pension funds) can be created only by limited types of entities, namely:

- employers entering into a collective agreement with a pension fund, technically become founders of a closed pension fund;

- for an open pension fund, two types of institutions can establish a fund:

- banks (licensed credit institutions);

- life insurance companies.

These founders usually hire a management company, who creates a different pension plan managed under one pension fund and manages the investment activities. Pension scheme assets can be managed only by the following commercial companies:

- a credit institution, which is entitled to provide investment services and non-core investment services in Latvia;

- an insurance company, which is entitled to engage in life insurance in Latvia;

- an investment brokerage company, which is entitled to provide investment services in Latvia;

- an investment management company, which is entitled to provide management services in Latvia.

The level of transparency in providing publicly available data for private pension funds before the year 2011 is rather low. Therefore, the analysis of the market and main pension vehicles has been performed with publicly available data starting from December 31st, 2011. Currently (as of December 31st, 2024), 34 pension funds in Pillar II and 21 open private voluntary pension funds in Pillar III and one closed private pension fund have existed on the market.

Second pillar: Mandatory pension funds

Currently (as of December 31st, 2024), 34 mandatory pension funds have been operational on the Pillar II market. There were 3 new high risk funds entering the market during 2023 and 1 new medium risk (balance) pension fund (VAIRO) for older cohorts of savers in 2024, which signals market attractiveness for fund providers and slightly changing risk appetite of savers. New funds focus on active management and can be characterized as target date funds. There is no specific legal recognition of types of pension funds based on their investment strategy, nor any legal requirement to provide a specific investment strategy for pension funds. It is up to a pension fund manager to provide an in-demand type of pension fund in order to succeed on the market. However, every fund manager is required to develop a systematic set of provisions, according to which funds are managed. They are presented in a prospectus of the relevant pension fund and in a Key Investor Information Document (KIID) — a Key Information Document (KID) specific to Undertaking for Collective Investment in Transferable Securities (UCITS) funds, with particular features — for participants of the scheme. The prospectus of a pension fund and the key information document for participants are an integral part of the contract entered into between the Agency and the manager of pension funds. Pension fund prospectus must clearly define the risk-reward profile and indicate proposed investment strategy of the respective expected portfolio structure.

Although there is no legal recognition of types of pension funds, they can be divided into three types based on their risk/return profiles:

- Conservative funds, with no equity exposure and a 100% share of bonds and money market instruments;

- Balanced funds with bonds and money market instrument share of at least 50%; in addition, a maximum of 15% of the funds’ balances can be invested in equities;

- Active funds with an equity share (resp. investments in capital securities, alternative investment funds or such investment funds that may make investments in capital securities or other financial instruments of equivalent risk) of up to 100% (since 2021) and no limits on investments in bonds and money market instruments.

The legislation sets relatively strict quantitative investment limits for pension funds, trying to supplement the prudent principle.

Overall asset allocation in Latvia is fairly conservative despite the possibility of choosing a plan according to risk preference. The chart below presents the amount of Assets under Management for types of pension funds according to their investment strategy.

Contrary to many other Central and Eastern Europe (CEE) countries running mandatory pension systems, there is no requirement for pension funds to guarantee a certain minimum return. On the contrary, doing so is explicitly forbidden.

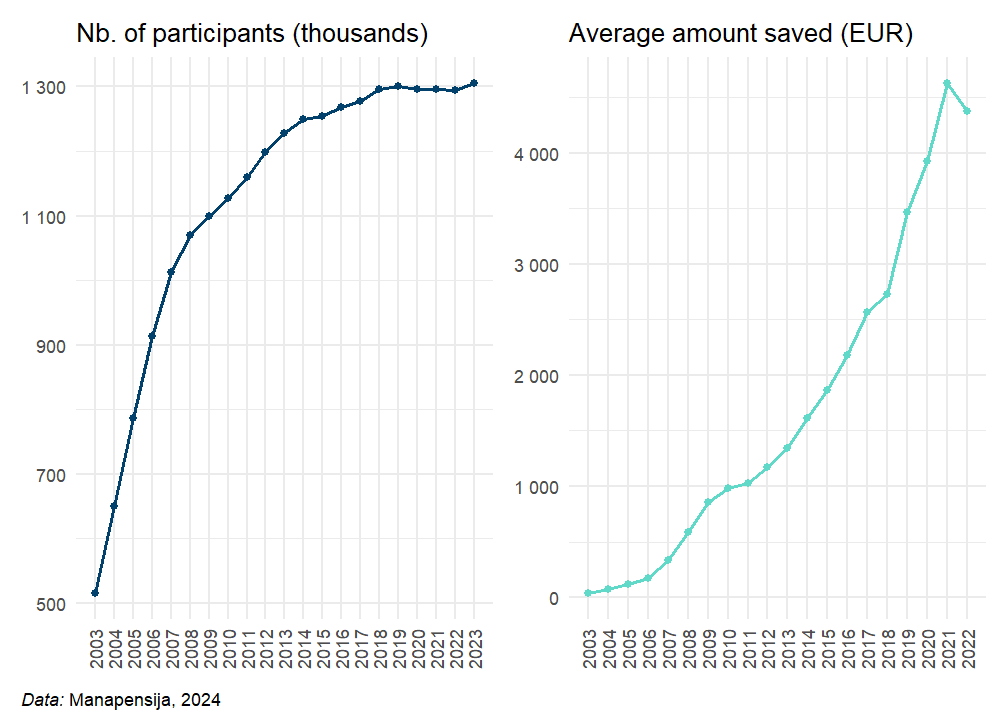

As the State Funded Pension scheme is mandatory for all economically active individuals in Latvia, the number of savers (as well as the average amount of accumulated assets on individual accounts) is rising.

The number of Pillar II participants has almost encompassed the entire working population. Further growth of Pillar II savings will therefore be driven by the amount of contributions and mandatory pension funds’ performance.

The portfolio structure of Pillar II pension funds (Figure 13.3) shows that debt and other fixed income securities as well as investment funds (UCITS funds) remain the dominant investments. There is only limited direct investment into equities.

Investment funds are gaining the dominant share on the Pillar II pension funds’ portfolio structure, while the bonds and deposits portions are lowered. This increases the short-term volatility and potential performance of pension funds.

Third pillar: Voluntary pension funds

Voluntary private pension scheme, or pension Pillar III, was launched in July 1998, and it gives the opportunity to create additional voluntary savings in addition to the state organized Pillar I and II. Contributions that individuals and/or the employer regularly pay into the pension fund are invested in different securities, depending on the chosen investment strategy.

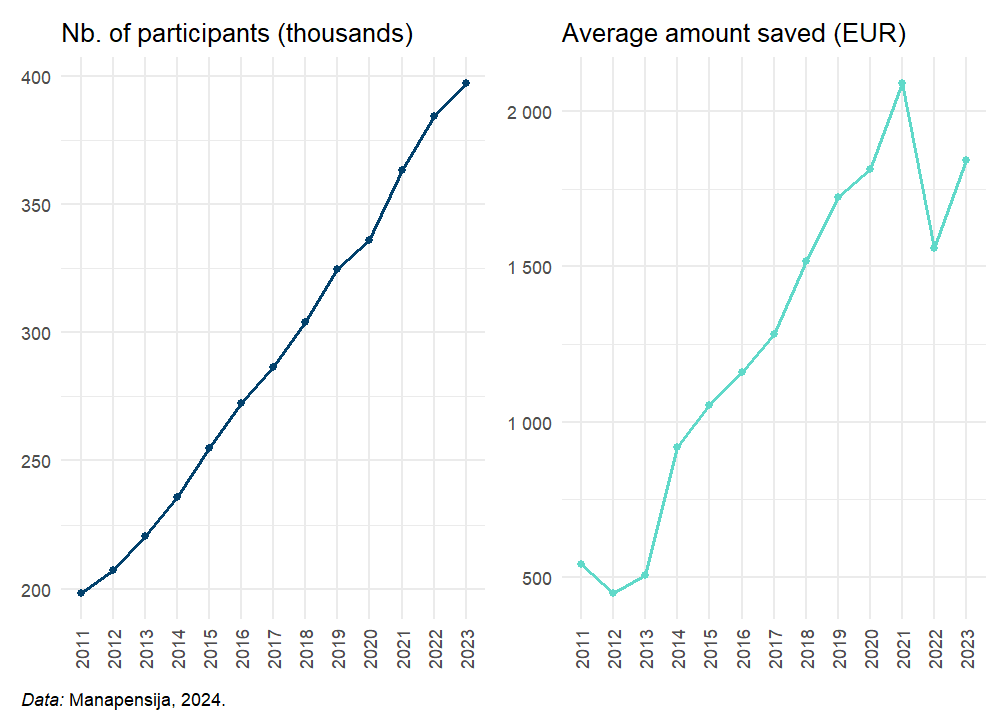

Compared to the mandatory pension funds scheme, the voluntary pension scheme covers significantly less economically active individuals with smaller amount of savings per saver in Pillar III.

The Law on Private Pension Funds foresees that Latvian commercial banks, insurance companies and legal persons have the right to establish a private fund. Assets are invested by private pension funds with the aim not only to maintain the value of savings, but to increase it over a long-time period. There are generally two types of voluntary private pension funds in Latvia:

- open pension funds (21 operational in Latvia in 2024);

- closed pension funds (only one operating in Latvia in 2024).

Pension scheme participants can subscribe to a pension scheme by entering directly into a contract with an open pension fund or via their employer. Pension scheme participants can participate in a pension scheme through the intermediation of their employer if the employer has entered into a collective contract with an open or closed pension fund. A collective contract with a closed pension fund may be entered into only in such cases when the relevant employer is also one of the founders (stockholders) of the same closed pension fund. Acknowledging the fact that employers might enter into collective agreement with employees and establish the pension scheme, voluntary private pension funds might be recognized as a collective pension scheme.

According to the Law on Private Pension Funds, accumulated pension capital in private pension funds can be accessed by individuals when they reach the age of 55. In order to receive the Pillar III accrued pension, an individual must submit an application to the respective pension fund. The supervisory authority for all voluntary private pension funds in Latvia is the Financial and Capital Markets Commission.

The portfolio structure of Pillar III pension funds is presented in Figure 13.5.

Generally, Pillar III pension funds invest predominantly into debt securities, bank deposits and UCITS funds. Direct investment into equities, real estate or other long-term riskier investment constitute for less than 1% of total portfolio.

13.3 Charges

Charges of mandatory pension funds

Latvia has adopted the cap on fees within Pillar II, which forces that the maximum amount of payment for the management of investment plan (including the fixed and variable parts of payment, calculating for the last 12-month period) to not exceed:

- 1.50% of the average value of investment plan assets to the investment plans, where the investment plan prospectuses do not provide for any investments in the shares of commercial companies, other capital securities and other equivalent securities;

- 2.00% of the average value of investment plan assets of all other investment plans.

Fees that can be charged to pension funds by fund managers are recognized by law as having a fixed and variable part. The law stipulates that payment for the management of an investment plan shall include:

- fixed component of payment, which is 1% of the average value of investment plan assets per year and includes payments to the manager of the funds, custodian, as well as payments to third persons, which are performed from the funds of the investment plans (except expenses which have arisen upon performing transactions by selling the assets of the investment plan with repurchase);

- variable component of payment, which is remuneration to the manager of funds of the funded pension scheme for performance of investment plan, with its amount depends on the return of the pension plan.

| Year | Total ongoing charges | Total Expense Ratio |

|---|---|---|

| 2003 | 1.18% | 1.38% |

| 2004 | 1.26% | 1.46% |

| 2005 | 1.30% | 1.50% |

| 2006 | 1.42% | 1.62% |

| 2007 | 1.40% | 1.60% |

| 2008 | 1.42% | 1.62% |

| 2009 | 1.39% | 1.59% |

| 2010 | 1.50% | 1.70% |

| 2011 | 1.51% | 1.71% |

| 2012 | 1.50% | 1.70% |

| 2013 | 1.50% | 1.70% |

| 2014 | 1.51% | 1.71% |

| 2015 | 1.52% | 1.72% |

| 2016 | 1.52% | 1.72% |

| 2017 | 1.64% | 1.84% |

| 2018 | 0.99% | 1.19% |

| 2019 | 0.80% | 1.00% |

| 2020 | 0.51% | 0.71% |

| 2021 | 0.47% | 0.67% |

| 2022 | 0.41% | 0.61% |

| 2023 | 0.45% | 0.45% |

| 2024 | 0.48% | 0.48% |

| Data: Manapensija Calculations: BETTER FINANCE. | ||

The year 2024 brought stabilization of fees based on the fund’s strategy. Introduction of low-cost passively managed pension funds has spurred price battle after 2018, however divergence between the fees started to emerge in 2021 with an average fee level of 0.48% in 2024.

Charges of voluntary pension funds

Compared to the mandatory pension funds’ level of fees, voluntary pension funds fees are higher. Complex fee structure and high fees preserve in Latvian Pillar III even if slight decrease in custodian fees can be observed in Pillar III.

Voluntary private pension funds have typically lower level of transparency when it comes to fee policy. In most cases, only current fees and charges are disclosed. Historical data is almost impossible to track via publicly accessible sources. Charges of voluntary private pension funds for the last 5 years are presented in Table 13.8. Administration cost, Fund Manager’s Commission, and Custodian bank’s commission are based on the assets under management. Funds managed by Nordea and Swedbank use mixed Administration costs, which are a combination of entry fees (fees on contributions paid) and ongoing charges (assets under management (AuM)-based). CBL funds also use a performance fee if the fund returns outperform the benchmark (12-month RIGIBID).

| Year | Total ongoing charges | Admin. and mgt. fees | Other ongoing fees | Other fees | Total Expense Ratio |

|---|---|---|---|---|---|

| 2011 | 2.83% | NA | NA | NA | 2.83% |

| 2012 | 2.83% | NA | NA | NA | 2.83% |

| 2013 | 2.83% | NA | NA | NA | 2.83% |

| 2014 | 2.83% | NA | NA | NA | 2.83% |

| 2015 | 2.83% | 1.50% | 1.07% | 0.24% | 2.83% |

| 2016 | 2.67% | 1.50% | 0.94% | 0.21% | 2.67% |

| 2017 | 1.90% | 0.95% | 0.82% | 0.12% | 1.90% |

| 2018 | 1.77% | 0.91% | 0.73% | 0.12% | 1.77% |

| 2019 | 1.64% | 0.84% | 0.69% | 0.10% | 1.64% |

| 2020 | 1.32% | 0.75% | 0.49% | 0.08% | 1.32% |

| 2021 | 1.32% | 0.75% | 0.49% | 0.08% | 1.32% |

| 2022 | 1.12% | 0.61% | 0.42% | 0.08% | 1.12% |

| 2023 | 1.17% | 0.60% | 0.43% | 0.15% | 1.17% |

| 2024 | 0.95% | 0.50% | 0.38% | 0.07% | 0.95% |

| Data: Manapensija Calculations: BETTER FINANCE. | |||||

When comparing the charges applied to the voluntary private pension funds and to state-funded pension funds, the level of charges in Pillar III pension funds are significantly higher and the structure of fees is more complex. This limits the overall understanding of the impact of fees on the pension savings for an average saver. The total cost ratio of Pillar III funds starts at 0.8% p.a. and can reach as high as 3% p.a. on managed assets.

There are neither limitations nor caps on fees in the law. The legislative provisions only indicate that at least the following should be disclosed: general information on maximum fees and charges applied, procedures for covering the expenses of the scheme, information regarding maximum payments to the management of the pension scheme and to the manager of funds, and the amount of remuneration to be paid out to the holder of funds, as well as the procedures by which pension scheme participants shall be informed regarding such pay-outs of the scheme.

13.4 Taxation

Latvia is applying an Exempt Exempt Taxed (EET) taxation regime for Pillar II with some specifications (deductions) to the payout regime taxation, where generally the “T” regime is applied for the pay-out phase in retirement.

Latvian tax legislation stipulates the use of the EET regime (like Pillar II) for voluntary private pension schemes as well.

| Product categories |

Phase

|

Fiscal Regime | ||

|---|---|---|---|---|

| Contributions | Investment returns | Payouts | ||

| Mandatory pension funds | Exempted | Exempted | Taxed | EET |

| Voluntary pension funds | Exempted | Exempted | Taxed | EET |

| Source: BETTER FINANCE own elaboration, based on Own elaboration. | ||||

In Pillar II, contributions paid to the state funded pension scheme are made via social insurance contributions redirection. As such, these contributions are personal income tax deductible items, so the contributions are not subject to additional personal taxation.

The Corporate Income tax rate in Latvia is 15%. However, income or profits of the fund (investment fund as a legal entity) are not subject to Latvian corporate income tax at the fund level. Latvia applies a general principle for all investment and savings-based schemes to levy the income taxation on the final beneficiaries and not on the investment vehicles.

Latvia has one of the lowest levels of income redistribution among European Union (EU) countries. Personal income tax rate is 23% and the pension benefits paid from the NDC PAYG scheme (Pillar I) and state-funded pension scheme (Pillar II) are considered taxable income. As such, pension benefits are subject to personal income tax. Latvia applies a non-taxable minimum, which is recalculated and announced every year by Cabinet regulation.

For Pillar III, the EET regime for voluntary private pension schemes is also applied. The contribution by individuals is treated in a slightly different way compared to the Pillar II social insurance contributions. Payments made to private pension funds established in accordance with the Republic of Latvia Law on Private Pension Funds or to pension funds registered in another Member State of the European Union or the European Economic Area State shall be deducted from the amount of annual taxable income, provided that such payments do not exceed 10% of the person’s annual taxable income. However, there is a limit on total income tax base deductible payments. The total of donations and gifts, payments into private pension funds, insurance premium payments and purchase costs of investment certificates of investment funds may not exceed 20% of the amount of the payer’s taxable income.

13.5 Performance of Latvian long-term and pension savings

Real net returns of Latvian long-term and pension savings

Mandatory pension funds’ performance in Pillar II is closely tied to the portfolio structure defined by an investment strategy (as well as investment restrictions and regulations) applied by a fund manager. Investment regulations differ, depending on whether pension plans are managed by the State Treasury or by private companies. The State Treasury is only allowed to invest in Latvian government securities, bank deposits, mortgage bonds and deposit certificates. Moreover, it can only invest in financial instruments denominated in the national currency. In contrast, private managers are allowed to invest in a much broader range of financial instruments. The main investment limits include the following:

- 35% for securities guaranteed by a state or international financial institution;

- 5% for securities issued or guaranteed by a local government;

- 10% for securities of a single issuer, except government securities; for deposits at one credit institution (investments in debt and capital securities of the same credit institution and derivative financial instruments may not exceed 15%); and for securities issued by one commercial company (or group of commercial companies);

- 20% for investments in non-listed securities;

- 5% for investments in a single fund (10% of the net assets of the investment fund).

There is no maximum limit for international investments so long as pension funds invest in securities listed on stock exchanges in the Baltics, other EU member states, or the European Free Trade Association (EFTA). However, the law stipulates a 70% currency matching rule. There is also a 10% limit for each non-matching currency. Investments in real estate, loans, and self-investment are not permitted.

Pillar III voluntary pension funds investment rules are similar to those for state-funded schemes but are more flexible. For example, investment in real estate is permitted (with a limit of 15%), the currency matching rule is only 30%, and limits for some asset classes are higher. Considering the structure of voluntary pension funds’ portfolios in Latvia, a larger proportion is invested in structured financial products (mainly equity based UCITS funds) and direct investment in equities and bonds is decreasing.

Due to the lack of publicly available data before 2011, the performance of voluntary pension funds is calculated from the year 2011.

It should be noted that during the year 2021 several fully equity voluntary pension funds emerged (Luminor indeksu ieguldījumu plāns Ilgtspējīgā nākotne Active 100) has started its operation in June 2021, Swedbank ieguldījumu plāns Dinamika Indekss Active 100 in August 2021). Some of existing Active 75 increased their equity share are assigned as Active 100 showing rising risk appetite of savers. Additional 3 new funds (high risk oriented) entered the market in 2023 and one medium risk target date fund in 2024.

Do Latvian savings products beat capital markets?

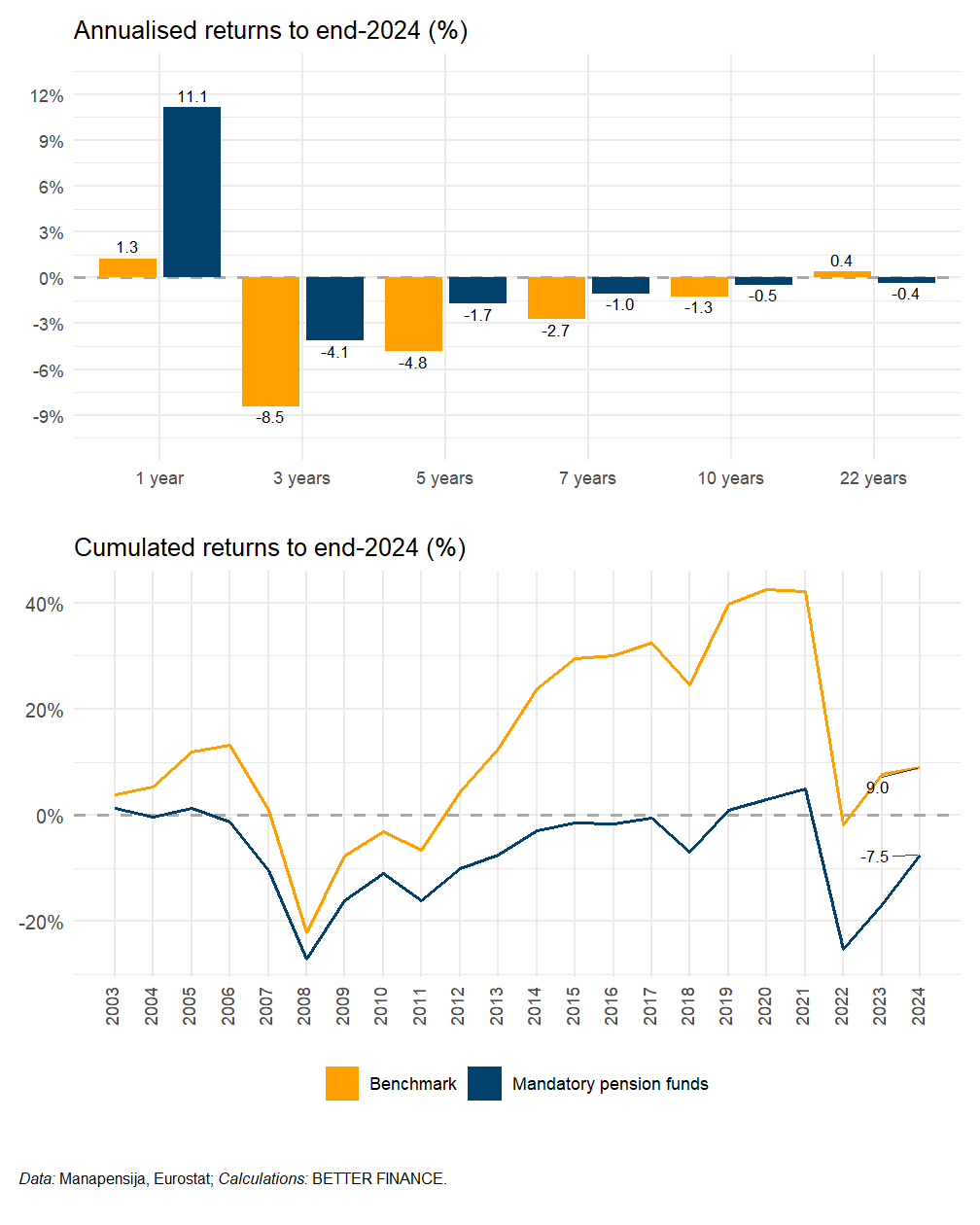

In this section, we compare the performance of the mandatory and voluntary pension funds in Latvia to the performance of relevant capital market benchmarks. By analysing the portfolio structure of pension funds, we have selected a rather conservative benchmark portfolio (35% equity–65% bonds) for mandatory pension funds, and a more aggressive one (55% equity–45% equity) for voluntary pension funds, both based on two pan-European indices.

| Equity index | Bonds index | Start year | Allocation | |

|---|---|---|---|---|

| Mandatory pension funds | STOXX All Europe Total Market | Barclays Pan-European Aggregate Index | 2003 | 35%–65% |

| Voluntary pension funds | STOXX All Europe Total Market | Barclays Pan-European Aggregate Index | 2011 | 55%–45% |

| Data: STOXX, Bloomberg; Note: Benchmark porfolios are rebalanced annually. | ||||

In both cases, we conclude that Latvian pension vehicles are not able to beat the market benchmark. However, detailed analysis of the particular pension funds’ performance could show that more aggressive pension funds are able to stay in positive real returns over the analysed period.

13.6 Conclusions

Latvia has managed to build a sustainable pension system over the last decade with impressive growth in Pillar II funds. Acceptance of voluntary pension savings in Pillar III is still weak, but this trend has changed after the financial crisis. Pillar III pension funds have enjoyed high inflow of new contributions despite rather weak performance and high fees.

Latvian Pillar II experienced drop in charges starting from 2019 and diversification of fees as well as funds’ investment strategies in 2021 driven by a competition from low-cost passively managed funds and ability to charge the fees based on the riskiness of the strategy. Pillar III funds managers enjoy smaller decrease in charges, but Pillar III charges remain relatively high. Delivered real returns on the other hand are negative. Most of the Pillar II pension funds were not able to beat the inflation. One of the reasons is also the relatively conservative risk/return profile of most funds. Pillar III vehicles in Latvia suffer not only from significantly high fees charged by fund managers, but also from low transparency.

Pension fund managers of both pillars have started to prefer packaged investment products (investment funds) and limit their engagement in direct investments. Thus, the question of potential future returns (when using financial intermediaries multiplied by high fee policy) in both schemes should be raised.

Latvia has improved significantly its mandatory part of funded pension system. Together with its NDC scheme for PAYG pillar, mandatory funded part as well as NDC part form a well-designed pension system that motivates individuals to contribute as there is a clear connection between paid contributions and expected pension benefits. However, voluntary part of the pension system still suffers from very complicated fee structure, high fees and low transparency.

These limits, despite a generous fiscal stimulus, larger participation in voluntary pension scheme. Regulators should seek for modern fee policies that would on one hand decrease the fee structure and on the other hand introduce success fee tied to the market benchmark. Applying high-water mark principle could limit the risk appetite of asset managers as they will start to prefer low-risk investments where constant fee revenue could be expected. If the benchmarking principle is applied, where the asset manager is rewarded by higher fee when the market benchmark has been outperformed and penalized by lower fees if the fund performance is lower than the market benchmark, savers could benefit more and start trusting the voluntary pension providers on a larger scale.

Acronyms

- AuM

- assets under management

- CEE

- Central and Eastern Europe

- EET

- Exempt Exempt Taxed

- EFTA

- European Free Trade Association

- EU

- European Union

- KID

- Key Information Document

- KIID

- Key Investor Information Document

- NDC

- notional defined contribution

- PAYG

- pay-as-you-go

- UCITS

- Undertaking for Collective Investment in Transferable Securities

- p.a.

- per annuum