Product categories

|

Reporting periods

|

||

|---|---|---|---|

| Name | Pillar | Earliest data | Latest data |

| Mandatory pension funds | Occupational (II) | 2008 | 2024 |

| Voluntary pension funds | Voluntary (III) | 2007 | 2024 |

Rezumat

Populația României scade rapid, îmbătrânește și migrează, ceea ce pune o presiune considerabilă asupra sistemului public de pensii. În 2019, au fost adoptate noi modificări privind calcularea pensiilor pentru limită de vârstă din pilonul de plată, în vigoare din septembrie 2021 și modificate în continuare în 2023 pentru a aduce mai multă stabilitate fiscală sistemului de pensii.

Deși pensiile ocupaționale sunt obligatorii indiferent de forma de muncă (salariați și liber-profesioniști), gospodăriile din România trebuie să fie mai mult stimulate să economisească în planuri de pensii facultative (Pilonul III). Planurile de pensii private din România au înregistrat un randament nominal pozitiv excepțional în 2023. În medie, randamentele nominale pentru 2023 au fost de 17,2% pentru fondurile din Pilonul II și de 17,8% pentru fondurile din Pilonul III. Cu toate acestea, inflația încă ridicată a redus randamentele la jumătate în 2023.

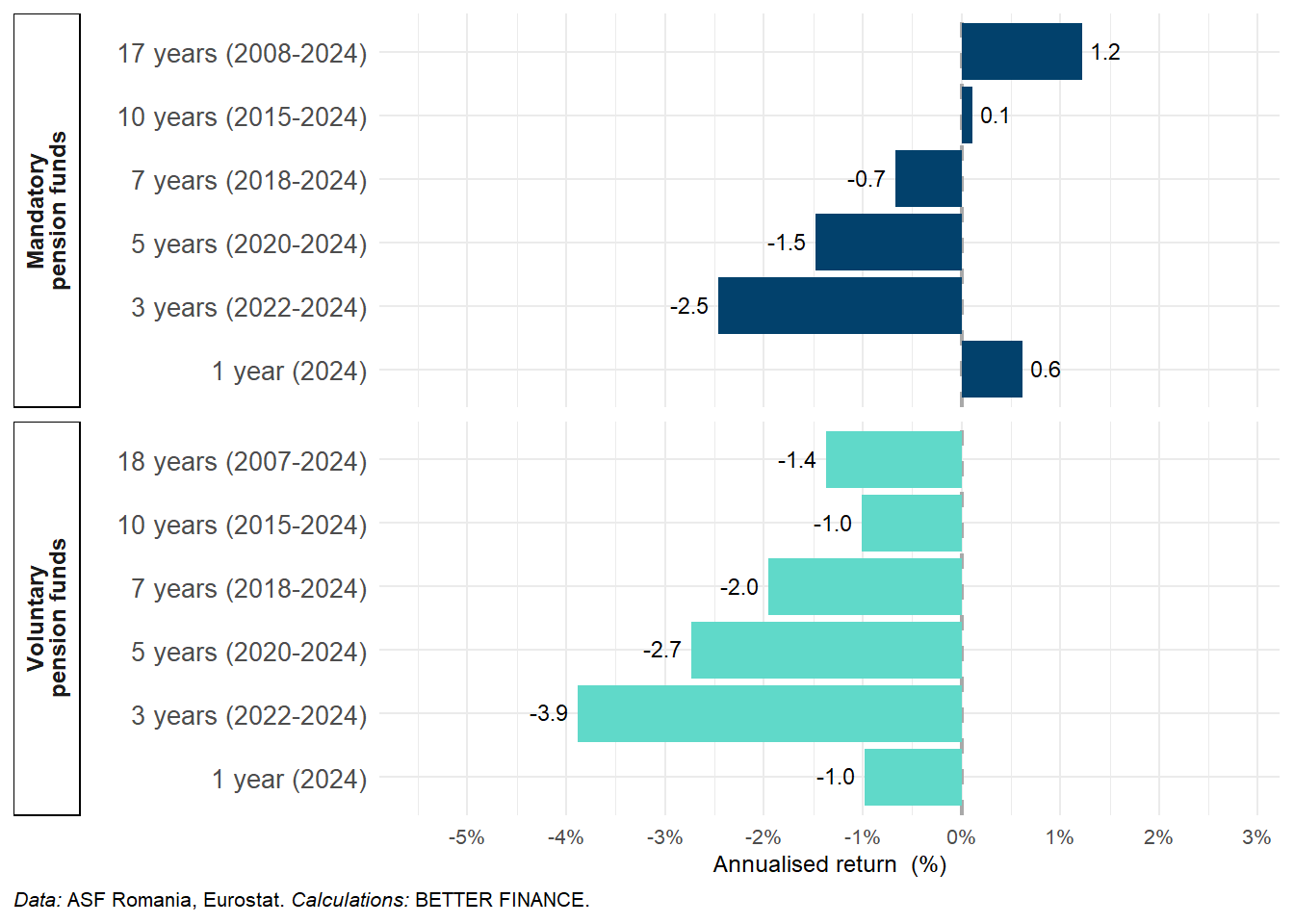

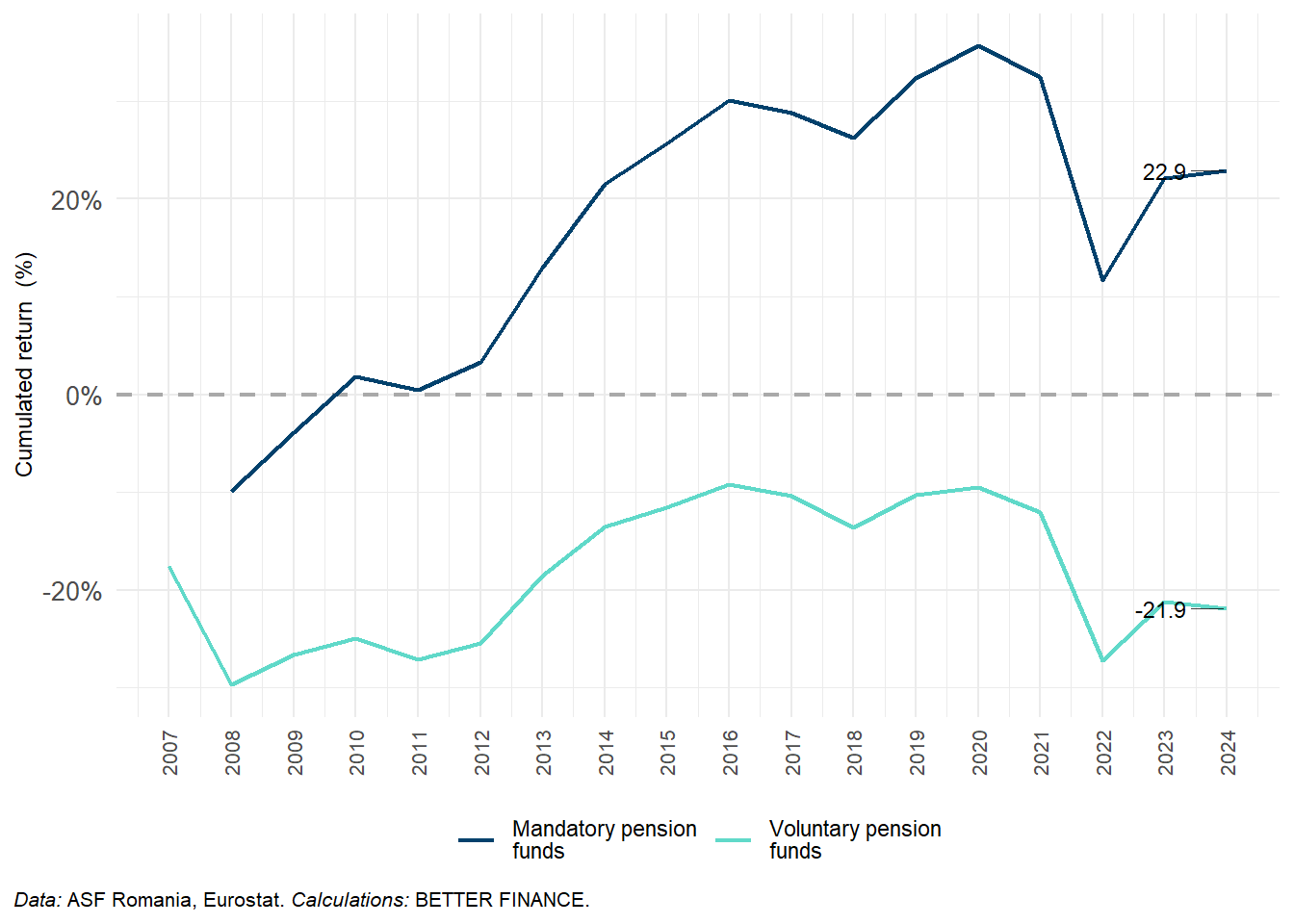

Ambele sisteme (ocupațional și privat) au structuri de portofoliu aproape identice și generează astfel randamente brute similare. Cu toate acestea, performanța netă a Pilonului III este influențată în mod semnificativ de structura comisioanelor ridicate (de aproape 4 ori mai mari în comparație cu fondurile Pilonului II) și, pe termen lung, va genera randamente mai mici decât cele ale fondurilor similare Pilonului II. În general, randamentul real al fondurilor de pensii din Pilonul II este încă ușor pozitiv pentru întreaga istorie, cu toate acestea, fondurile din Pilonul III rămân în teritoriu negativ pentru întreaga istorie, chiar și după randamentele solide din 2023.

Summary

Romania’s population is rapidly decreasing, ageing, and migrating, which puts considerable pressure on the State pension system. In 2019, new changes on calculating old-age pensions from pay-as-you-go (PAYG) pillar have been adopted effective since September 2021 and further amended in 2023 to bring more fiscal stability to the pension system.

Although occupational pensions are mandatory regardless of the work form (employees and self-employed), the Romanian households must be incentivised more to save in voluntary pension plans (Pillar III). Private pension schemes in Romania recorded an exceptional positive nominal returns in 2023. On average, nominal returns for 2023 were 17.2% for Pillar II funds and 17.8% for Pillar III funds. However, the still elevated inflation cut the returns by half in 2023.

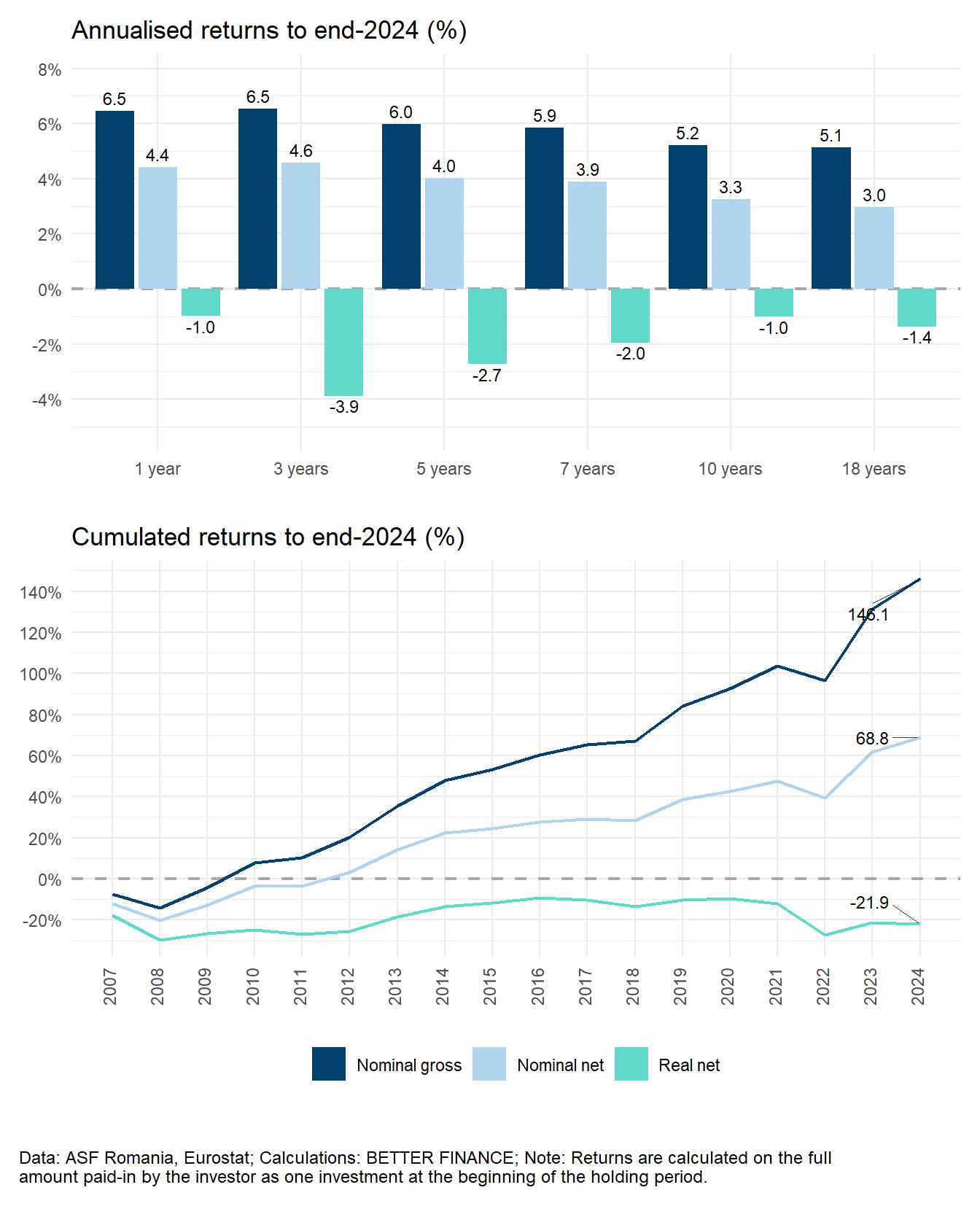

Both schemes (occupational and private) have almost identical portfolio structures and thus generate similar gross returns. However, Pillar III net performance is significantly influenced by the high fee structure (almost 4-times higher compared to Pillar II funds) and will, in the long-run, deliver lower returns than Pillar II peers. Overall, the real return of pension funds in Pillar II are still mildly positive for the entire history, however, Pillar III funds stay in the negative territory for the entire history even after solid returns in 2023.

16.1 Introduction: The Romanian pension system

- Private pension schemes in Romania recorded an exceptional positive nominal performance in 2023. On average, nominal returns for 2022 were 17.22% for Pillar II funds and 17.77% for Pillar III funds. It should be noted, that the portfolio structure of almost all pension funds in Pillar II and Pillar III is similar and the savers are of limited choice regarding the investment strategy.

- Real returns of all funds in both pillar were significantly affected by elevated inflation in 2023. Real returns for both pillars were cut by the inflation to 9.34% for mandatory pension funds (Pillar II) and 8.27% for voluntary pension funds (Pillar III) in 2023.

Holding period

|

|||||||

|---|---|---|---|---|---|---|---|

| 1 year | 3 years | 5 years | 7 years | 10 years | Whole reporting period | to... | |

| Mandatory pension funds | 0.6% | -2.5% | -1.5% | -0.7% | 0.1% | 1.2% | end 2024 |

| Voluntary pension funds | -1.0% | -3.9% | -2.7% | -2.0% | -1.0% | -1.4% | end 2024 |

| Data: ASF Romania, Eurostat; Calculations: BETTER FINANCE | |||||||

- Romania has committed to reforming the first pillar of its pension system under the recovery plan financed by the European Union (EU) by the end of 2023.

- The reforming plans include gradual increase of the retirement age to 65 years (a move pertaining to the public pension system, but also the employees subject to special pensions) and calculating the pension based on the entire working period and not allowing pension benefits highest than the net wages received by same recipients.

- The reform should by focused on fair treatment of so-called special service pensions. These are pensions granted to certain professional categories such as judges, prosecutors, military, police and secret service employees, some of which are even ten times higher than the average pension in the country. These special pensions are still not based on the contributory principle and are considered a burden on the state budget.

Pension system in Romania: An overview

The Romanian old-age pension system is based on the World Bank’s multi-pillar model, which consists of three main pillars:

- Pillar I — State pension organized as a mandatory PAYG scheme;

- Pillar II — Organised as a mandatory, funded and defined contribution pension scheme,

- Pillar III — A supplementary pension scheme, based on the principle of voluntary participation with the defined-contribution characteristic.

Romania’s multi-pillar pension reform began in 2007, when Pillar III was added into the pension system (collecting the first contributions) and became voluntary for all persons earning any type of income. Pillar II was put into place in 2008 (collecting the first contributions) and became mandatory for all employees aged under 35.

Table 16.3 and text provide an overview of the Romania’s pension system. It contains information on main characteristics of each pillar, main pension savings vehicles, respective coverage of each pillar.

| Pillar I | Pillar II | Pillar III |

|---|---|---|

| State Pension | Funded pension | Voluntary pension |

| Law no. 263/2010 on the unitary public pension system | Law no. 411/2004 on the privately managed pension funds, republished, including subsequent amendments and additions | Law no.204/2006 on the voluntary pensions, including subsequent amendments and additions |

| Mandatory | Mandatory | Voluntary |

| Publicly managed | Privately managed pension funds | |

| PAYG | Funded | |

| DB scheme | DC schemes | |

| The possibility of early and partially early retirement, contingent upon the fulfillment of the age conditions and the contribution stage provided by the law and the accumulated points. | Withdrawal from the system is only allowed through retirement at standard retirement age. | The participant can, at any time, suspend or stop the contribution payment (they remain members in the system until 60 years old). |

| Quick facts | ||

| Nb. of old-age pensioners: 4.59 mln. | Administrators: 7 | Administrators: 8 |

| Nb. of insured: 6.305 mln. | Funds: 7 | Funds: 10 |

| Avg. old-age pension: EUR 582 | Custodians: 3 | Custodians: 3 |

| Average salary (gross): EUR 1465 | Brokers: 14 | Brokers: 21 |

| Gross replacement ratio (state pension): 31.29% | AuM: EUR 30.32 bln. | AuM: EUR 1.14 bln. |

| Participants: 8.287 mln. | Participants: 0.83 mln. | |

|

Source: Own elaboration based on CNPP, ASF and INSSE, 2025; Note: data on average old-age pension and gross salary and data on the number of old-age pensioner are as of December 2024; data on number of participants and assets under management as of December 2024. |

||

The overall coverage of Pillar II was almost entire working population, while Pillar III covered only 10% of the economically active population. Thus, we can expect than future pension income stream will be influenced mostly by Pillar II pensions, while Pillar III will generate an insignificant part of individuals income during retirement.

The first pillar of the Romanian pension system is organized on the PAYG principle of redistribution, being funded on an ongoing basis and functioning on the defined-benefit rule.

The state (through the National House of Public Pensions, a public institution constituted for this purpose in particular ) collects the social pension contribution from the contributors and immediately pays the pensions to the current retirees. State pension in Romania is also based on the principle of solidarity between generations and gives the right to pension entitlement upon retirement age, following a minimum contribution period (15 years), as provided by law. This compulsory system is closely connected to the economic activity and income of citizens. It is 88% financed from social security contributions made by both employers and by employees, while generally consuming the biggest part (or entirety) of the social security budget.

According to Romania’s legislation until 2023, the standard retirement age is 63 years for women and 65 years for men. These levels were to be gradually reached as follow:

- between January 2011 and January 2015, the standard age for the pensioning of women will grow from 59 years to 60 years and for men from 62 years to 65 years;

- at the end of 2015 period retirement age will gradually increase only for women from 60 years to 63 years until 2030.

Early retirement: According to Law no. 263/2010 regarding the public pension schemes (in force since 1 January 2011) claiming early pension is possible as of a maximum 5 years before the standard retirement age, provided the worker has at least eight or more contribution years. The deduction made on early pension payment is fixed at 0.75% for each month (9% per year), which might bring a maximum deduction of 45% from the standard pension. The deduction is applied until the standard age limit is reached.

Year 2023 introduced new legislature (No. 360/2023) that was part of the Recovery plan pension reform. The new legislation:

- introduces a new calculation formula for new pensions and pensions in payment. The parameters of the formula shall be carefully chosen in line with the target for pension expenditure as percentage of gross domestic product (GDP). Moreover, they shall not allow for ad hoc increases on pension levels;

- introduces a new pension indexation rule in line with the pension expenditure as percentage of GDP target and mechanisms against ad hoc indexation;

- significantly reduces possibilities for early retirement, introduce incentives to expand the working life and to voluntary increase standard retirement age up to 70 years in line with the increases of life expectancy, and equalize the statutory retirement age for men and women at 65 years by 2035;

- starts gradually lift the retirement age also for woman to 65. However, the new law introduces the deduction from the statutory retirement age based on the number of raised children, more specifically 6 months per child; introduces incentives for postponing retirement;

- revises special pensions to bring them in line with the contributory principle;

- strengthen the contributory principle of the system;

- increases the adequacy of minimum and lower pensions, in particular for those below the poverty threshold;

- ensures financial viability of the Pillar II of the pension system by increasing contributions to this pension pillar.

Romania’s mandatory private pensions system (Pillar II) is a fully funded scheme, with mandatory participation and private management of funds based on personal accounts and on the Defined contributions (DC) philosophy with minimum return guarantees. The minimum return guarantee means that participants will receive at least the sum of contributions, net of fees, at retirement. Each fund has to comply, during the accumulation phase, with a minimum return mechanism that is set quarterly by national regulation and based on average market performance of all funds. Pillar II represents the privately managed mandatory pensions funds or schemes.

Pillar II has been mandatory since its inception for all employees paying social security contributions under the age of 35 and voluntary (optional) for employees aged 35 to 45.

Contribution collection is centralized by the Casa Națională de Pensii Publice (CNPP), the Romanian national house of public pensions, which collects and directs the contributions towards the mandatory pension funds.

A participant contributes during his active life and will get a pension when reaching the retirement age. The starting level of contribution was at 2% of the participant’s total gross salary and it should go up by 0.5 percentage points a year, to reach 6% of total gross revenues in 2017. However, these values were never reached and the value for 2019 3.75 pp. The contribution level is fixed, with no possibility to contribute less or more based on individual preferences.

The contributions to a pension fund are recorded in individual personal pension account. The savings are invested by the pension fund administrator, according to the rules and quantitative limits generally set by the law regulating Pillar II vehicles. Participants can choose only one pension fund. Withdrawal from the Pillar II is only allowed at the standard retirement age of participants in the private pension system.

Mandatory pension funds are managed by their administrators, pension management companies (PMCs). Each PMC can manage only one mandatory pension fund. Mandatory pension funds operations are similar to the investment funds. PMCs must obtain several licenses from Romania’s pension market regulatory and supervisory body, which is the Autoritatea de Supraveghere Financiară (ASF), the Financial Supervisory Authority.

The ASF is in charge of control, regulation, supervision and information about private pensions as an independent administrative authority and legal entity under the control of the Romanian Parliament.

Romania’s voluntary private pensions system Pillar III is also based on the World Bank’s multi-pillar model. It is also a fully funded system, based on personal accounts and on the DC philosophy. Pillar III represents privately managed supplementary, voluntary pensions.

In Pillar III, participation is open to everybody earning an income, either employees or the self-employed. Contributions are generally made through the employers in case of employees. In case of self-employed, the contributions are sent directly on the accounts managed by pension management companies. The contributions are made by the employee, with the possibility for employers to contribute a share.

Pillar III is fully voluntary and the contributions are invested via voluntary pension funds as a special purpose vehicle that are managed by their administrators - PMCs, life insurance companies (LICs) or asset management companies (AMCs). Each administrator is obliged to establish and operate at least one voluntary pension fund. However, in contrast to Pillar II, administrators can manage as many funds as they wish. A voluntary pension fund operates on a similar basis as investment fund. Pension fund administrators must get several licenses from Romania’s ASF.

Participants to a voluntary pension fund contribute during their active life and will get a pension at the age of 60 (both woman and men) if he had accumulated at least 90 contributions. The contribution is limited up to 15% of the participant’s total gross income. The contribution level is flexible: it can be decided upon, changed, and even interrupted and resumed.

16.2 Long-term and pension savings vehicles in Romania

Pension saving vehicle for both pillars in Romania are based on a saving principle with investment strategies and realized via pension funds. The transparency of information regarding the pension funds is really high in Romania, where all key information on performance, fees, risk and portfolio structure are well presented to the public.

Assets under management (AuM) for pension funds offered under both pillars (in million EUR) are presented in Figure 16.1. Pillar II plays dominant role and represents more than 97% of pension savings in Romania.

In Pillar II, seven asset managers offer seven mandatory pension funds in Romania. Performance analysis reveals similarities in their investment strategy, implying similarity in the pension funds’ portfolio structure.

In Pillar III, eight asset managers offer 10 voluntary pension funds in Romania. AZT and NN are the only providers which offer two voluntary pension funds. The performance of all pension funds shows the same finding as for the Pillar II mandatory pension funds—there is similarity in voluntary pension funds’ investment strategy. Performance results also imply a similarity in pension funds’ portfolio structure.

Second pillar: Mandatory pension funds

As indicated above, each PMC specifically authorized to provide Pillar II savings products in Romania is allowed to manage only one mandatory pension fund. At the introduction of the Pillar II, the total number of authorized administrators (funds) was 18. Consolidation started as early as 2009 and 2010.

Currently (end of 2023), there are 7 administrators offering 7 pension funds. The two biggest mandatory pension funds (AZT and NN) dominant the market with cumulative market share above 50%.

Each PMC is authorized and supervised by ASF. One of the most important conditions imposed on PMCs is to attract at least 50 000 participants. ASF withdraws the fund’s authorization if the number of participants drops below 50 000 for a quarter.

Mandatory pension funds’ investment strategy is very strictly regulated. The law imposes percentage limits for different asset classes. Mandatory pension funds can invest:

- up to 20% in money market instruments;

- up to 70% in State bonds of Romania, the EU or European Economic Area (EEA);

- up to 30% in bonds and other transferable securities issued by the local public administrations in Romania, the EU or EEA, traded on a regulated market in Romania, EU or EEA;

- up to 50% in securities traded on a regulated market in Romania. the EU or EEA;

- up to 15% in bonds issued by third-party states, traded on a regulated market in Romania, the EU or EEA;

- up to 10% in bonds and other transferable securities issued by the local public administration in third-party states, traded on a regulated market in Romania. the EU or EEA;

- up to 15% in bonds issued by the World Bank. the European Bank for Reconstruction and Development (EBRD) and theEuropean Investment Bank (EIB), traded on a regulated market in Romania, the EU or EEA;

- up to 5% in bonds issued by Non-governmental Foreign Bodies, traded on a regulated market in Romania, the EU or EEA;

- up to 5% in units issued by Undertaking for Collective Investment in Transferable Securitiess (UCITSs), including exchange-traded funds (ETFs) in Romania, the EU or EEA;

- up to 3% in exchange-traded commodities (ETCs) and equity securities issued by non UCITSs set up as closed investment funds, traded on a regulated market in Romania, the EU or EEA;

- up to 10% in private equity—only for voluntary pension funds.

There is no explicitly defined general quantitative limit on equity investments.

Aside from the quantitative restrictions by asset class, fund managers have quantitative limits by type of issuer:

- 10% of the total number of shares issued by one issuer;

- 10% of the preferential shares issued by one issuer;

- 25% of the equity securities issued by an UCITS, ETF, non-UCITS closed investment fund orETC;

- 10% of an issuer’s bonds, with the exception of the state bonds.

Mandatory pension funds can invest all their assets abroad. There are no explicit restrictions regarding investments made abroad.

Pension funds can have one of three possible risk profiles, which are calculated on a daily basis according to a formula established by ASF regulations:

- low risk (risk level up to and including 10%),

- medium risk (risk level between 10%, exclusively, and 25%, inclusively),

- high risk (risk level between 25%, exclusively, and 50%, inclusively).

Pillar II mandatory pension funds portfolio structure is presented in Figure 16.2

[1] "Mandatory pension funds" "Voluntary pension funds"Romanian mandatory pension funds invest mostly in government securities and bonds asset classes. The second most important asset class (from the portfolio structure point of view) are equities and the third most important are bank deposits. Three other classes have minimal impact on pension fund’s performance. The portfolio structure of the Romanian Pillar II is presented below. According to the data available, currently almost 73% of all investments in Pillar II pension funds are bond investments and less than 23% is invested in equities despite relatively young age structure of savers.

Third pillar: Voluntary pension funds

The Romanian Pillar III allows each administrator (PMC, LIC or AMC) to manage as many voluntary pension funds as they prefer. At its inception, there were only four providers and six voluntary pension funds. Currently (at the end of 2021), there was 8 providers offering 10 voluntary pension funds. Only two administrators (NN and AZT) are currently offering more than one voluntary pension fund.

Each administrator in Pillar III (PMC, LIC or AMC) is authorized by ASF and must get several licenses from ASF. ASF withdraws the fund’s authorization if the number of participants drops below 100 for a quarter.

Voluntary pension funds are also constituted by civil contract and authorized by ASF. Accounting of the voluntary pension fund is separated from the administrator.

Investment rules in the voluntary private pension pillar are the same as in the mandatory pillar (see quantitative and restriction limits for different asset classes in the text above), with less strict limits on private equity (5%) and commodities (5%).

Analysing the portfolio structure of voluntary pension funds based on Comisia de Supraveghere a Sistemului de Pensii Private (CSSPP) data, we can conclude that most of the performance is tied to the Government Securities and Bonds asset classes. The second most important asset class (from the portfolio structure point of view) are the equities and the third most important part of the portfolio are the bank deposits. Other asset classes have minimal impact on pension fund’s performance results.

Portfolio structure of Romanian Pillar III voluntary pension funds is presented in Figure 16.3.

According to the data for 2023, around 72% of all investments in Pillar III pension funds are bond investments and about 25% is invested in stocks and collective investment vehicles (UCITSs funds). Overall, Pillar III portfolio structure is very similar to that of Pillar II over the whole analysed period. The difference in the performance could therefore be devoted to the negative impact of fees, which are significantly higher in Pillar III.

16.3 Charges

Charges in both pillars are regulated differently. As the Pillar II is more regulated and represents the dominant role for the future pension income stream, the regulation of fees and charges pushes the overall costs down for Pillar II pension funds compared to the Pillar III peers.

Charges of Pillar II products: Mandatory pension funds

According to the Mandatory Pensions Law, the fund manager’s income resulted from the administration of privately administrated pension funds are composed of:

- Entry fee — maximum 1% of the contributions paid (entry fee is paid before the conversion of contributions into fund units, of which 0.5% is transferred to the CNPP, the organization that administers the social insurance program)

- Management fee — from 0.02% to 0.07% monthly of net assets under management, depending on the fund’s rate of return relative to the inflation rate. Before 2019, the maximum monthly management fee was 0.05 percent.

- Transfer penalties (covered from personal assets, in case of moving to another fund/PFC earlier than in 2 years — between 3.5% and 5%);

- Tariffs for additional information services, in particular:

- Depositary commission (depository fee);

- Transaction costs (trading fees);

- Bank commissions (banking fees);

- Fund auditing taxes (pension fund auditing fees).

The transfer penalty represents the amount paid by the participant in the event of a transfer to another administrator, occurring within two years of the subscription date to the private pension fund, with the maximum ceiling of this penalty being established by ASF and set at maximum 5% of assets (Norm CSSPP 12/2009 for Pillar II and Norm 14/2006 for Pillar III).

The fund also pays for the annual auditing fee (Fund auditing taxes) and the rest of the fund’s expenses (custody, depositary, transaction/trading expenses) must be supported by the pension company (the administrator). The next table compares effective charges of mandatory pension funds in Pillar II over time, calculated via total and net asset value (NAV).

The year 2023 brought further decrease in fees for pension administrators in Pillar II, while the effective charges dropped down to 0.22% annually.

Table 16.4 presents the effective annual charges for mandatory pension funds (in percentage of NAV).

| Year | Total ongoing charges |

|---|---|

| 2008 | 0.77% |

| 2009 | 0.70% |

| 2010 | 0.66% |

| 2011 | 0.61% |

| 2012 | 0.62% |

| 2013 | 0.61% |

| 2014 | 0.60% |

| 2015 | 0.60% |

| 2016 | 0.58% |

| 2017 | 0.56% |

| 2018 | 0.61% |

| 2019 | 0.51% |

| 2020 | 0.51% |

| 2021 | 0.48% |

| 2022 | 0.24% |

| 2023 | 0.22% |

| 2024 | 0.24% |

| Data: ASF Romania Calculations: BETTER FINANCE. | |

Charges of Pillar III products: Voluntary pension funds

According to the Voluntary Pensions Law, the administrator shall charge a fee from participants and beneficiaries for the management of a pension fund.

- The levels of fees shall be established in the pension scheme prospectus and shall be the same for all participants and beneficiaries;

- Participants shall be notified of any change to the fees at least 6 months before it is applied.

The administrator’s revenue will come from:

- entry fee - management commission charged as a percentage from contributions paid by participants; this percentage cannot be higher than 5% and must be made before contributions are converted into fund units (Management commission);

- management fee — charged as a percentage from the net assets of the voluntary pension fund; this percentage cannot be higher than 0.2% per month and shall be mentioned in the pension scheme prospectus;

- transfer penalties (covered from personal assets, in case of moving to another fund/PFC earlier than in 2 years — 5%);

- fees for services requested by participants:

- Depositary commission (depository fee);

- Transaction costs (trading fees);

- Bank commissions (banking fees);

- Fund auditing taxes (pension fund auditing fees).

A transfer penalty is applicable (paid by the participant) in the event of a transfer to another fund within two years of having joined the previous fund; its upper limit is established by Commission norms. Table 16.5 compares effective charges of voluntary pension funds in pillar III over time (calculated via total and net NAV).

| Year | Total ongoing charges |

|---|---|

| 2007 | 4.72% |

| 2008 | 1.91% |

| 2009 | 2.12% |

| 2010 | 2.30% |

| 2011 | 2.09% |

| 2012 | 2.10% |

| 2013 | 1.99% |

| 2014 | 1.99% |

| 2015 | 2.01% |

| 2016 | 1.92% |

| 2017 | 1.83% |

| 2018 | 1.99% |

| 2019 | 1.99% |

| 2020 | 1.98% |

| 2021 | 1.96% |

| 2022 | 1.94% |

| 2023 | 1.84% |

| 2024 | 2.04% |

| Data: ASF Romania Calculations: BETTER FINANCE. | |

The analysis confirms that despite the almost same portfolio structure and same performance, Pillar III pension funds are almost seven times more expensive than Pillar II funds, charging almost 1.84% annually in 2023. The decrease in Pillar III charges is recorded in 2023, but only on a small scale.

16.4 Taxation

Romania applies an EET system for the taxation of future mandatory accounts. Employee contributions are tax-deductible and investment income on the level of the pension fund is tax-exempt. Pension benefits paid out during retirement will be subject to a personal income tax (10% tax rate) above a certain level.

The amount of contributions to voluntary pension funds is fiscally deductible from each subscriber’s gross monthly wage or any other assimilated revenue if the total amount is not greater than the equivalent in Romanian Leu (RON) of EUR 400 in a fiscal year. The same rule applies to the employer, meaning that the employer can deduct the amount paid to the employee’s voluntary pension account up to EUR 400 annually. The investment returns achieved by the third pillar fund are tax exempt until the moment of payments toward subscribers’ start. The pension benefits paid from Pillar III are subject to personal income tax, thus representing an Exempt Exempt Taxed (EET) regime.

| Product categories |

Phase

|

Fiscal Regime | ||

|---|---|---|---|---|

| Contributions | Investment returns | Payouts | ||

| Mandatory pension funds | Exempted | Exempted | Taxed | EET |

| Voluntary pension funds | Exempted | Exempted | Taxed | EET |

| Source: BETTER FINANCE own elaboration, based on Own elaboration. | ||||

16.5 Performance of Romanian long-term and pension savings

Real net returns of Romanian long-term and pension savings

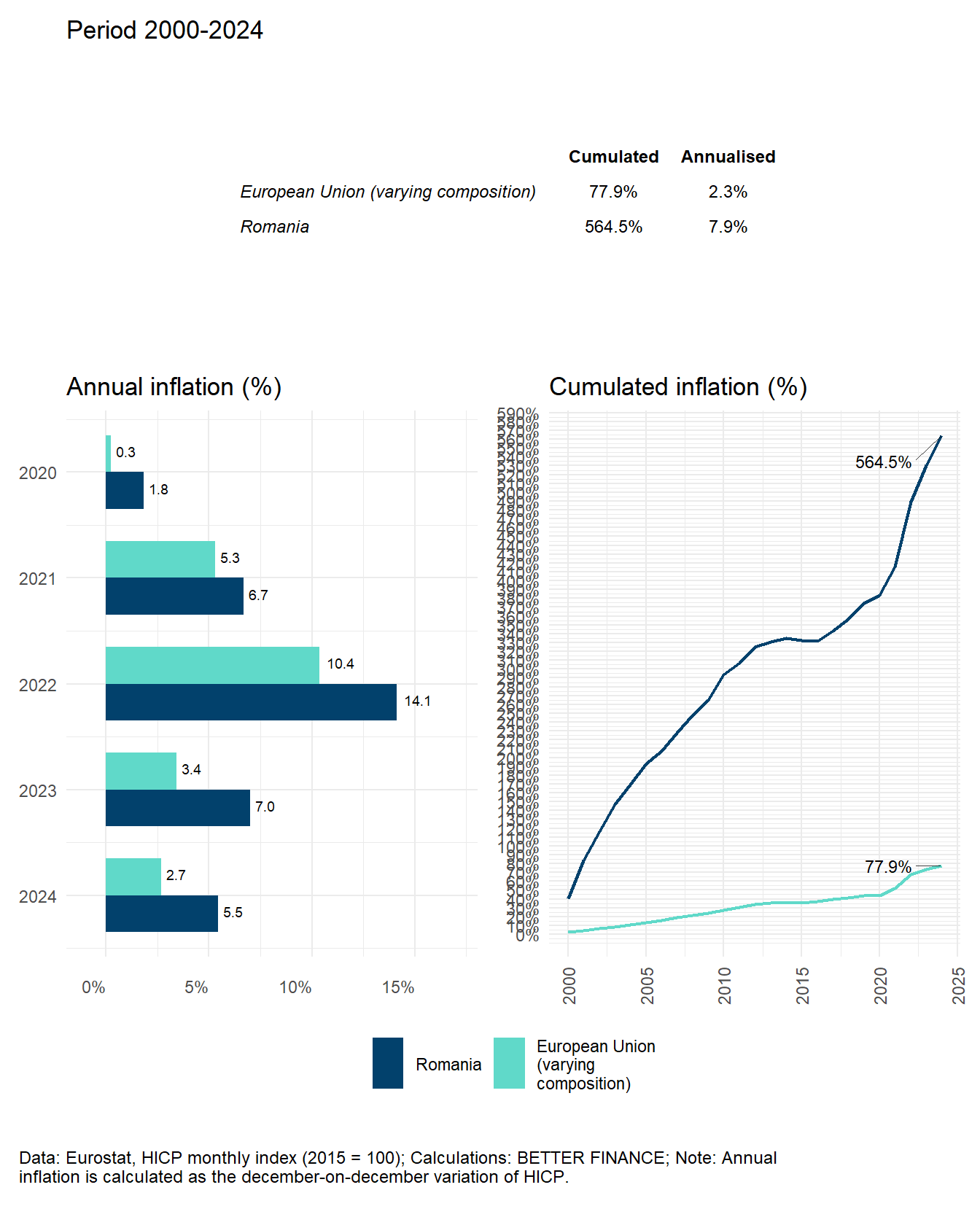

Romania is a high inflation country. The average annual inflation rate between years 2001 and 2023 was 9.28%, while for the rest of theEU, the annual inflation rate was 6.38%. Thus, we can expect that the inflation will have a significant effect on the real returns of pension vehicles.

Figure 10.2 shows two charts presenting the development of the inflation in Romania.

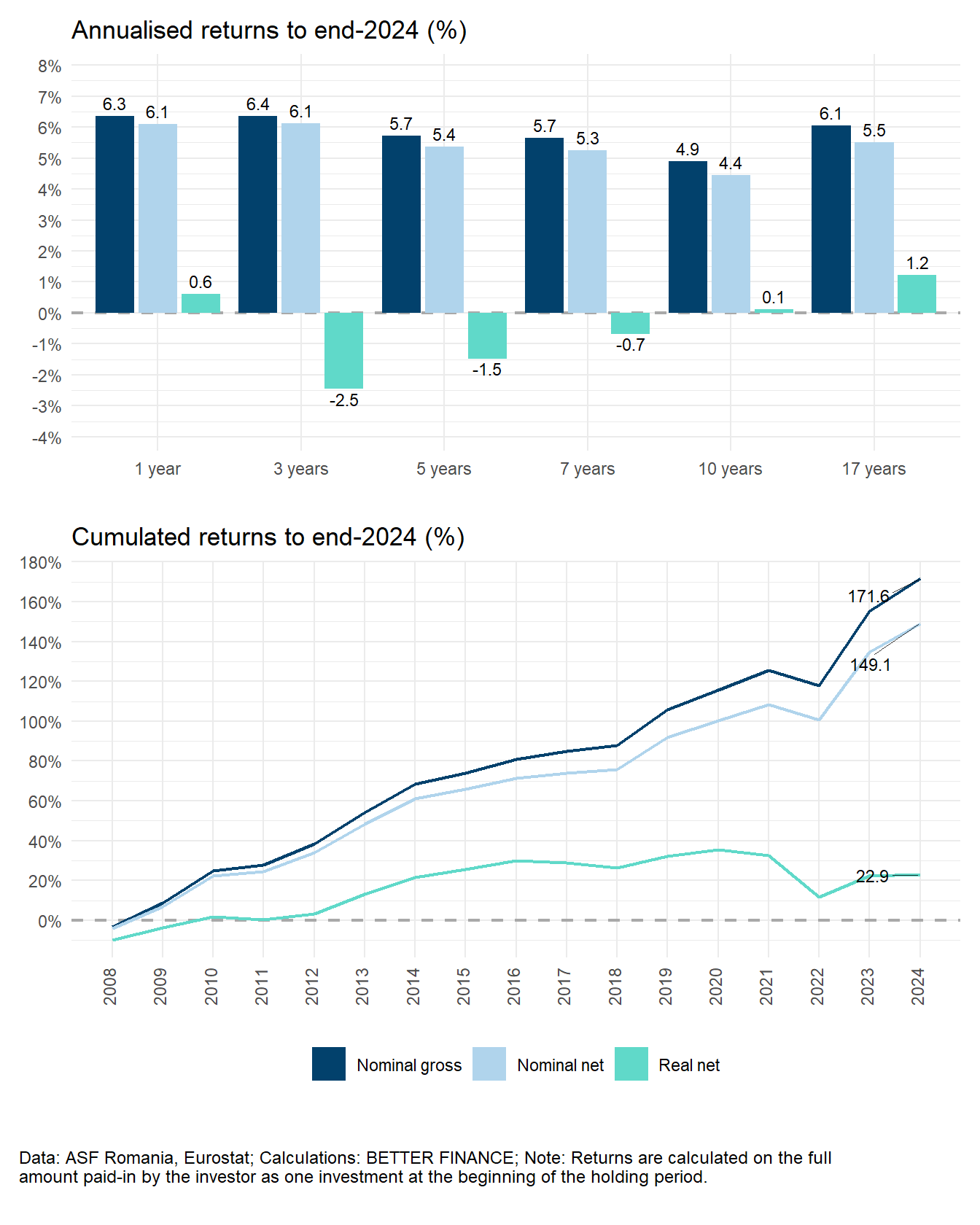

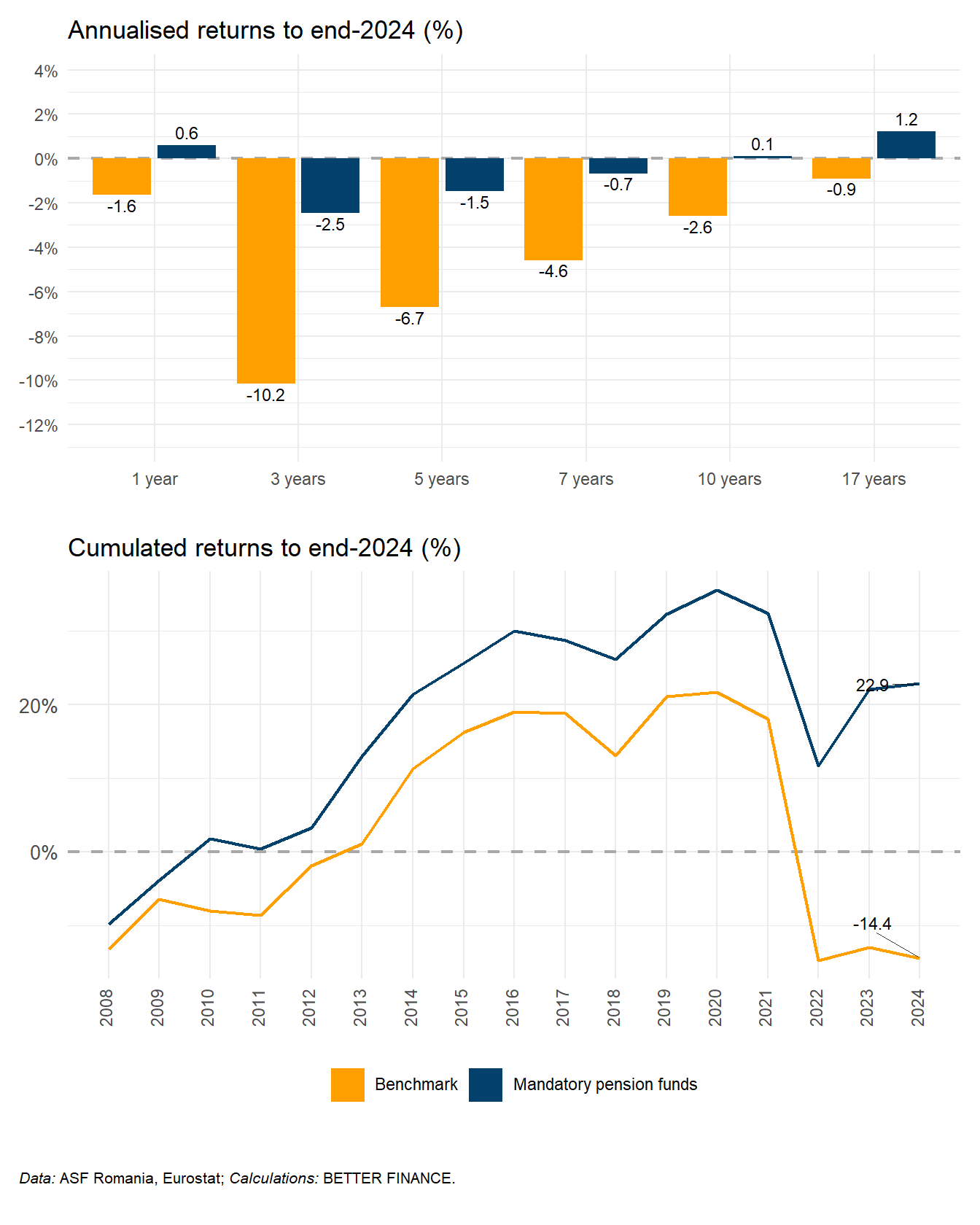

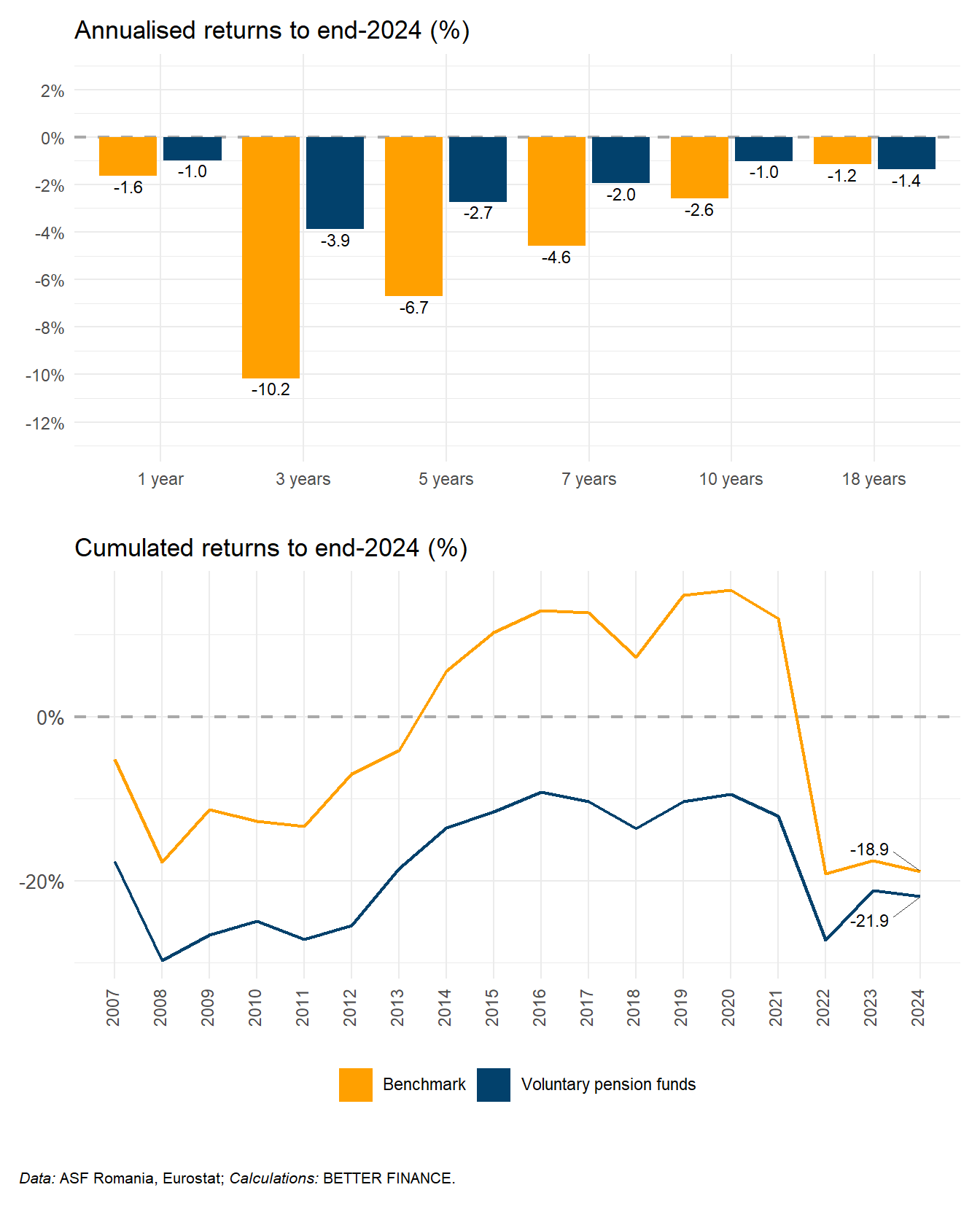

The performance of pension funds for both pillars in Romania are presented in Figure 16.5, Figure 16.6.

When inspecting the development of the performance of pension products within each pillar, the inflation do play a key role in maintaining the buying power of the savings for the retirement age.

For pillar III voluntary pension funds performance, the fees and charges are the second factor influencing the real value of savings.

Figure 16.7 and Figure 16.8 show the nominal and real net performance of pension funds for both pillars.

For voluntary pension funds, the fees and charges decrease the performance of funds by almost half, indicating more room for cost-effectiveness.

Do Romanian savings products beat capital markets?

In this section, we compare the performance of the Romanian Pillar II and Pillar III pension funds to the performance of relevant capital market benchmarks. In order to do so, we have analysed the portfolio structure of pension funds and set the weight of asset classes for the benchmark portfolio creation.

We have set the weight of the equities at 20% of the benchmark portfolio.

| Equity index | Bonds index | Start year | Allocation | |

|---|---|---|---|---|

| Mandatory pension funds | STOXX All Europe Total Market | Barclays Pan-European Aggregate Index | 2008 | 20%–80% |

| Voluntary pension funds | STOXX All Europe Total Market | Barclays Pan-European Aggregate Index | 2007 | 20%–80% |

| Data: STOXX, Bloomberg; Note: Benchmark porfolios are rebalanced annually. | ||||

Pillar II Mandatory pension funds do perform quite strongly compared to the capital market benchmark. Detailed evolution of the performance of pension funds are presented in Figure 16.9 and Figure 16.10

While the respective market benchmark has been negative on the analysed time-frame 2008–2023, Romanian mandatory pension funds were able to beat the benchmark and keep the real value of savings of the analysed period.

The different story is being seen when comparing the performance of Romanian voluntary pension funds with the respective market benchmark.

Over the analysed period of 2007–2023, the cumulative performance of the Pillar III pension funds was below its market benchmark and also negative. The key element explaining the results seems to be the high level of charges as the portfolio composition is quite similar to Pillar II funds.

16.6 Conclusions

Romania’s population is rapidly decreasing and ageing, which—unless they adopt the necessary reforms—will lead to the explosion of the demographic bomb in a few decades. In the public PAYG pensions system, the state collects contributions from employees and redistributes the money among existing pensioners. Demographics show that this redistribution logic is no longer viable, as contributors’ numbers will fall, and the number of pensioners is already going up. The departure from this dilemma takes the form of the private pensions system, allowing each active person to save for their own future retirement.

Romanian pillar II is a fully funded system based on personal accounts and on the DC philosophy. Pillar II is mandatory for all employees aged under 35 years and voluntary (optional) for employees aged 35 to 45. The starting level of contribution was set at 2% of the participant’s total gross income and increases by 0.5 percentage points annually until it reaches 6 of total gross income in 2017. However, this level has not been reached, and the contribution system has reversed.

Mandatory pension funds are managed by their administrators—PMCs. Each PMC is obliged by respective law to administrate and manage just one mandatory pension fund. Currently, there are seven PMCs managing seven mandatory funds on the Romanian Pillar II market. The market is dominated by two PMCs (AZT and NN) and as the portfolio structure of pension funds are quite similar, there is no real competition among providers and no viable life-cycle investment strategy is applied.

Romanian pillar III is also a fully funded system based on personal accounts and on the DC philosophy. Pillar III represents privately managed supplementary pensions. This system is opened to all income cohorts. Voluntary pension funds in Pillar III are managed by their administrators—PMCs, LICs or AMCs. Each administrator is obliged to establish and operate at least one voluntary pension fund. Currently, there are eight providers offering 10 voluntary pension funds. Pillar III market is fairly concentrated, where three dominant players cover almost 90 of the market.

Mandatory as well as voluntary pension funds’ investment strategy is strictly regulated. The law imposes percentage limits and restrictions for different asset classes. It must be noted that investment rules in mandatory and voluntary system are very similar. This fact logically causes implications on portfolio structure, thus also on performance of mandatory and voluntary pension funds in Romania. Currently about 73% of all investments in Pillar II as well as Pillar III pension funds are bond investments (Romanian Government Money market instruments and Bonds) and only about 22 is invested in equities, which could raise a question about suitability of portfolio structure with regard to the age structure of savers.

Overall, the real return of pension funds in Pillar II is positive, however high charges weight on the performance of Pillar III pension funds. Combining the effect of high fees and low participation, the Pillar III needs a serious reform in order to play an important role in securing adequate pension income for savers in a future.

Acronyms

- AMC

- asset management company

- ASF

- Autoritatea de Supraveghere Financiară

- AuM

- assets under management

- CNPP

- Casa Națională de Pensii Publice

- CSSPP

- Comisia de Supraveghere a Sistemului de Pensii Private

- DC

- Defined contributions

- EBRD

- European Bank for Reconstruction and Development

- EEA

- European Economic Area

- EET

- Exempt Exempt Taxed

- EIB

- European Investment Bank

- ETC

- exchange-traded commodity

- ETF

- exchange-traded fund

- EU

- European Union

- GDP

- gross domestic product

- LIC

- life insurance company

- net asset value

- PAYG

- pay-as-you-go

- PMC

- pension management company

- UCITS

- Undertaking for Collective Investment in Transferable Securities