Product categories

|

Reporting periods

|

||

|---|---|---|---|

| Name | Pillar | Earliest data | Latest data |

| Mandatory pension funds | Occupational (II) | 2002 | 2024 |

| Voluntary pension funds | Voluntary (III) | 2002 | 2024 |

Sažetak

Hrvatska je stvorila tipičan mirovinski sustav s 3 stupa, gdje se državno organizirani mirovinski stup temeljen na PAYG-u (preraspodjela doprinosa od radno sposobnog stanovništva starijem stanovništvu) nadopunjuje obveznim kapitaliziranim mirovinskim sustavom (II. stup) i subvencioniranim (izravno i neizravno) dobrovoljnim mirovinskim štednim sustavom (III. stup).

Rastući omjer pokrivenosti radno sposobnog stanovništva drugim stupom kompenzira se niskim obuhvatom unutar trećeg stupa. To bi u budućnosti moglo dovesti do sve većeg problema niskog životnog standarda za umirovljeničko stanovništvo jer prvi stup osigurava samo 30% stope zamjene, a preostala dva stupa neće moći dodati značajne izvore za pojedince tijekom mirovine. Čak i ako su performanse oba kapitalizirana stupa prilično solidne, prilično mali doprinosi i niska stopa pokrivenosti trećeg stupa dovode u pitanje adekvatnost mirovinskog sustava u Hrvatskoj.

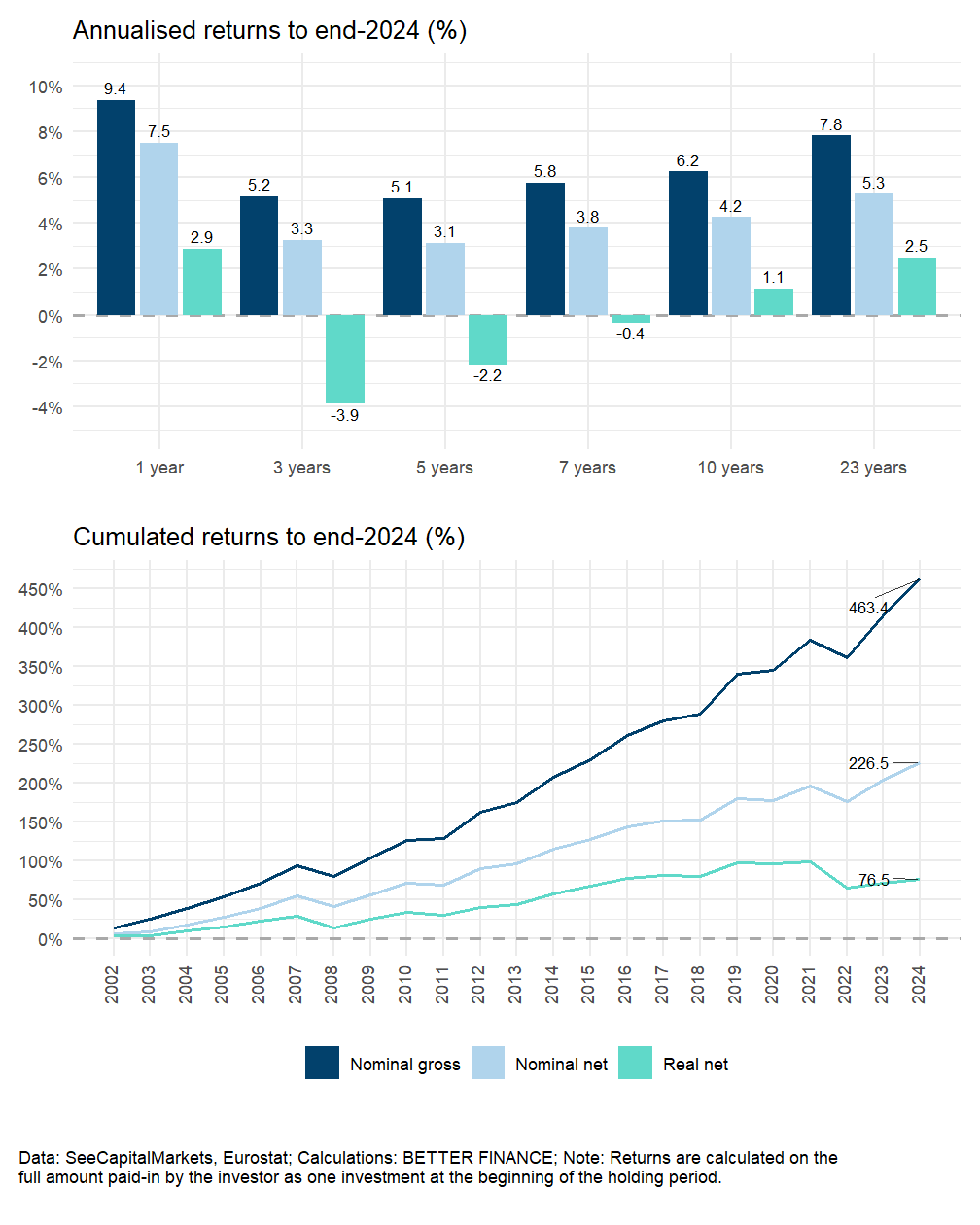

Općenito, realni neto prinosi mirovinskih fondova bili su pozitivni u 2024. Ako se uzme u obzir cijelo analizirano razdoblje, godišnji prinosi su u pozitivnom teritoriju i za proizvode II. i III. stupa, posebno zbog pozitivnih prinosa tijekom posljednjih godina.

Summary

Croatia has created typical 3-pillar pension system, where the state organized pension pillar based on PAYG (redistribution of contributions from working to elderly population) is supplemented by mandatory funded pension scheme (pillar II) and by subsidized (directly as well as indirectly) voluntary pension saving scheme (pillar III).

Increasing coverage ratio of working population by the second pillar is offset by low coverage within the third pillar. This might bring up the increasing problem of low living standard for retiring population in future as the first pillar provides only 30% replacement rate and remaining two pillars will not be able to add significant sources for individuals during retirement. Even if the performance of both funded pillars is quite solid, rather small contributions and low coverage ratio of the third pillar raises questions about the adequacy of the pension system in Croatia.

Overall, the real net returns of pension vehicles was positive in 2024. If the entire analysed period is considered, the annualized returns are in positive territory both for Pillar II as well as Pillar III products especially due to the positive returns during last years.

7.1 Introduction: The Croatian pension system

There have been no major changes in the pension system in Croatia in 2024. However, pension system is a subject of national Recovery and Resilience Plan where the overarching objective of the reform is to improve pension adequacy and sustainability by incentivising longer working lives, strengthening the second pension pillar and increasing the lowest pensions (Council of the European Union 2021). In 2024, state pensions have increased due to the high inflation in the past year.

Holding period

|

|||||||

|---|---|---|---|---|---|---|---|

| 1 year | 3 years | 5 years | 7 years | 10 years | Whole reporting period | to... | |

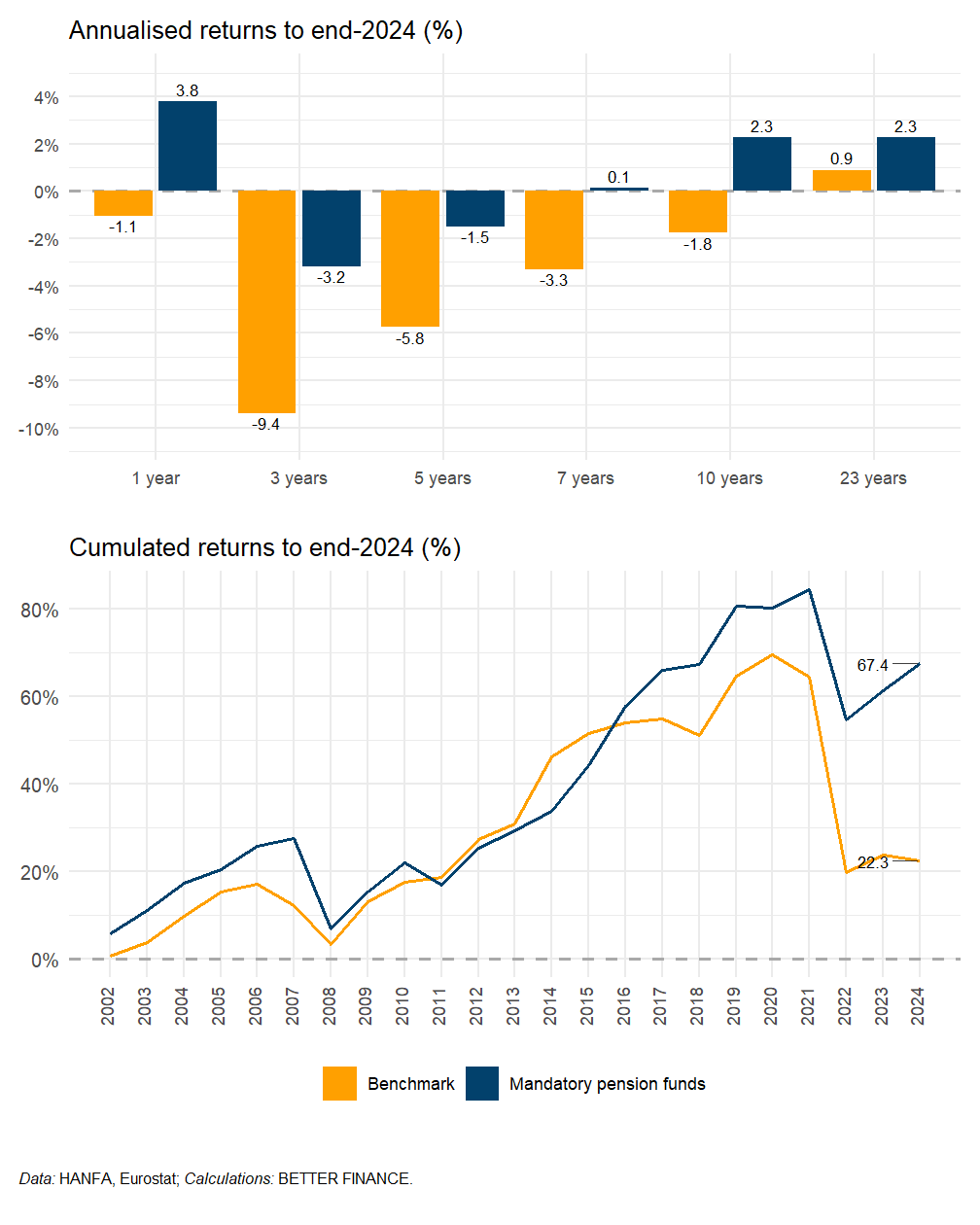

| Mandatory pension funds | 3.8% | -3.2% | -1.5% | 0.1% | 2.3% | 2.3% | end 2024 |

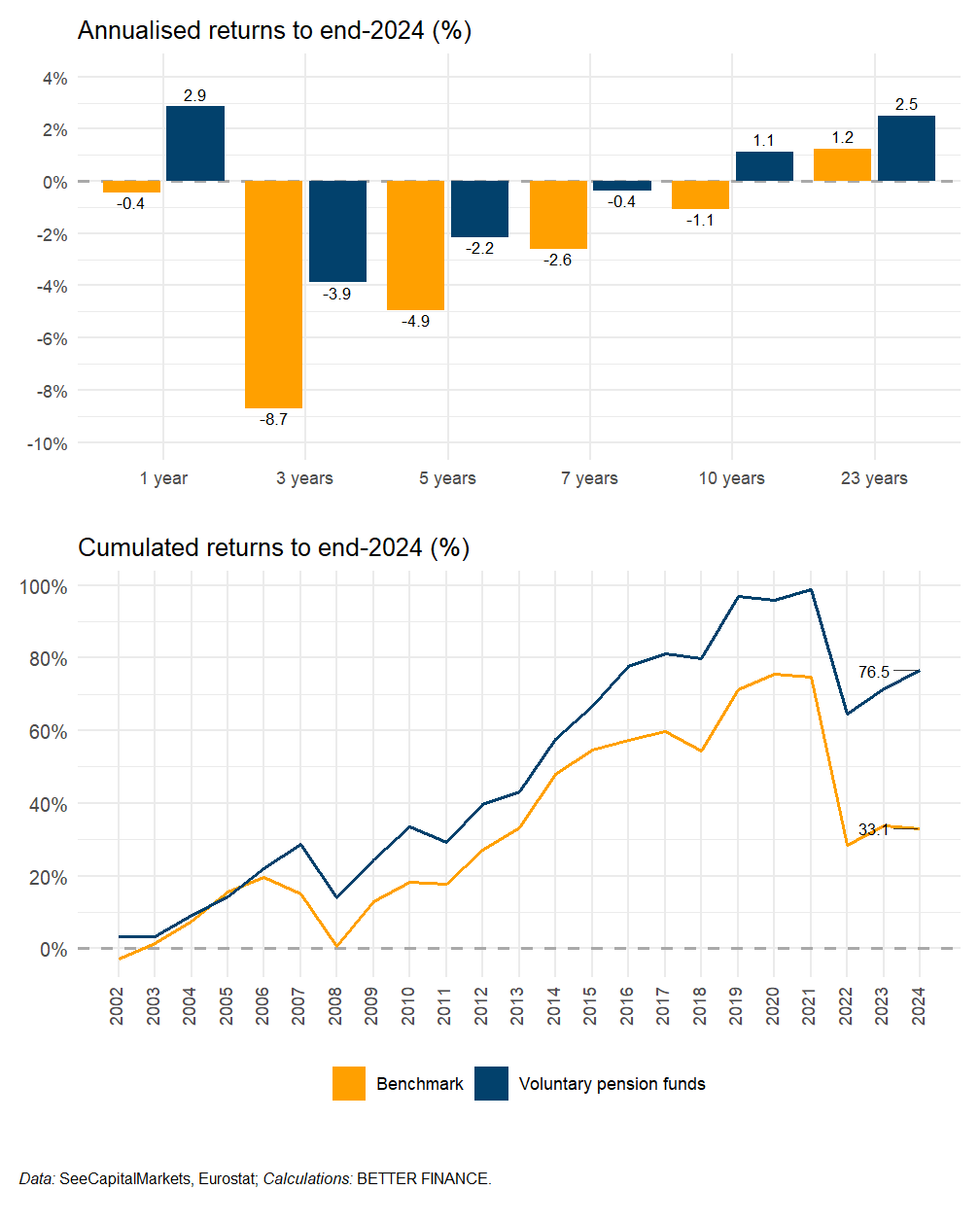

| Voluntary pension funds | 2.9% | -3.9% | -2.2% | -0.4% | 1.1% | 2.5% | end 2024 |

| Data: HANFA, SeeCapitalMarkets, Mandatory Pension funds statutes, Voluntary Pension Funds statutes, Eurostat; Calculations: BETTER FINANCE | |||||||

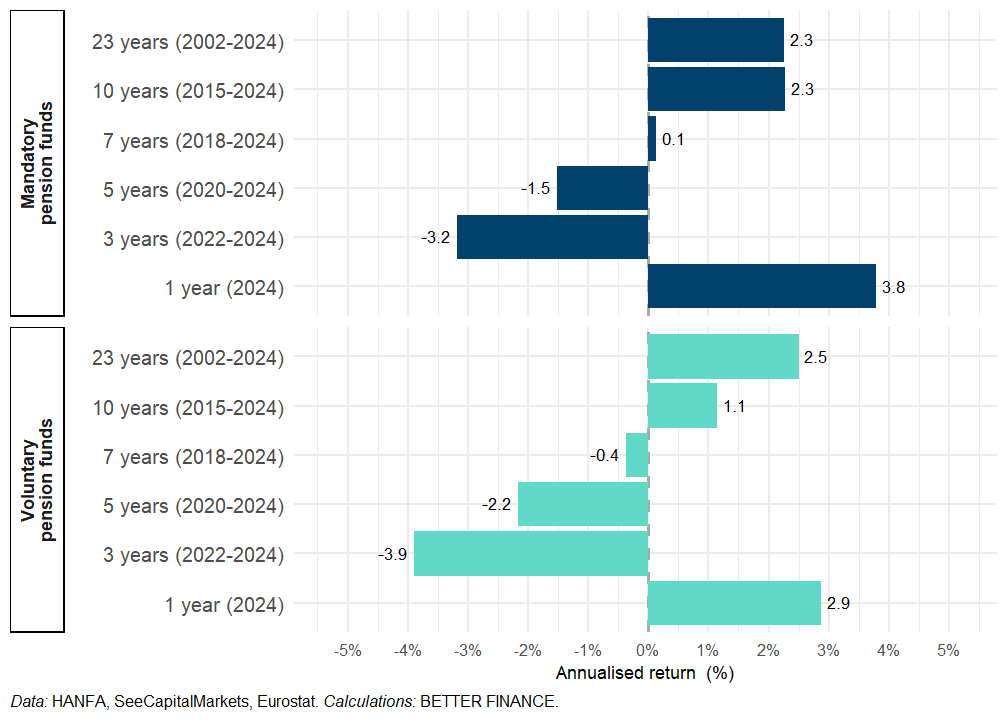

The performance of private pensions (mandatory as well as voluntary) was positive in 2024 both in nominal and real terms mainly due to the pick-up of the world markets and decreasing inflation.

Pension system in Croatia: An overview

Croatian pension system is since 2002 designed on conventional World bank 3-pillar model. Croatian pension system was as of January 1st, 1999 reformed by introducing a mixed public-private pension system consisting of three pillars of pension insurance:

- First pillar — compulsory pension insurance based on generational solidarity;

- Second pillar — compulsory pension insurance based on individual capitalized savings;

- Third pillar — voluntary pension insurance based on individual capitalized savings.

Key facts on the design of the Croatian Pension system are presented in Table 7.3.

| Pillar I | Pillar II | Pillar III |

|---|---|---|

| Mandatory state pension | Mandatory funded pensions | Voluntary fully funded DC pensions |

| PAYG principle | Individual accounts | Individual accounts |

| Coverage: 89.6% | Coverage: 89.63% | Coverage: 22.02% |

| Managed by the Social Insurance Company | Managed by Pension Asset Management Companies (PAMCs) | |

| Quick facts | ||

| Retirement age: 65 years for men; 63 years for woman (2023) | ||

| A relatively high old-age dependency ratio of 35.6% in 2022 | ||

| Average gross replacement ratio = 30.45% / Average net replacement ratio = 42.10% | ||

| Working population: 1.67 mln. | ||

| Number of old-age beneficiaries: 700 723 | ||

| Gross average monthly salary: EUR 1821 | ||

| Net average monthly salary: EUR 1318 | ||

| Net average pension: EUR 615 | ||

| Number of pension companies: | 4 | 4 |

| Number of pension funds: | 12 | 29 |

| Number of members (savers): | 2 333 992 | 446 792 |

| Data: Own elaboration based on Mirovinsko data, 2025. | ||

First pillar: PAYG scheme

The first pillar of pension insurance is called a pillar of generational solidarity based on pay-as-you-go (PAYG) redistributional principle, as persons who work pay contributions for pension insurance, whereas such contributions serve for giving pensions to current pension beneficiaries. In addition to contributions collected from insured persons, the first pillar is also funded from the state budget. According to the Pension Insurance Act , insured persons are compulsorily insured in accordance with principles of reciprocity and solidarity for the event of ageing, reduction of working capacity with remaining working capacity and partial or total loss of working capacity, and the members of their families in the event of insured person’s or pension beneficiary’s death (right to an old-age pension, early retirement pension, disability pension, temporary disability pension, survivors’ pension, minimum pension, basic pension).

Funding: the system of generational solidarity is a defined benefits system. The Contribution Act1 prescribes the obligation to pay contributions for funding of compulsory insurance, including contributions for pension insurance. Contributions are collected by the Tax Administration and the contribution rate for insured persons who are insured only in the first pillar amounts to 20% of gross salary, while the contribution rate for first pillar for insured persons who are insured in both compulsory pillars (first and second pillar) amounts to 15%.

The implementation of pension insurance based on generational solidarity falls within the competence of the Croatian Pension Insurance Institute (HZMO), the Croatian Pension Insurance Institute. The HZMO is the competent institution for exercising the right exclusively from pension insurance based on generational solidarity (first pillar).

The right to an old-age pension payable from the first pillar is acquired by an insured person who has reached 65 years of age, if he/she has completed 15 years of qualifying periods. Insured persons — women in the period from 2014 to 2029 are entitled to an old-age pension at a lower age. In 2024, they could retire at the age of 63 years and 6 months (under the condition of 15 years of service), where the age requirement for each calendar year increases by 3 months until 2029. As of January 1st, 2030, women and men can exercise the right to old-age pension benefit under the same conditions, having reached the age of 65 and 15 years of pensionable service, irrespective of the gender of the insured person.

The amount of old-age pension is calculated by multiplying personal points, pension factor and the actual value of pension. The pension factor is determined by the type of pension to be realized, and the actual value of the pension is determined by the Governing Board of the HZMO, based on the data of the Croatian Bureau of Statistics, no later than two months after the end of each half-year. Personal points are calculated by multiplying the average value point with achieved qualifying periods and the initial factor. The initial factor affects the amount of pension in case of old-age pensions and early retirement pensions, so that:

- An old-age pension is increased to insured persons who are granted pension for the first time after the age of 65, and have 35 years of qualifying periods, by 0.34% for each month after reaching the prescribed age for acquiring the right to an old-age pension, but no longer than 5 years,

- An early retirement pension is reduced for the insured persons by 0.2% for each month of early retirement before reaching the statutory retirement age of the insured person for the acquisition of the right to an old-age pension.

The average value point is calculated based on salaries earned over the entire working life in relation to the average annual salary in the Republic of Croatia.

The right to an early retirement pension is acquired by an insured person who has reached 60 years of age and completed 35 years of qualifying periods. There are again some exceptions for women. The amount of the old-age pension is permanently reduced for each calendar month of the earlier exercise of entitlement, up to the completed years of life of the insurer prescribed for the acquisition of the right to an old-age pension, linearly by 0.2% for each month of early retirement, i.e. 2.4% per year up to a maximum of 12% for a maximum of 5 years prior to retirement.

Paid old-age pensions are adjusted twice a year in relation to economic trends in the Republic of Croatia. The adjustment rate, applied starting from January 1st, 2015, is determined by the variable ratio of the consumer price index and gross salaries of all employees in the Republic of Croatia in the previous year, compared to the year preceding it (70:30, 50: 50 or 30:70, whichever is preferred). From July 1st, 2019, it is aligned as follows: from January 1 to July 1 each calendar year according to the 70:30 or 30:70 model.

Second pillar: Mandatory pension funds

The second pillar has been effectively introduced starting January 2002. The second pillar represents individual capitalized savings. Individual savings refer to personal assets of insured persons and the fact that paid funds are recorded in personal accounts, while capitalized savings refer to return on investment achieved upon payment to the selected compulsory pension fund. This form of pension insurance was introduced to expand the source of funding in relation to compulsory pension insurance based on generational solidarity, which sought to achieve greater individual responsibility for the safety of the elderly.

The second pillar includes compulsory insured persons of up to 40 years of age. The rate of contributions for persons insured in the second pillar amounts to 5 % of the gross salary, whereby insured persons may themselves choose a compulsory pension fund and compulsory pension fund category to which they will contribute the said amount. Persons compulsory insured in the first and the second pillar and insured persons who voluntarily chose the second pillar have the right in the process of exercising the right to a pension to choose in which system the pension will be realized, that is, the system which is more favourable for them (opt-out system). Insured persons can:

- Leave the second pillar and get the pension exclusively from the first pillar;

- Stay in the second pillar and get the pension from both pillars (in this case, the pension from the first pillar is determined for the years of service completed by December 31st, 2001, with a supplement of 27% and for the years of service completed from January 1st, 2002, with a supplement of 20.25 %, determined by the factor of basic pension (0.75%).

Management of savings within the second pillar is carried out through compulsory pension management companies offering pension funds, while the payout phase is carried out exclusively through pension insurance companies. The pension system based on capitalized savings is regulated by two statutory regulations, depending on whether they refer to the phase of accumulation and capitalization of contributions regulated by the Act on Compulsory Pension Funds2 or the phase of pension payouts regulated by the Act on Pension Insurance Companies. 3 The Central Register of Insured Persons (REGOS) is the competent institution for insurance based on individual capitalized savings (second pillar).

Compulsory pension fund is established by a pension company that manages such fund on its behalf and for the joint account of pension fund members. Pension fund may fall under categories A, B or C, and are managed by the same pension company. Pension funds of different categories have different investment strategies and vary according to membership limitations (considering life expectancy of savers/members), investment strategy and investment limitations. The assumed risk should be the lowest in category C funds, and the largest in category A pension funds.

The right to pension and based on individual capitalized savings — second pillar is realized based on the Decision on Retirement Benefits issued by the HZMO. From January 1st, 2019, all insured persons who are insured in both pension pillars can, when they apply for old-age or early old-age pension, select whether they want to receive pension only from the first pillar or pension from both pillars through a personal statement to the REGOS.

For a member of the fund to choose a more favourable pension, REGOS will collect informative pension calculations from the HZMO and the pension insurance company (MOD) and submit them to the home address. If a member of the fund opts for pension only from the compulsory pension insurance based on generational solidarity (first pillar), the HZMO will determine the pension as if the insured was only insured in the I pillar. The selection of this pension means that a member of the fund wants to leave the second pillar, i.e. compulsory pension insurance of individual capitalized savings, and the total capitalized funds from the personal account of the member of the fund are transferred to the state budget. If a member of the fund opts for a combined pension from the first and second pillars, HZMO will determine the basic pension from compulsory pension insurance for generational solidarity and submit to REGOS the data from the Decision. Upon receipt of the Decision, which is provided to REGOS by HZMO, REGOS checks the data from the Decision regarding the status of the future pension beneficiary. It is checked whether the personal account of the future pension beneficiary is opened and whether he or she has exited from the II pillar. After selecting the pension insurance company, REGOS will close the personal account of the member of the fund and transfer the overall funds to the pension insurance company which will contact than the beneficiary for the conclusion of the pension agreement. The compulsory pension company that manages the compulsory pension fund has a deadline of five working days from the date of initiating the closing of the personal account to allocate funds to the payment account for second pillar contributions. Upon settlement of the obligation by the custodian bank, the following working day it is verified whether the funds have been transferred to the account of the legal recipient of funds — the Raiffeisen Pension Insurance Company (currently the only MOD) that will pay the pension on the basis of individual capitalized savings. REGOS informs the Pension Insurance Company electronically on the data from R-POD form and the amount of transferred funds. Upon receipt of the aforementioned information, the pension insurance company will contact the future pension beneficiary regarding the conclusion of the Contract on pension based on individual capitalized savings.

If the old-age pension from the first pillar is higher than 15% of the minimum pension from the first pillar according to the Pension Insurance Act, the future pension beneficiary from the second pillar can decide on a partial, one-time cash payment of 15% in the gross amount of the total capitalized funds allocated to MOD.

Third pillar: Voluntary fully funded pensions

Voluntary pension funds were also introduced in 2002 and completed the three-pillar system. The third pillar is a voluntary pension savings Defined contributions (DC)-based scheme. Voluntary pension schemes are either offered by voluntary pension funds or can be set up by trade unions and employers, making open and closed funds possible. Open-ended pension funds are open for membership to any natural person interested in becoming a member of an open-ended pension fund, whereas closed-ended pension funds form their membership out of natural persons who are either employed with an employer, or are trade union members, members of associations of self-employed persons or self-employed persons. Voluntary pension funds need to have at least 2000 members two years after being established.

The payment of retirement benefits within the framework of mandatory pension insurance based on individual capitalized savings of members of mandatory pension funds is made by pension insurance companies only. The payment of retirement benefits within the framework of voluntary pension insurance based on individual capitalized savings of members of voluntary pension funds is made by pension insurance companies, but exceptionally, the payment of retirement benefits on a temporary basis may be made by voluntary pension funds under the conditions laid down in the Act on Voluntary Pension Funds.

The collection of funds within the framework of third pillar of pension insurance is carried out through voluntary pension funds, while payouts of pensions are made by pension insurance companies, and, exceptionally, pension companies, that may carry out temporary pension payouts from voluntary pension funds. Pension reform, which entered into force on , has also introduced the possibility of pension payments by the life insurance companies.

There are no limitations on membership. Also, there are no time restrictions on the duration of membership. A member may choose the amount, duration, and dynamics of payments to the fund. Payments are not compulsory and depend solely on payer’s current capabilities. The membership in the fund is not terminated by termination of payments or irregular payments. All paid funds are personally owned by a member, no matter who their payer is, and they can be inherited in full. The only condition for using the funds is reaching 50 years of age.

The Act on Voluntary Pension Funds 4 regulates the establishment and operation of voluntary pension funds, while the Act on Pension Insurance Companies regulates the establishment and operation of pension insurance companies, pension schemes and pensions and their distribution. The Croatian Financial Services Supervisory Agency (HANFA) provides supervision over the business of pension insurance companies.

7.2 Long-term and pension savings vehicles in Croatia

Croatian pension vehicle in Pillar II and Pillar III are very similar what is considering the design and operation. The differences are in the strictness of the regulation, while the Pillar III pension funds have more liberate regulation.

Figure 7.1 presents the amount of savings under management for both pillars, in billion euros.

When inspecting the assets under management, Pillar II pension funds are clearly dominating the market as the contributions flow directly from the mandatory social insurance contributions and cover basically entire working population. Pillar III pension funds are significantly smaller than Pillar II peers, while covering only 20% of working population contributing smaller amounts regularly.

Mandatory pension funds

There have been 4 mandatory pension asset management companies operating in Croatia in 2024:5

- Allianz ZB d.o.o. društvo za upravljanje obveznim i dobrovoljnim mirovinskim fondovima

- ERSTE d.o.o. - društvo za upravljanje obveznim i dobrovoljnim mirovinskim fondovima

- PBZ CROATIA OSIGURANJE d.d. za upravljanje obveznim mirovinskim fondovima

- Raiffeisen društvo za upravljanje obveznim i dobrovoljnim mirovinskim fondovima dioničko društvo

There are 12 mandatory pension funds offered to savers, while each mandatory pension company manages 3 pension funds with different investment strategy:

- Type “A” mandatory pension fund with riskier investing strategy. Members of this fund can be persons who are at least 10 years old until the age requirements for acquiring the right to an old-age pension are met. At least 30% of the fund’s net assets are invested in bonds of the Republic of Croatia, European Union (EU) or Organisation for Economic Co-operation and Development (OECD) countries. Maximum 55% of the fund’s net assets are allocated in shares of issuers from the Republic of Croatia, EU member states or OECD countries and at least 40% of the fund’s net assets are denominated in kuna.

- Type “B” mandatory pension fund — balanced investment strategy. Initially, all members will be members of this fund, unless they choose Fund A or C themselves. At least 50% of the fund’s net assets are invested in bonds of the Republic of Croatia, EU or OECD countries. Maximum 35% of the fund’s net assets are invested in shares of issuers from the Republic of Croatia, EU member states or OECD countries and at least 60% of the fund’s net assets are denominated in kuna.

- Type “C” mandatory pension fund — conservative investment strategy. It is suitable for older members of the fund who have less than 5 years left to meet the age requirements for acquiring the right to an old-age pension. According to this condition, REGOS will automatically transfer policyholders from the category B fund to the category C fund. At least 70% of the fund’s net assets should be allocated in bonds of the Republic of Croatia, EU member states or OECD countries. Investment in shares is not allowed, and exposure to investment funds is limited to 10%. At least 90% of the fund’s net assets are denominated in kuna.

Portfolio structure of the mandatory pension funds is presented in Figure 7.2.

Considering the portfolio structure of all mandatory pension fund, most of the investments (almost 64%) are allocated in government and municipal bonds with increasing share of equities. This could also explain positive nominal returns in 2024.

Third pillar: Voluntary pension funds

Voluntary pension savings scheme offers more flexibility for providers. There are 4 voluntary pension asset management companies in Croatia:

- Allianz ZB d.o.o. društvo za upravljanje obveznim i dobrovoljnim mirovinskim fondovima

- CROATIA osiguranje mirovinsko društvo za upravljanje dobrovoljnim mirovinskim fondom d.o.o.

- ERSTE d.o.o. – društvo za upravljanje obveznim i dobrovoljnim mirovinskim fondovima

- Raiffeisen društvo za upravljanje obveznim i dobrovoljnim mirovinskim fondovima dioničko društvo

These companies manage mandatory as well as voluntary pension funds. Within the third pillar, the companies can offer open-ended funds to any member as well as closed-ended funds to predefined range of members. Currently (as of December 31st, 2024), there have been available data for 16 closed-ended funds and 6 open-ended voluntary pension funds offered to savers 6. However, open-ended funds manage more than 80% of all pillar III assets.

The portfolio structure of Pillar III pension funds is presented in Figure 7.3.

Voluntary pension funds can be considered more riskier compared to the mandatory pension funds. Almost 20% of assets is allocated into equities and equity based Undertaking for Collective Investment in Transferable Securities (UCITS) funds and 60% in government bonds.

7.3 Charges

Charges of mandatory pension funds

Croatian pillar II pension funds managed by 4 companies do exhibit regulated fee policy ensuring relatively low level of fees. Detailed structure of fees of mandatory pension funds offered within the second pillar is presented in Table 7.4.

| Year | Total ongoing charges | Entry fees1,2 | Admin. and mgt. fees | Other ongoing fees | Exit fees | Total Expense Ratio |

|---|---|---|---|---|---|---|

| 2002 | 0.92% | NA | NA | NA | NA | NA |

| 2003 | 0.92% | NA | NA | NA | NA | NA |

| 2004 | 0.92% | NA | NA | NA | NA | NA |

| 2005 | 0.98% | NA | NA | NA | NA | NA |

| 2006 | 0.99% | NA | NA | NA | NA | NA |

| 2007 | 1.12% | NA | NA | NA | NA | NA |

| 2008 | 0.89% | NA | NA | NA | NA | NA |

| 2009 | 0.82% | NA | NA | NA | NA | NA |

| 2010 | 0.79% | NA | NA | NA | NA | NA |

| 2011 | 0.69% | NA | NA | NA | NA | NA |

| 2012 | 0.57% | NA | NA | NA | NA | NA |

| 2013 | 0.57% | NA | NA | NA | NA | NA |

| 2014 | 0.57% | NA | NA | NA | NA | NA |

| 2015 | 0.57% | NA | NA | NA | NA | NA |

| 2016 | 0.51% | NA | NA | NA | NA | NA |

| 2017 | 0.44% | NA | NA | NA | NA | NA |

| 2018 | 0.41% | NA | NA | NA | NA | NA |

| 2019 | 0.38% | NA | NA | NA | NA | NA |

| 2020 | 0.35% | NA | NA | NA | NA | NA |

| 2021 | 0.32% | NA | NA | NA | NA | NA |

| 2022 | 0.31% | 0.50% | 0.27% | 0.02% | 0.80% | 0.29% |

| 2023 | 0.30% | 0.50% | 0.25% | 0.02% | NA | NA |

| 2024 | 0.29% | 0.00% | 0.24% | 0.02% | NA | NA |

| 1 % of contributions | ||||||

| 2 % of divestments | ||||||

| Data: Mandatory Pension funds statutes Calculations: BETTER FINANCE. | ||||||

Pillar II mandatory pension funds do exhibit rather complex fee structure, however the total cost indicator is presented in annual financial report of each pension fund. In 2024, mandatory pension fund providers charge management fee of 0.25% p.a., depository fee on average of 0.015% p.a. of total assets under management, but the entry fee of 0.5% of contributed amount has been abolished 7. The exit fee is determined based on the duration of the agreement between the saver and provider. If the duration of the saving agreement is less than 1 year, usually the exit fee of 0.8% of savings is charged. If the duration of the agreement is more than 3 years, no exit fee can be charged.

The year 2024 brought further reduction and diversification of fees based on the fund´s strategy. Introduction of low-cost passively managed pension funds has spurred price battle after 2018, however divergence between the fees started to emerge in 2021 with an average fee level of 0.54% p.a. Lower total expense ratio in 2024 could be explained by higher positive returns as well as further legislative decrease in fund fees.

Charges of voluntary pension funds

Compared to the mandatory pension funds’ level of fees, voluntary pension funds fees are significantly higher and amount on average more than 1.8% p.a. on assets under management.

Obtaining data for voluntary pension funds is quite challenging and only average cost ratio for all voluntary pension funds is available. The fee structure suggests that the total costs are quite dependent on the overall performance and thus the performance-tied fees play key role in the fee structure of voluntary pension funds in Croatia. The average cost ratio has been calculated using the voluntary pension funds’ financial statements.

| Year | Total ongoing charges |

|---|---|

| 2002 | 7.69% |

| 2003 | 7.69% |

| 2004 | 3.18% |

| 2005 | 2.05% |

| 2006 | 1.89% |

| 2007 | 1.82% |

| 2008 | 1.96% |

| 2009 | 2.01% |

| 2010 | 2.04% |

| 2011 | 2.05% |

| 2012 | 1.97% |

| 2013 | 1.96% |

| 2014 | 1.98% |

| 2015 | 2.01% |

| 2016 | 2.04% |

| 2017 | 2.05% |

| 2018 | 2.05% |

| 2019 | 2.04% |

| 2020 | 2.04% |

| 2021 | 2.03% |

| 2022 | 2.04% |

| 2023 | 1.74% |

| 2024 | 1.87% |

| Data: Voluntary Pension Funds statutes Calculations: BETTER FINANCE. | |

Pillar III costs and charges are significantly higher compared to the mandatory pension funds offered in Pillar II, when the fee structure is regulated and capped. Higher overall costs do negatively impact the overall performance of Pillar III pension funds.

7.4 Taxation

Taxation of the mandatory pension scheme (Pillar II) is of the Exempt Exempt Taxed (EET) type. Contributions and investment income are tax-exempt, whereas benefits are taxed. The tax allowance for pensioners is 1.7 times higher than for employees, meaning that pensions are only modestly taxed.

At each pension payment, as well as a one-time payment of 15% of the total capitalized funds allocated to mandatory pension funds, the pension insurance company calculates and pays income tax and surtax on income tax in accordance with the Income Tax Act and pays the net amount to the pension beneficiary. Tax rates for pensioners are reduced and are 12% and 18%, depending on tax brackets. Based on the final income tax calculation that is done by the Tax Administration, the pension beneficiary may be required to pay a tax or may be entitled to a refund of overpaid income tax, depending on the received receipts and the personal deductions used in that year.

Voluntary pension savings (Pillar III) are the only form of saving which includes two types of state incentives: state incentive funds and tax incentives for employers. Croatia encourages pension savings and approves the incentive to all members of the third pillar in the amount of 15% of the annual payment, up to a maximum of HRK 5000.00 (EUR 672), that is, the highest state incentive can amount to HRK 750.00 (EUR 100). Every resident can exercise the right to receive incentives only during the period that they pay compulsory pension insurance. The membership in a voluntary pension fund offers its member the option of voluntary pension savings being paid by his employer. All payments made by the employer in Pillar III of pension insurance up to the monthly amount of HRK 500 (EUR 67.2), that is, up to HRK 6000 (EUR 806.5) a year, are not considered a salary. That amount is considered a tax-recognized expense or employer’s expense. During the pay-out phase, pension benefits are subject to personal income tax. Therefore, we can say that the taxation scheme for Pillar III pension savings is EET with exceptions.

| Product categories |

Phase

|

Fiscal Regime | ||

|---|---|---|---|---|

| Contributions | Investment returns | Payouts | ||

| Mandatory pension funds | Exempted | Exempted | Taxed | EET |

| Voluntary pension funds | Exempted | Exempted | Taxed | EET |

| Source: BETTER FINANCE own elaboration, based on Own elaboration, 2024. | ||||

7.5 Performance of Croatian long-term and pension savings

Real net returns of Croatian long-term and pension savings

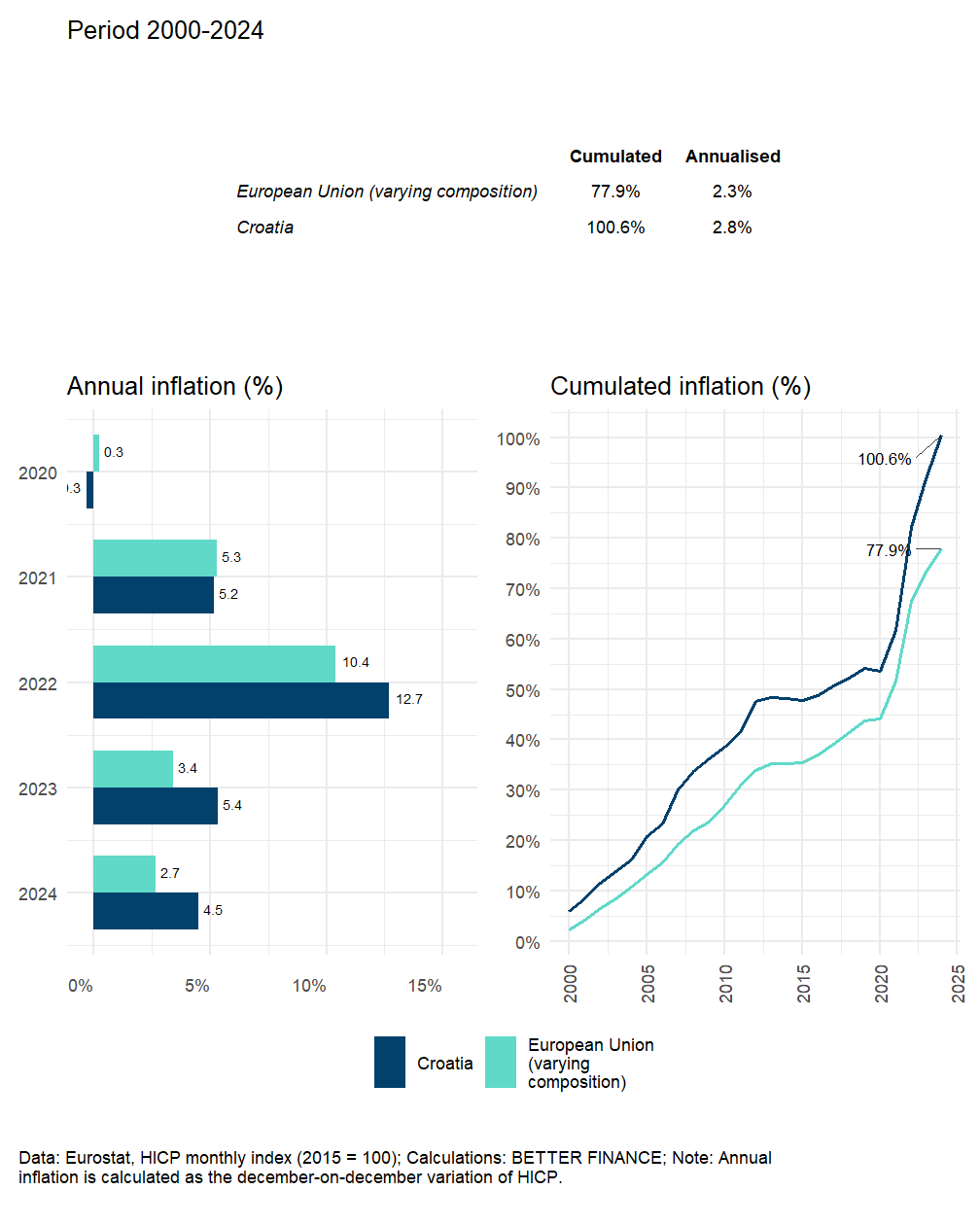

The ability of the pension vehicle to maintain the buying power is the key feature for savers. Especially in countries, where the historical inflation is higher, the pension providers must adjust the portfolio structure to be able to keep up with local inflationary pressures.

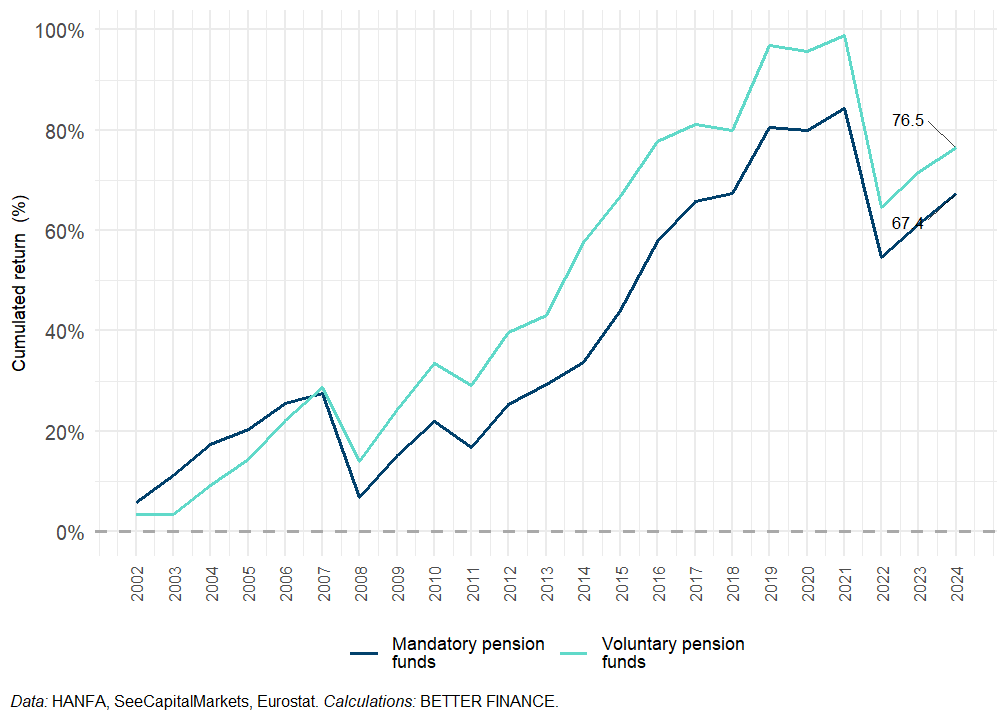

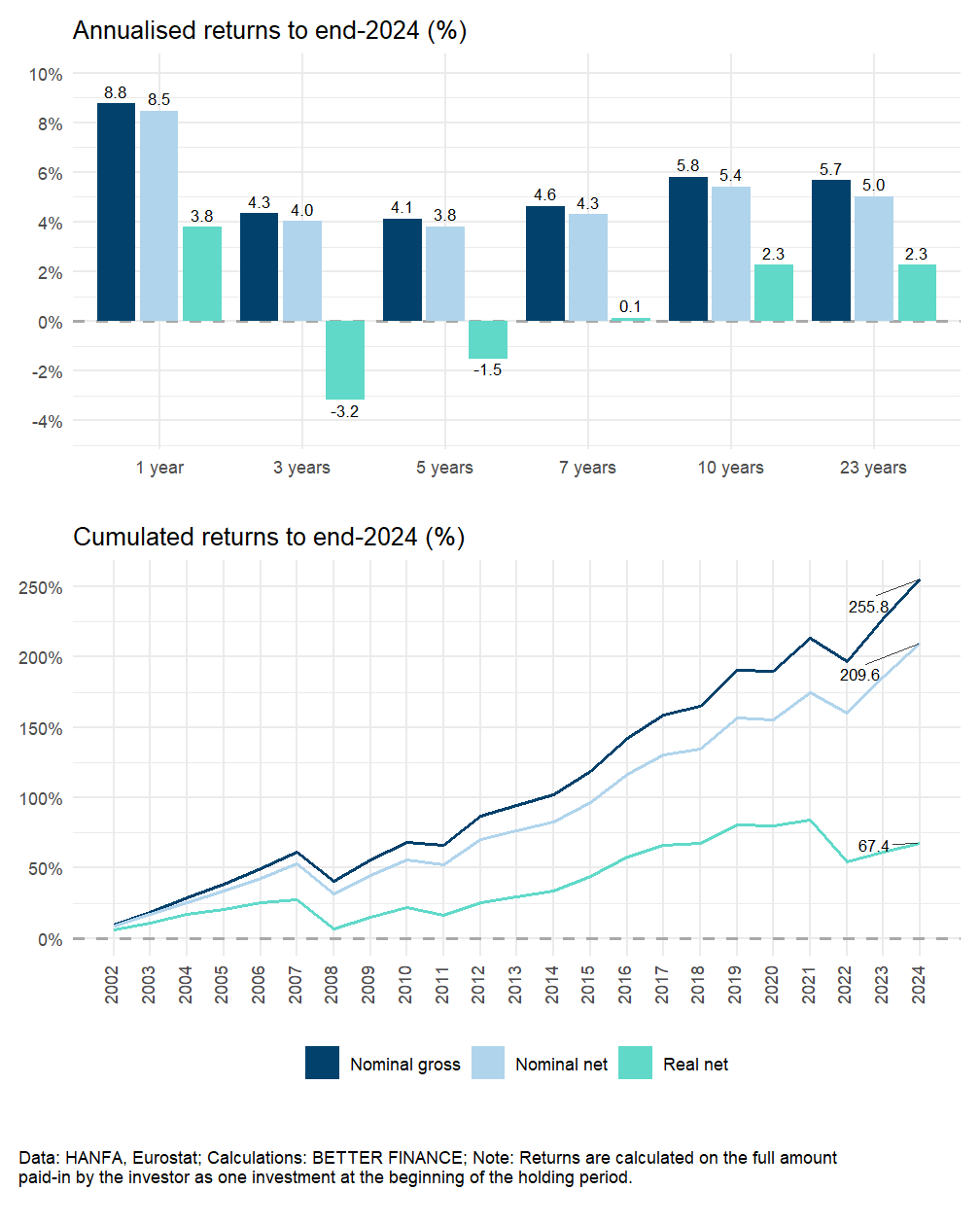

Croatian mandatory pension funds have been able to beat the inflation over the analysed period of 2002–2024. This is not the fact for the voluntary pension funds, where the overall cumulative performance after the inflation was negative.

Performance of mandatory and voluntary pension funds before fees and inflation is quite similar. However, when the charges and inflation is applied, the differences occur where the voluntary pension funds record lower returns.

Do Croatian savings products beat capital markets?

In this section, we compare the performance of the mandatory and voluntary pension funds in Croatia to the performance of relevant capital market benchmarks.

| Equity index | Bonds index | Start year | Allocation | |

|---|---|---|---|---|

| Mandatory pension funds | STOXX All Europe Total Market | Barclays Pan-European Aggregate Index | 2002 | 15%–85% |

| Voluntary pension funds | STOXX All Europe Total Market | Barclays Pan-European Aggregate Index | 2002 | 25%–75% |

| Data: STOXX, Bloomberg; Note: Benchmark porfolios are rebalanced annually. | ||||

Croatian mandatory pension funds have been able to maintain the buying power of savings and beat the respective market benchmark. This is quite visible after the year 2015, when the charges started to drop below 0.5% p.a. and the portfolio structure of the funds became more stable and passively oriented. The opposite is true for the voluntary pension funds, which have not been able to keep up with the market benchmark and on top of it, they were below the inflation index. The main reason can be found in the quite conservative portfolio structure and really high fees compared to other pension vehicles.

7.6 Conclusions

Croatian pension system offers rather low replacement rates from the state-organized first pillar. This leaves the working population to rely on individual savings and thus the importance of mandatory as well as voluntary pension savings will rise over time and will play a significant role of one’s income during the retirement.

Mandatory as well as voluntary pension funds have provided the savers with solid returns over the last 22 years.

Pillar II scheme is compulsory for the working population and thus the coverage ratio as well as benefit ratio will be expected to rise in future. The problem could be seen in rather low coverage ratio within the III. pillar, where only 20% of working population saves for retirement and the pension vehicle do not offer cost-effective way of securing the future income.

Understating the weak points of Croatian pension system (low coverage ratio and relatively low contribution rates for funded schemes), the pension system could be improved by:

- allowing for additional voluntary contributions for mandatory pension pillar on top of 5% contribution rate envisaged by the current law as the II. pillar offers quite solid performance with low cost ratio;

- increase indirect state support and further enhance the tax exemption for III. pillar contributions in order to increase the coverage ratio;

- allow more open competition for voluntary pension funds from the side of Pan-European Personal Pension (PEPP) that would offer cost-effective and transparent products.

Overall, the performance of Croatian pension funds could be considered solid, compared to other peers in other countries. However the performance is driven mostly by bond yields of domestic issuers, which would not hold for the longer period.

Acronyms

- DC

- Defined contributions

- EET

- Exempt Exempt Taxed

- EU

- European Union

- HANFA

- Croatian Financial Services Supervisory Agency

- HZMO

- Croatian Pension Insurance Institute

- MOD

- pension insurance company

- OECD

- Organisation for Economic Co-operation and Development

- PAYG

- pay-as-you-go

- PEPP

- Pan-European Personal Pension

- REGOS

- Central Register of Insured Persons

- UCITS

- Undertaking for Collective Investment in Transferable Securities

https://www.zakon.hr/z/708/Zakon-o-obveznim-mirovinskim-fondovima↩︎

https://www.zakon.hr/z/712/Zakon-o-mirovinskim-osiguravaju%C4%87im-dru%C5%A1tvima↩︎

https://www.zakon.hr/z/709/Zakon-o-dobrovoljnim-mirovinskim-fondovima↩︎

Source:HANFA, 2025.↩︎

Source:HANFA, 2025.↩︎

Source: https://regos.hr/en/news-regarding-the-application-of-legal-regulations-from-1-january-2024/, 2025↩︎