Product categories

|

Reporting periods

|

||

|---|---|---|---|

| Name | Pillar | Earliest data | Latest data |

| Employee pension funds | Voluntary (III) | 2002 | 2024 |

| Voluntary pension funds | Voluntary (III) | 2013 | 2024 |

| Employee capital plans | Voluntary (III) | 2020 | 2024 |

| Pan-European personal pension products | Voluntary (III) | 2024 | 2024 |

Streszczenie

Dodatkowy system emerytalny w Polsce składa się aktualnie z pięciu elementów: pracowniczych programów emerytalnych (PPE), indywidualnych kont emerytalnych (IKE), indywidualnych kont zabezpieczenia emerytalnego (IKZE), pracowniczych planów kapitałowych (PPK) oraz ogólnoeuropejskiego indywidualnego produktu emerytalnego (OIPE) wprowadzonego we wrześniu 2023 r. Na koniec 2024 roku zgromadzono w nich odpowiednio 29,4 mld PLN (6,9 mld EUR), 22,8 mld PLN (5,3 mld EUR), 12,1 mld PLN (2,8 mld EUR), 30,3 mld PLN (7,1 mld EUR) oraz 0,11 mld PLN (0,03 mld EUR).

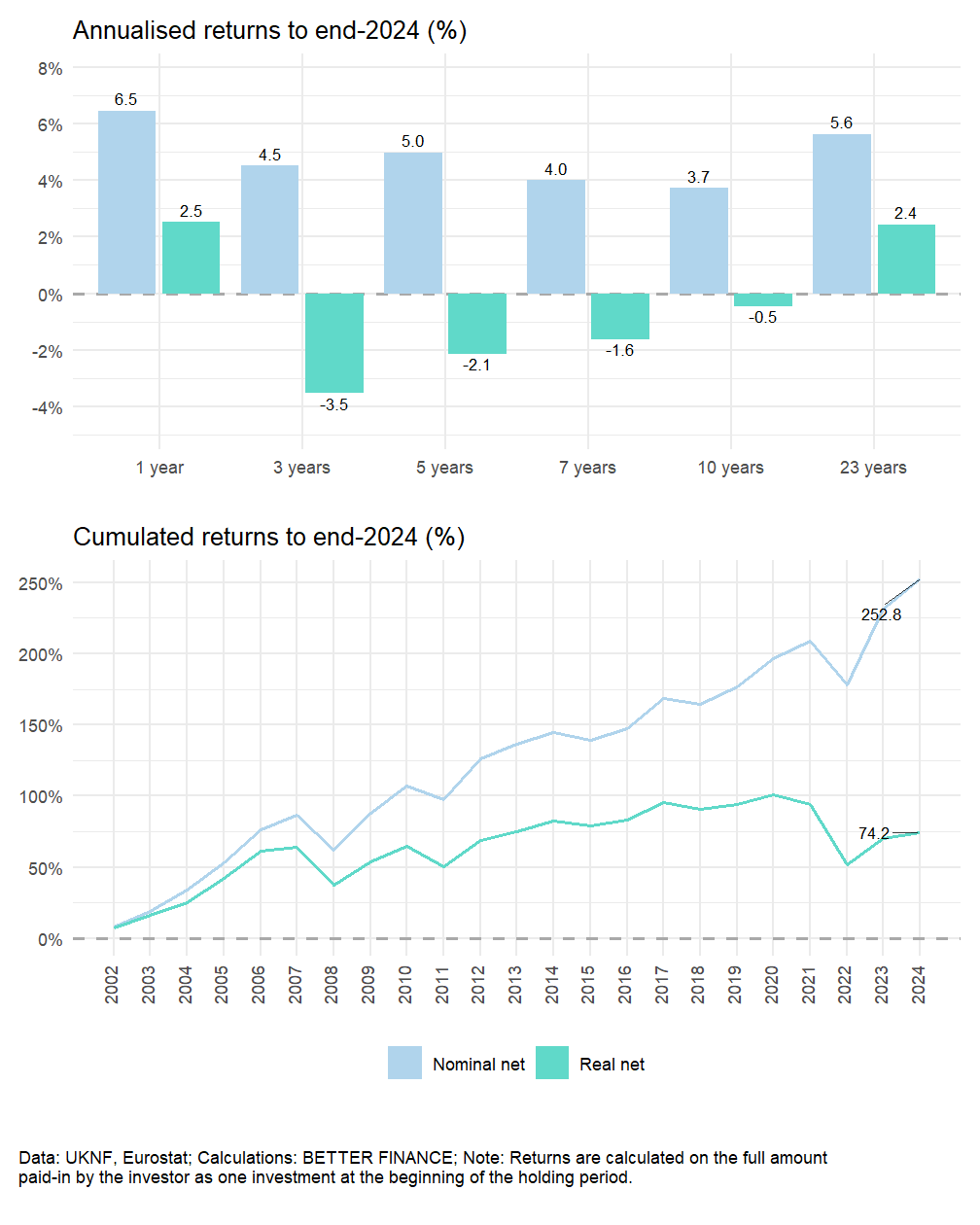

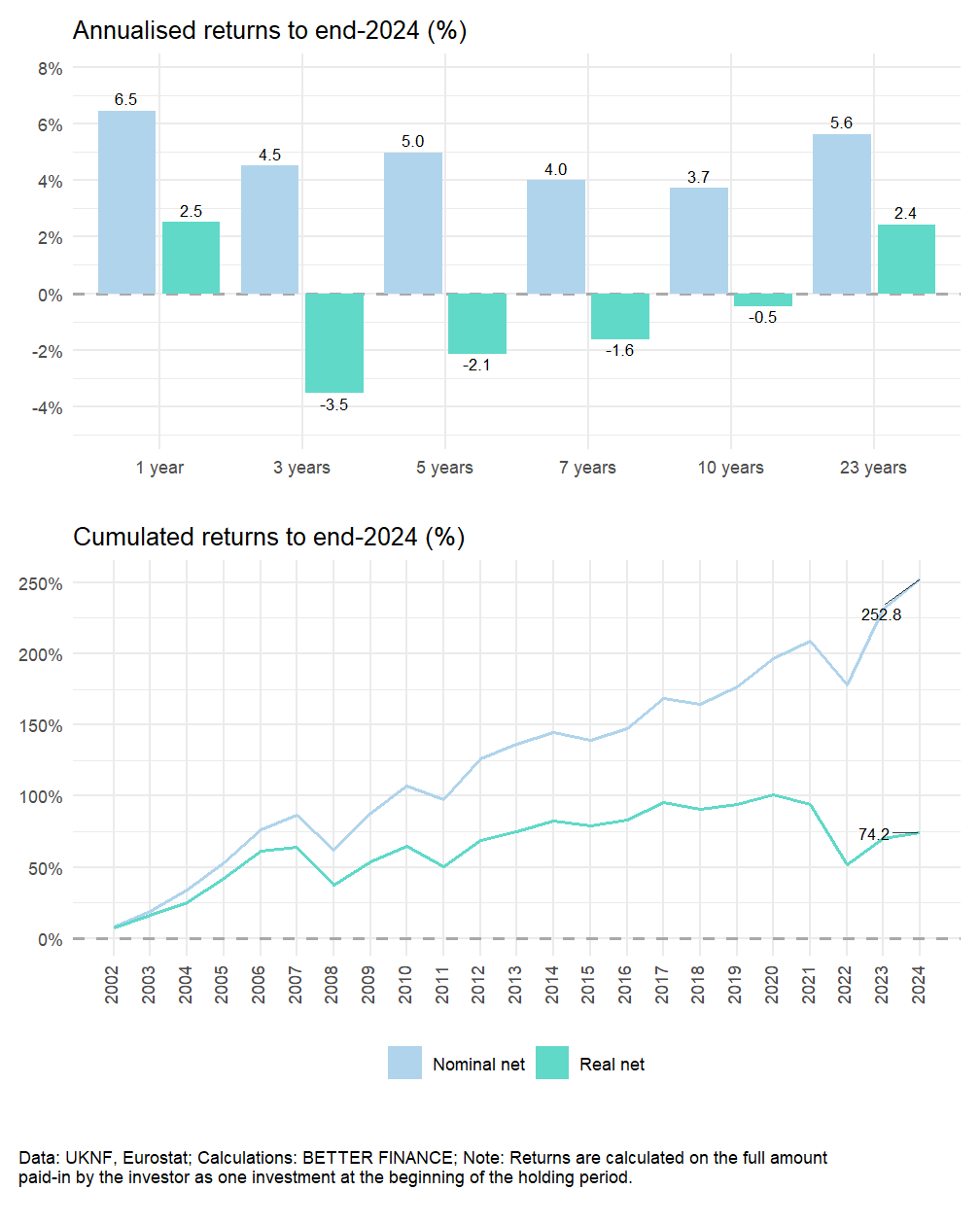

W analizowanym okresie (2002-2024) pracownicze fundusze emerytalne (PFE), będące jedną z form PPE, wypracowały nominalne stopy zwrotu równe 5,64% w skali roku. Średnia realna stopa zwrotu za cały analizowany okres wyniosła natomiast 2,44%.

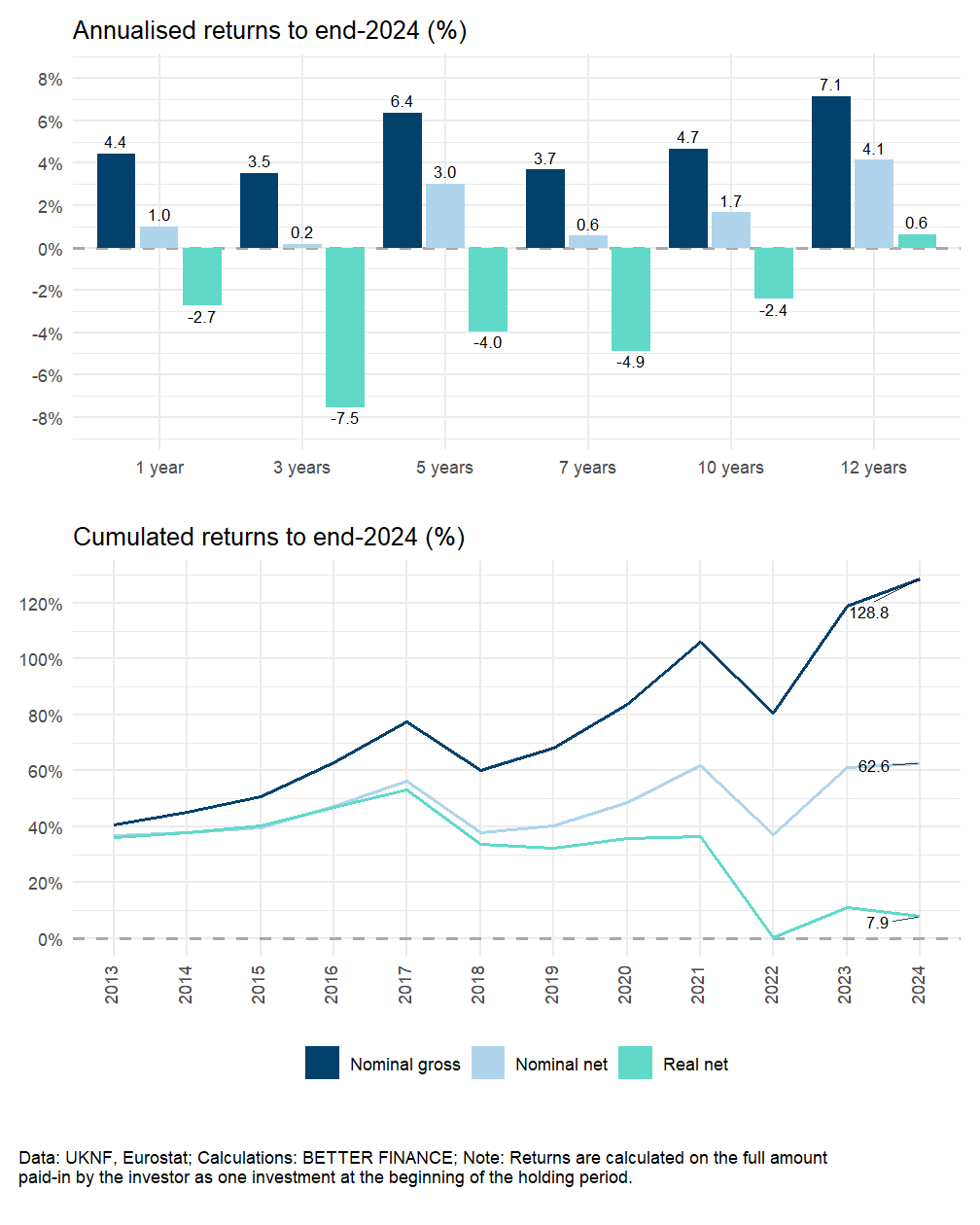

Dobrowolne fundusze emerytalne (DFE), będące jedną z form IKE i IKZE, osiągnęły nadzwyczajne wyniki inwestycyjne w początkowym okresie funkcjonowania, które nie zostały jednak powtórzone w kolejnych latach. Średnia nominalna stopa zwrotu z uwzględnieniem opłat za lata 2013-2024 wyniosła 4,13%, a realna 0,78%.

Wprowadzone tuż przed pandemią pracownicze plany kapitałowe (PPK) oferowane w formie funduszy zdefiniowanej daty osiągnęły natomiast w okresie 2020-2024 nominalną stopę zwrotu równą 7,82% rocznie i realną na poziomie 0,25%.

Summary

The supplementary pension system in Poland currently consists of five components: employee pension plans (PPE), individual retirement accounts (IKE), individual retirement security accounts (IKZE), and employee capital plans (PPK) and pan-european personal pension products (OIPE introduced in September 2023). At the end of 2024, they have accumulated PLN 9.4 billion (EUR 6.9 billion), PLN 22.8 billion (EUR 5.3 billion), PLN 12.1 billion (EUR 2.8 billion), PLN 30.3 billion (EUR 7.1 billion), and PLN 0.11 billion (EUR 0.03 billion) respectively.

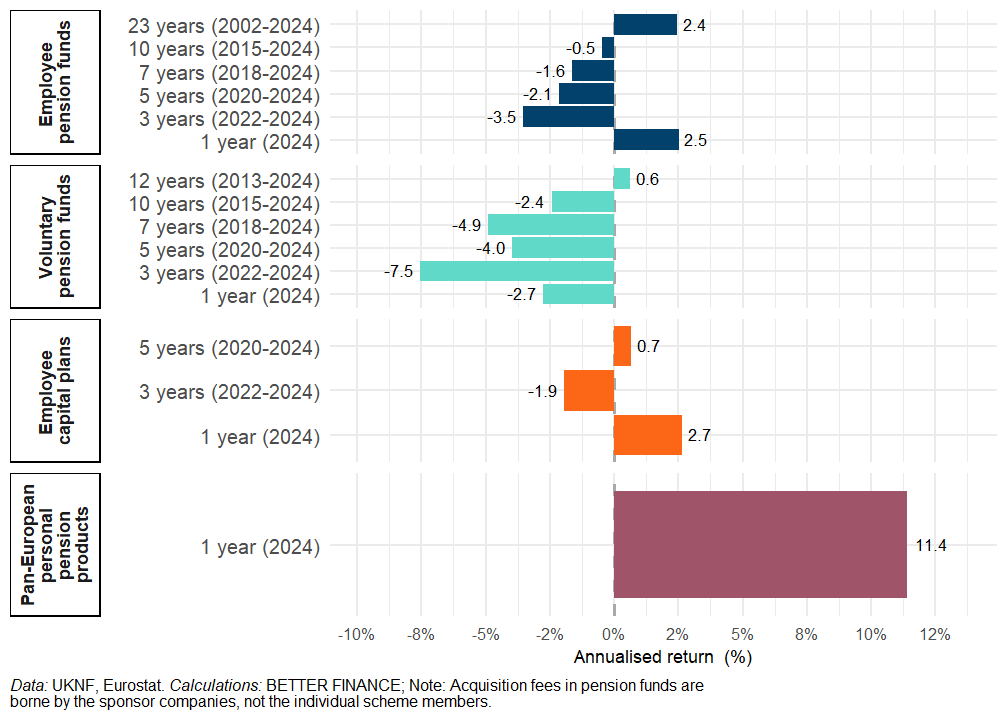

During the period under review (2002-2024), employee pension funds (PFEs), which are one form of PPEs, generated nominal rates of return of 5.64% per year. In contrast, the average real rate of return for the entire period analyzed was 2.44%.

Voluntary pension funds (DFEs), which are a form of IKEs and IKZEs, achieved extraordinary investment results in their initial period of operation, but these were not repeated in subsequent years. The average nominal rate of return including fees for 2013-2024 was 4.13%, and the real rate was 0.78%.

Introduced just before the pandemic, employee capital plans (PPKs) offered in the form of target-date funds achieved a nominal rate of return of 7.82% and 0.25% in real terms annually for the 2020-2024 period.

15.1 Introduction: The Polish pension system

- All forms of supplementary pension savings in Poland are offered in funded Defined contributions (DC) formula, which means high investment risk exposure for individual participants.

- The schemes are generally offered in few forms: a contract with an asset management company (investment fund); a contract with a life insurance company (group unit-linked life insurance); an employee pension fund run by the employer—pracowniczy fundusz emerytalny (PFE)—, an account in a brokerage house; a bank account (savings account) or a voluntary pension fund—dobrowolny fundusz emerytalny (DFE).

- At the end of 2024, PLN 94.66 bln (EUR 22.14 billion) assets were collected in Poland’s supplementary pension system.

- In 2022 due to turbulent times caused by the war in Ukraine all the schemes reported negative returns but they were compensated with good investment results in 2023, and moderate ones in 2024. Hence, average rates of return for longer periods both nominal and real stayed positive for all plans.

Holding period

|

|||||||

|---|---|---|---|---|---|---|---|

| 1 year | 3 years | 5 years | 7 years | 10 years | Whole reporting period | to... | |

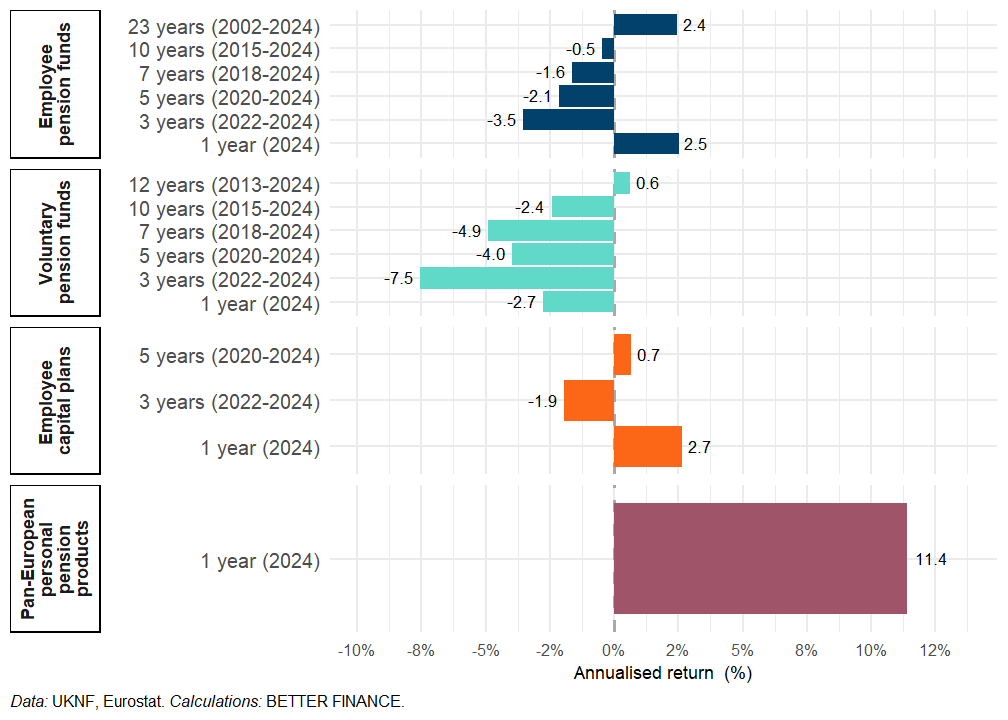

| Employee pension funds | 2.5% | -3.5% | -2.1% | -1.6% | -0.5% | 2.4% | end 2024 |

| Voluntary pension funds | -2.7% | -7.5% | -4.0% | -4.9% | -2.4% | 0.6% | end 2024 |

| Employee capital plans | 2.7% | -1.9% | 0.7% | NA | NA | NA | end 2024 |

| Pan-European personal pension products | 11.4% | NA | NA | NA | NA | NA | end 2024 |

| Data: UKNF, Eurostat; Calculations: BETTER FINANCE | |||||||

Pension system in Poland: An overview

The old-age pension system in Poland is a multi-tier structure consisting of three main elements:

- Tier I — a mandatory, notional defined contribution (NDC) system;

- Tier II — a mandatory NDC system with a partial opt-out for funded open pension funds—otwarte fundusze emerytalnes (OFEs)—; and

- Tier III — voluntary or quasi-obligatory, occupational and individual DC pension plans.

| Pillar I | Pillar II | Pillar III |

|---|---|---|

| Mandatory | Mandatorya | Voluntary |

| PAYG | PAYG/Funded (opt-out) | Funded |

| NDC | NDC/DC (opt-out) | DC |

| Basic benefit | Basic benefit | Complementary benefit |

| Publicly managed | Publicly/Privately managed | Privately managed |

| Social insurance institution (ZUS) | Social insurance institution (ZUS) / Open Pension Funds in opt-out element | Pension savings managed by different financial institutions depending on the product form, organised by employers or individual |

|

a The II tier is still mandatory although open pension funds (OFE) have been made voluntary since 2014 (partial opt-out for funded system). Source: Own elaboration. |

||

The first part of the system is contributory and is based on a NDC formula. The total pension contribution rate amounts to 19.52 % of gross wage (Tier I + Tier II) and the premium is financed equally by employer and employee. Out of the total pension contribution rate, 12.22 pp. are transferred to Tier I (underwritten on individual accounts of the insured), and 7.3 p.p. to Tier II. If a person has not opted out for open pension funds—OFE—, the total of 7.3 p.p. is recorded on a sub-account administered by the Social Insurance Institution (NDC system). If he/she has opted out for the funded element (OFE), 4.38 pp. are recorded on a sub-account and 2.92 pp. are allocated to an account in a chosen open pension fund.1

Tier I is managed by the Social Insurance Institution—Social Insurance Institution (ZUS)—, which records quotas of contributions paid for every member on individual insurance accounts. The accounts are indexed every year by the inflation rate and by the real growth of the social insurance contribution base. The balance of the account (pension rights) is switched into pension benefits when an insured person retires.

Tier II of the Polish pension system consists of sub-accounts administered by the Social Insurance Institution—ZUS—and possible partial opt-out for open pension funds—OFEs, funded system. Polish OFEs are just a mechanism of temporarily investing public pension system resources in financial markets (financial vehicles for the accumulation phase). An insured person who enters the labour market has the right to choose whether to join an OFE or to remain solely in the pay-as-you-go (PAYG) system. When the insured chooses to contribute to the OFE, 2.92% of his/her gross salary will be invested in financial markets. If no such decision is taken, his/her total old-age pension contribution will automatically be transferred to the ZUS. This default option resulted in a huge decrease in OFEs’ active participation in 2014.

The pension law establishes the contribution level and guarantees minimum pension benefits paid together from the whole basic system (tier I + II) by the public institution ZUS. The statutory retirement age is 60 for women and 65 for men.2 Before retirement the member’s assets gathered in an OFE (if one opted out for funded element) are transferred to a sub-account administered by ZUS.3 Pension benefits from the basic system are calculated following a DC rule and are paid in the form of an annuity by the ZUS.

The old-age pension from the basic system (tier I+II) depends solely on two components: 1) the insured person’s total pension entitlements accumulated during his/her entire career (balance of an NDC account and a sub-account), and 2) the average life expectancy upon retirement.

Tier III supplements the basic, mandatory pension system and represents voluntary and quasi-obligatory, additional pension savings. It consists of four different vehicles:

- employee (occupational) pension programmes: pracownicze programy emerytalnes (PPEs);

- individual retirement accounts: indywidualne konta emerytalnes (IKEs);

- individual retirement security accounts: indywidualne konta zabezpieczenia emerytalnegos (IKZEs);

- employee capital plans: pracownicze plany kapitałowes (PPKs);

- pan-european personal pension products: ogólnoeuropejski indywidualny produkt emerytalnys (OIPEs).

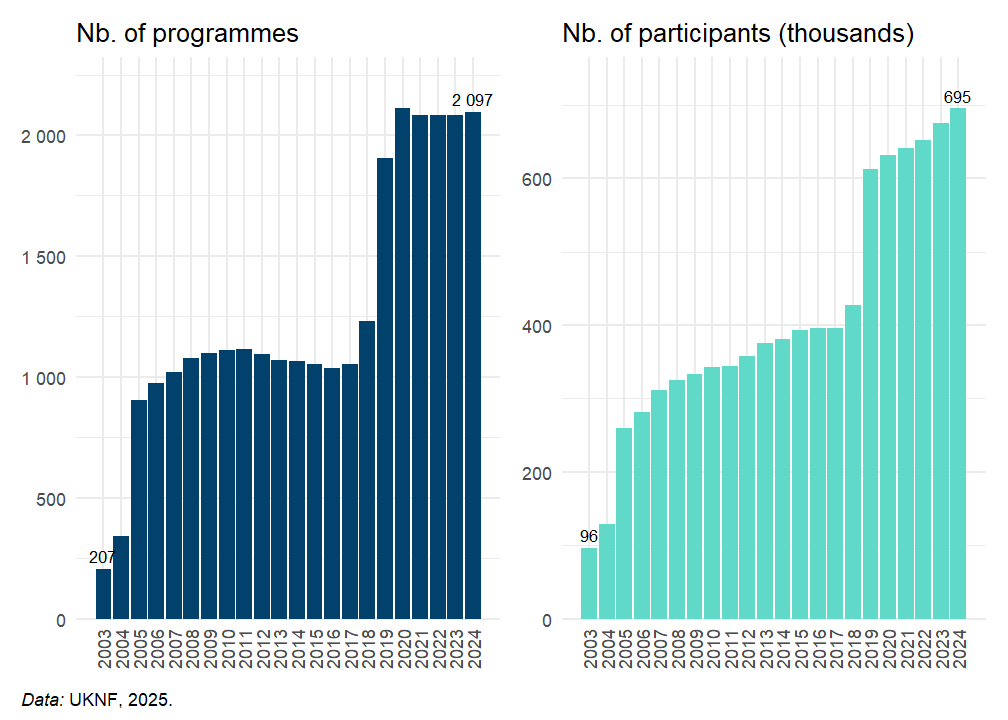

Employee pension programmes—PPE—are plans organised by employers for their employees. PPE settlement happens after an employer agrees with the representatives of the employees on the plan’s operational conditions, signs the contract on asset management with a financial institution (or decides to manage assets himself), and registers a programme with the Financial Supervisory Commission—Komisja Nadzoru Finansowego (KNF). The basic contribution (up to 7% of an employee’s salary) is financed by the employer, but an employee must pay personal income tax. Participants in the programme can pay additional contributions deducted from their net (after-tax) salaries. There is a yearly quota limit for additional contributions amounting to 4.5 times the average wage (PLN 35 208— EUR 8235.79 — in 2024). PPE’ returns are exempt from capital gains tax. Benefits are not taxable and can be paid as a lump sum or as a programmed withdrawal after the saver reaches 60 years. At the end of 2024 PPE covered 695 thousand employees representing only 3.92% of the working population in Poland.4

Employee capital plans—PPKs—are also organized by employers but use auto-enrolment and matching defined contribution mechanisms. They started to operate in 2019 and their full implementation was staggered in accordance with the given below dates and depending on the company size:

- since July 1st, 2019—companies employing at least 250 people;

- since January 1st, 2020—companies with at least 50 employees,

- since July 1st, 2020—companies having at least 20 employees,

- since January 1st, 2021 — remaining companies, including the entities financed from the state budget.

The employee contribution amounts to 2-4% of the gross salary. The minimum matching contribution financed by the employer is 1.5% of the gross salary but can be higher voluntarily (up to 4%). People earning 120% or less of the average income can save less, namely a minimum of 0.5% of the gross salary. To encourage individuals to save in PPKs, the state budget offers a PLN 250 kick-start payment (EUR 58.48) and a regular annual state subsidy of PLN 240 ( EUR 56.14). The employee and employer contributions are taxed while the state subsidies remain exempt from taxation at the accumulation and decumulation stages. PPKs’ returns are exempt from capital gains tax. Benefits can be paid as a lump sum (max. 25% of the accumulated capital) and programmed withdrawal when a saver reaches 60 years. Savings can be partially withdrawn (25% of the capital) in the case of the serious disease of the saver, his/her spouse, or a child. The accumulated money can be also borrowed from the account (100% of the capital) to finance an individual commitment when taking a mortgage. PPKs covered 4.3 million employees at the end of 2024, which represents ca. 24.5% of the working population.

Individual retirement accounts—IKEs—were introduced in 2004, allowing people to save individually for retirement. Financial institutions such as asset management companies, life insurers, brokerage houses, banks, and pension societies offer them. An individual can only gather money on one retirement account at a time but can change the form and the institution during the accumulation phase. Contributions are paid from the net salary with a ceiling of 3 times the average wage (PLN 23 472 — EUR 5490.53 — in 2024). Returns are exempt from capital gains tax and the benefits are not subject to taxation. When a saver reaches 60 (or 55 years, if he/she is entitled by law to retire early), money is paid as a lump sum or a programmed withdrawal. At the end of 2024, only 965 thousand Polish citizens had an individual retirement account (IKE) representing 5.44% of the working population.

Individual retirement security accounts—IKZEs—started to operate in 2012 and are offered in the same forms as individual retirement accounts (IKEs) but have other contribution ceilings and offer a different form of tax relief. Premiums paid to the account can be deducted from the personal income tax base. Contributions and returns are exempt from taxation, but the benefits are subject to taxation at a reduced rate. Savings accumulated in IKZE are paid to the individual as a lump sum or as a programmed withdrawal after the saver reaches the age of 65. The limit for IKZE contributions is 120% of the average wage (PLN 9388.8 5 — EUR 2196.21 in 2024). Only about 3.34% of the Polish working population (2024) is covered by this type of supplementary old-age provision.

In September 2023, the options for supplementary old-age pension saving were expanded to include the Pan-European Personal Pension (PEPP)—OIPE. This product is based on IKE regulations with the same contribution limit and tax regime. Its only provider is Slovak Finax who offers OIPE in a form of exchange-traded funds (ETFs) with two investment strategies: active (100/0) and moderate (80/20).

| Employee Pension Programmes (PPE) | Employee capital plans (PPK)a | Individual Retirement Accounts (IKE) | Individual Retirement Security Accounts (IKZE) | Pan-European Pension Products (OIPE)b |

|---|---|---|---|---|

| Type of pension vehicles | ||||

|

|

|

|

Various forms (e.g., ETFs) |

| Assets under Management | ||||

| PLN 29.36 bln. | PLN 30.27 bln. | PLN 22.80 bln. | PLN 12.11 bln. | PLN 0.11 bln. |

| EUR 6.87 bln. | EUR 7.08 bln. | EUR 5.33 bln. | EUR 2.83 bln. | EUR 0.03 bln. |

| 31.02% of Pillar III assets | 31.98% of Pillar III assets | 24.09% of Pillar III assets | 12.79% of Pillar III assets | 0.12% of Pillar III assets |

|

a This vehicle started operating in 2019. b This vehicle started operating on September 26th, 2023. Source: Own composition based on KNF (2025). |

||||

15.2 Long-term and pension savings vehicles in Poland

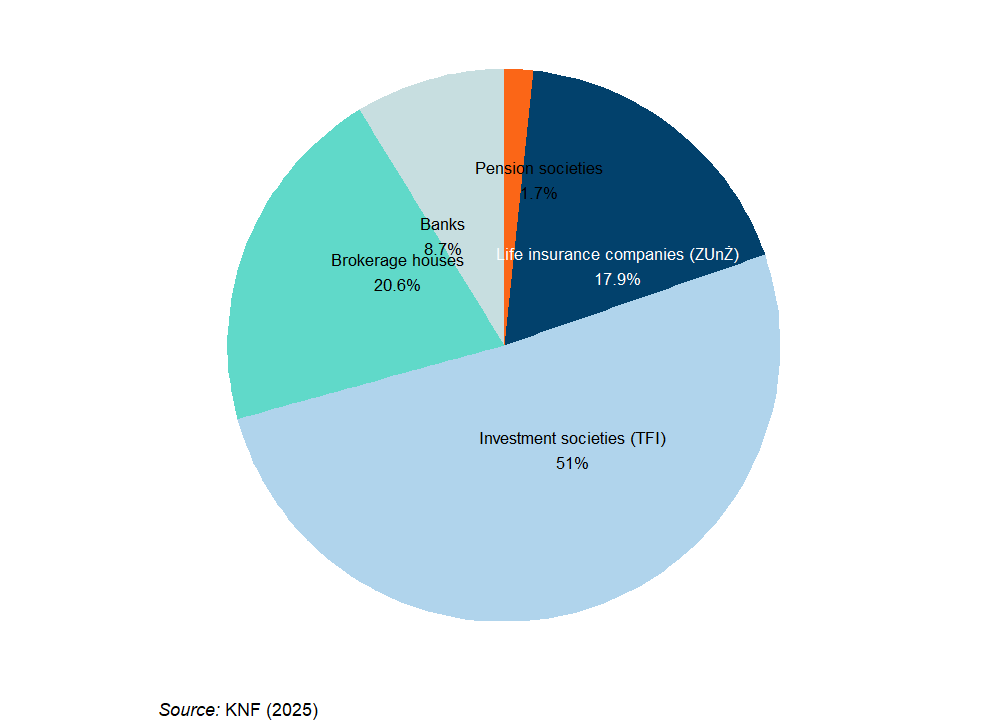

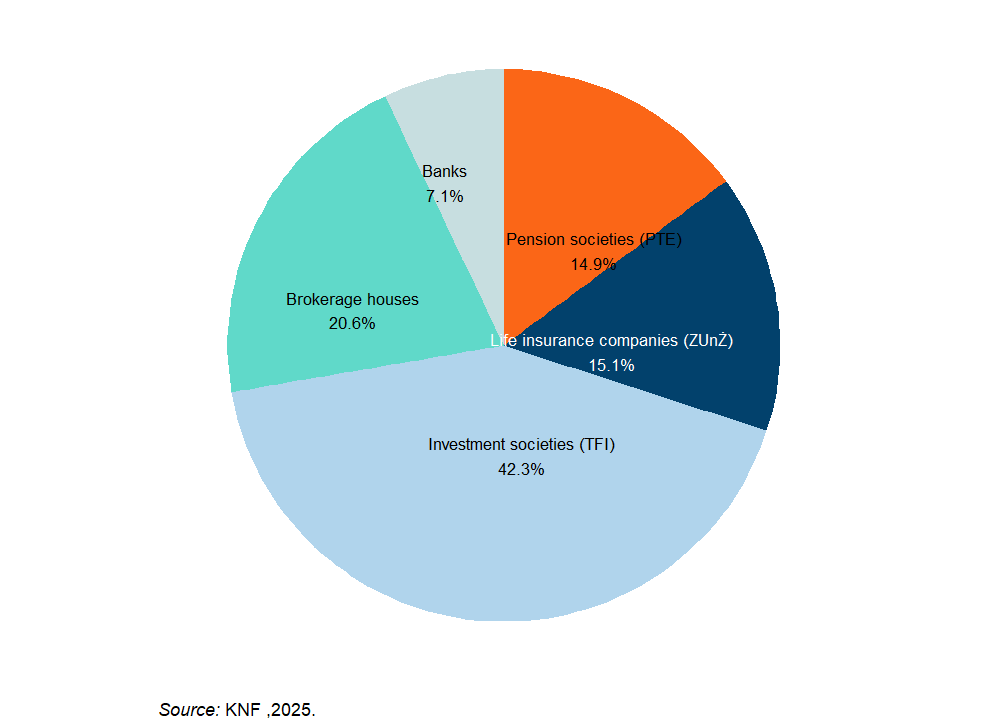

The most popular forms of supplementary pension plans are the collective ones, namely PPEs and PPKs which represent 63% of assets under management. Regarding the type of financial vehicle used, investment funds attracted the great majority of savers — 84.6% in PPE, 84.3% in PPK, 51% in IKE and 42% in IKZE.

Third pillar

Employee Pension Programmes

PPEs can be offered in four forms:

- as a contract with an asset management company (an investment fund);

- as a contract with a life insurance company (a group unit-linked insurance);

- as an employee pension fund run by the employer; or

- through external management.

Employee pension programs started to operate in 1999. The market development was very weak during the first five years of operation. After that, due to changes in PPE law, many group life insurance contracts were transformed into PPEs at the end of 2004 and in 2005. In 2023, the number of programs reached 2082, mainly due to a significant increase in 2019 and 2020 being the direct response to the new law that allowed employers to be exempt from the obligation to create PPK when they offer PPE.

The most popular forms of PPE are investment funds that represent 77.1% of PPEs (see Table 15.5) and manage 77.8% of total PPE assets. Their share is even higher when taking into consideration the number of participants (84.6%).

| Unit-linked life insurance | Investment fund | Employee Pension Fund | Total 2024 | |

|---|---|---|---|---|

| Nb. of PPE | 459 | 1 616 | 22 | 2 097 |

| Market share (% of of PPE nb.) | 21.9% | 77.1% | 1.0% | — |

| Nb. of participants (thousands) | 79.1 | 588.2 | 27.7 | 695.1 |

| Market share (% of participants) | 11.4% | 84.6% | 4.0% | — |

| Assets (PLN mln.) | 4 042.7 | 22 847.5 | 2 469.4 | 29 359.6 |

| Assets (EUR mln.) | 945.7 | 5 344.5 | 577.6 | 6 867.8 |

| Market share (% of total assets) | 13.8% | 77.8% | 8.4% | — |

| Data: UKNF, 2025 | ||||

PPE assets amounted to PLN 29.36 bln (EUR 6.87 bln) and the average account balance equalled PLN 42 240 (EUR 9880.7) at the end of 2024. The highest balance was observed in employee pension funds while the lowest in investment funds.

Employee Capital Plans (PPK)

Employee capital plans —PPKs— can be offered by life insurance companies, investment companies —towarzystwo funduszy inwestycyjnychs (TFIs)— general pension societies —powszechne towarzystwo emerytalnes (PTEs)— and employee pension societies —pracownicze towarzystwo emerytalnes (PrTEs)— in a form of target-date funds (TDFs), i.e., life-cycle funds. All employees aged 18-55 are automatically enrolled in a plan but can opt out by signing a declaration.

| Life insurers | Asset management companies | General Pension Societies | Total 2024 | |

|---|---|---|---|---|

| Nb. of participants (thousands) | 74.0 | 3 657.0 | 608.0 | 4 339.0 |

| Market share (% of participants) | 1.7% | 84.3% | 14.0% | — |

| Assets (PLN mln.) | 300.5 | 26 457.6 | 3 516.6 | 30 274.7 |

| Assets (EUR mln.) | 70.3 | 6 188.9 | 822.6 | 7 081.8 |

| Market share (% of total assets) | 1.0% | 87.4% | 11.6% | — |

| Data: UKNF, 2025. | ||||

A plan member should be assigned, and his/her contributions should be allocated to the fund with a date that is the nearest to the date when he/she reaches 60. Every provider has to offer many TDFs with target dates every 5 years. The limits of portfolio structure depend on a target date and are as follows:

- if the target date is more than 20 years before the date when the participants reach 60: 60-80% shares and 20-40% bonds,

- 10-20 years prior the age of 60: 40-70% shares and 30-60% bonds,

- 5-10 years before 60: 25-50% shares and 50-75% bonds,

- 0-5 years before reaching 60: 10-30% shares, 70-90% bonds,

- since reaching 60: 0-15% shares and 85-100% bonds.

At the end of 2024 34.34 million participants gathered PLN 30.27 billion (EUR 7.08 billion) in PPK.

Individual Retirement Accounts (IKE)

According to the Polish pensions law (the Individual Pension Accounts Act of 20 April 2004), individual retirement accounts —IKEs— can operate in a form of:

- a unit-linked life insurance contract;

- an investment fund;

- an account in a brokerage house;

- a bank account (savings account); or

- a voluntary pension fund.

Pension accounts are offered by life insurance companies, investment companies (asset management companies), brokerage houses, banks and pension societies. The most recent pension vehicles are voluntary pension funds that were introduced in 2012 at a time of significant changes in the statutory old-age pension system.

A voluntary pension fund is an entity established with the sole aim of gathering savings of IKE (or IKZE) holders. Pension assets are managed by a pension society—PTE— that also manages one of the open pension funds (OFEs in Tier II of the public pension system) in Poland. Assets of the funds are separated to guarantee the safety of the system, as well as due to stricter OFEs’ investment regulations.

The design of IKE products usually does not vary significantly from the standard offer on financial markets. The difference relates to the tax treatment of capital gains (exclusion from capital gains tax) and contribution limits. Moreover, financial institutions cannot charge any cancellation fee when an individual transfers money or resigns after a year from opening an account.

The most popular IKE products take the form of investment funds and accounts in brokerage houses. According to official data (UKNF 2025), these two forms of plans represent 71.6% of all IKE accounts.

| Year | Unit-linked life insurance | Investment fund | Account in the brokerage house | Bank account | Voluntary pension fund | Total |

|---|---|---|---|---|---|---|

| 2004 | 110 728 | 50 899 | 6 279 | 757 | — | 168 663 |

| 2005 | 267 529 | 103 624 | 7 492 | 4 922 | — | 383 567 |

| 2006 | 634 577 | 144 322 | 8 156 | 53 208 | — | 840 263 |

| 2007 | 671 984 | 192 206 | 8 782 | 42 520 | — | 915 492 |

| 2008 | 633 665 | 173 776 | 9 985 | 36 406 | — | 853 832 |

| 2009 | 592 973 | 172 532 | 11 732 | 31 982 | — | 809 219 |

| 2010 | 579 090 | 168 664 | 14 564 | 30 148 | — | 792 466 |

| 2011 | 568 085 | 200 244 | 17 025 | 29 095 | — | 814 449 |

| 2012 | 557 595 | 188 102 | 20 079 | 47 037 | 479 | 813 292 |

| 2013 | 562 289 | 182 807 | 21 712 | 49 370 | 1 473 | 817 651 |

| 2014 | 573 515 | 174 515 | 22 884 | 51 625 | 1 946 | 824 485 |

| 2015 | 573 092 | 201 989 | 25 220 | 53 371 | 2 548 | 856 220 |

| 2016 | 571 111 | 236 278 | 27 615 | 64 031 | 358 | 899 393 |

| 2017 | 568 518 | 275 796 | 30 418 | 71 922 | 4 922 | 951 576 |

| 2018 | 562 476 | 316 996 | 32 584 | 78 288 | 5 307 | 995 651 |

| 2019 | 462 171 | 355 031 | 39 030 | 88 460 | 6 075 | 950 767 |

| 2020 | 199 929 | 393 010 | 55 821 | 85 678 | 7 188 | 741 626 |

| 2021 | 195 179 | 432 756 | 79 906 | 79 002 | 9 646 | 796 489 |

| 2022 | 182 715 | 420 356 | 104 136 | 82 035 | 10 901 | 800 143 |

| 2023 | 176 158 | 455 695 | 134 045 | 81 198 | 12 835 | 859 931 |

| 2024 | 173 057 | 492 353 | 198 352 | 84 181 | 16 647 | 964 590 |

| Source: KNF, 2025. | ||||||

IKE holders do not fully use the contribution limit. The average contribution from 2004 to 2024 remains permanently below the statutory limit (3 times the average wage). The total amount of IKE assets amounted to PLN 22.8 bln (EUR 5.33 bln) as of December 31st, 2024. There were PLN 23 642 (EUR 5530.3) gathered on an IKE account on average.

Individual Retirement Security Accounts (IKZE)

Exactly like IKEs, the group of IKZE products consists of unit-linked life insurance; investment funds; bank accounts; accounts in brokerage houses; and voluntary pension funds.

At the end of 2024 around 593 thousand Poles had individual retirement security accounts. As shown on Figure 15.4, the biggest share of the IKZE market have asset management companies that manage 42% of IKZE accounts.

The savings pot of IKZE is small compared to other elements of the Polish supplementary pension system. At the end of 2024, financial institutions managed funds amounting to PLN 12.11 bln (EUR 2.83 bln). It is worth noting that this capital was raised through contributions in just thirteen years. There were PLN 20 417 (EUR 4775.9) gathered on an IKZE account on average.

Pan-European Personal Pension Products (OIPE)

The newest element of supplementary pension system that was introduced in September 2023 are PEPPs (pol. Ogólnoeuropejski Indywidualny Produkt Emerytalny, OIPE). They are offered only by one provider (Slovak Finax) in a form of ETFs in two portfolio versions: active (100% equity, 0% bonds, the “basic PEPP) and moderate (80% equity, 20% bonds). By the end of 2024, 6752 individuals opened OIPE accounts and gathered PLN 113 mln (EUR 26.5 mln) in these products.

15.3 Charges

Employee Pension Programmes (PPE)

Data on PPE charges is hardly available. The KNF does not provide any official statistics on value or the percentage of deductions on assets of employee pension programmes. Some information can be found in the statutes of PPEs, but they describe rather the types of costs charged than the level of deductions. Employers must cover many administrative costs connected with PPE organisation (disclosure of information, collecting employees’ declarations, transfer of contributions, etc.). The savings of participants are usually reduced by a management fee that varied from 0.5% pa. to 2% pa. of assets under management (AuM) and depend on the investment profile of funds chosen.

The lowest charges are applied to employee pension funds —PFEs—, which are set up by employers (in-house management of PPEs) and managed by employee pension societies. For this type of pension fund, no up-front fee is deducted and a rather low management fee—0.5% - 1% per annuum (p.a.)—applies to assets gathered.

Since 2019 there is a cap on a management fee charged by asset management companies. It could not exceed 3.5% in 2019, 3% in 2020, 2.5% in 2021 and 2% since 2022.

Employee Capital Plans (PPK)

Financial institutions offering PPKs can charge management fee (max. 0.5% AuM) and success fee (max. 0.1% AuM and only if the return is both positive and above the benchmark). The total management fee level depends on the risk profile of the fund and amounts from 0.112% to 0.465% with 0.33% being the average for the whole PPK market (Pracownicze Plany Kapitałowe 2025).

| Target date |

Fees

|

||||

|---|---|---|---|---|---|

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| 2020 | 0.24% | 0.19% | 0.15% | 0.14% | 0.13% |

| 2025 | 0.28% | 0.27% | 0.27% | 0.26% | 0.26% |

| 2030 | 0.31% | 0.31% | 0.31% | 0.30% | 0.30% |

| 2035 | 0.33% | 0.33% | 0.32% | 0.31% | 0.31% |

| 2040 | 0.34% | 0.34% | 0.33% | 0.32% | 0.32% |

| 2045 | 0.36% | 0.35% | 0.35% | 0.34% | 0.34% |

| 2050 | 0.38% | 0.37% | 0.36% | 0.35% | 0.35% |

| 2055 | 0.39% | 0.38% | 0.38% | 0.36% | 0.36% |

| 2060 | 0.41% | 0.40% | 0.39% | 0.37% | 0.37% |

| 2065 | 0.41% | 0.40% | 0.40% | 0.38% | 0.38% |

| Average for all funds | 0.35% | 0.35% | 0.35% | 0.33% | 0.33% |

| Source: PFR Portal 2021–2024. | |||||

Individual Retirement Accounts (IKE) and Individual Retirement Security Accounts (IKZE)

The type and level of charges depend on the type of product. There is a management fee for investment funds, voluntary pension funds and unit-linked insurance. In addition, for a unit-linked life insurance, a financial institution can charge an up-front fee, use different “buy and sell” prices for investment units (spread) and deduct other administrative fees from the pension savings accounts, e.g. conversion fees and fees for changes in premium allocation in case changes occur more frequently than stipulated in the terms of the contract. Charges that are not connected with asset management and the administration of savings accounts cannot be deducted from IKZE (i.e. life insurance companies cannot deduct the cost of insurance from the retirement account).6 The accumulation of pension savings through direct investments (accounts in brokerage houses) is subject to fees which depend on the type of transaction and the level of activity on financial markets (trading fees and charges). Banks do not charge any fees for the IKZEs they offer (apart from a cancellation fee).

All financial institutions offering individual retirement accounts (IKE) can charge a cancellation fee (also called a transfer fee) when a member decides to transfer savings to a programme offered by another financial entity during the first year of the contract. No cancellation fee can be deducted from the account when a saver resigns from the services of a given institution after 12 months and transfers money to another plan provider.

There are no official data on fees in IKEs and IKZEs for 2024. The most recent data is published in the study by Rutecka-Góra et al. (2020) and it reflects fees charged in 2017.

| Up-front fee | Management fee (% of AuM) | Transfer fee | |

|---|---|---|---|

| life insurance companies | 0-8% | 0-2.0 | 10-50% of assets |

| Asset management companies | 0-5.5% | 0.8-2.0; success fee 0-30% of the return above the benchmark | 0-PLN 500 |

| pension societies | 0-53.4%; quota limit may be applicable | 0.6-2.0; success fee 0-20.0 of the return above the benchmark | 10-50% of assets; min. PLN 50 |

| Source: Own composition based on Rutecka-Góra et al. 2020 and taking into account a statutory limit of management fee (max. 2% since 2022). | |||

Pan-European Personal Pension Products (OIPE)

In OIPE savers do not incur any upfront fees and do not pay for opening or closing an account. The provider (Finax) charges only a portfolio management fee of 0.6% annually plus value added tax (VAT), i.e. a total of 0.72%. The ETFs that make up the portfolios also include fees for their providers. These amount to approximately 0.16%-0.18% on annual basis.

15.4 Taxation

Employee pension programmes (PPE)

Basic contributions financed by employers are subject to personal income tax, which is deducted from the employee’s salary. Additional contributions paid by the employer from the net salary are treated the same way (contributions paid from after-tax wage). Returns and benefits are not taxed—Taxed Exempt Exempt (TEE) regime.

Employee Capital Plans (PPK)

In PPK both an employee and an employer contributions are taxed. A state kick-off payment and regular annual subsidies as well as investment returns and benefits are exempt from taxation. Therefore, it is a TEE regime with a state subsidy.

Individual Retirement Accounts (IKE) and Pan-European Personal Pension Products (OIPE)

Contribution is taxed as it is paid by a saver from his/her net income. An individual can pay up to three times the average wage annually. There is a tax relief for capital gains. Benefits are not taxable —TEE regime.

Individual Retirement Security Accounts (IKZE)

Contributions to IKZE are deductible from the income tax base. Every individual can pay up to 120% of the average salary into an IKZE account. Since 2021 there is a higher limit of contribution for self-employed that amounts to 180% of the average salary in the economy. Returns are not subject to taxation, but benefits are taxed with a reduced flat-rate income tax (10%). This part of the supplementary pension system is the only one that follows the Exempt Exempt Taxed (EET) tax regime.

| Product categories |

Phase

|

Fiscal Regime | ||

|---|---|---|---|---|

| Contributions | Investment returns | Payouts | ||

| Employee pension funds | Taxed | Exempted | Exempted | TEE |

| Voluntary pension funds as IKE | Taxed | Exempted | Exempted | TEE |

| Voluntary pension funds as IKZE | Exempted | Exempted | Taxed | EET |

| Employee capital plans | Taxed | Exempted | Exempted | TEE |

| Pan-European personal pension products | Taxed | Exempted | Exempted | TEE |

| Source: BETTER FINANCE own elaboration, based on Own elaboration. | ||||

15.5 Performance of Polish long-term and pension savings

Asset allocation

Polish law does not impose any strict investment limits on voluntary pension savings accounts (IKE, IKZE, OIPE, most forms of PPE, PPK) except for occupational pension programmes offered in the form of employees’ pension fund (types of asset classes are described by law). Every financial institution that offers IKE or IKZE provides information on investment policy in the statute of the fund. Since many existing plans offer PPE participants the possibility to invest in funds from a broad group of investment funds operating in the market (not only the funds dedicated exclusively to pension savings), it is impossible to indicate what the portfolios of most PPEs look like.

Figure 15.5 presents the investment portfolio of employee pension funds (PFEs), which are the only types of occupational pension products with official and separate statistics on asset allocation.

PPKs are target-date funds, which means that the general asset allocation (bonds vs shares) depends on the target date of the fund as described in Section 15.2.

There are no available statistics that allow for the identification of the asset allocation within IKE and IKZE offered as insurance contracts, investment funds and accounts in brokerage houses. It is because an individual can buy units of many investment funds (or financial instruments) that are also offered as non-IKE and non-IKZE products. Since no separate statistics for pension and non-pension assets of a given fund are disclosed, it is impossible to indicate neither which funds create the portfolios of IKE and IKZE holders nor what the rates of returns obtained by this group of savers are.

The only form of IKE and IKZE that is strictly separated from other funds and is dedicated solely to pension savings is a voluntary pension fund (DFE). These vehicles started operating in 2012.

Real net returns of Polish long-term and pension savings

The investment efficiency of supplementary pension products is almost impossible to assess due to the lack of necessary data published by financial institutions. In Poland in many retirement plans there is no obligation to disclose rates of return to pension accounts holders. Generally, owners of savings accounts are informed about contributions paid, the value of investment units and the balance of their accounts at the end of the reporting period. But they are not informed neither about their pension accounts real efficiency nor the total cost ratio deducted from their individual retirement accounts. No comprehensive data concerning the investment efficiency of supplementary pension products, especially individual plans, is published in official statistics.

Due to the shortage of detailed statistics, the assessment of the efficiency of pension product investments is possible only for the selected vehicles, namely employee pension funds (PFE), capital pension plans (PPK), and voluntary pension funds (DFE). There are also first statistics for OIPEs, which reported 17.1% and 14.1% nominal returns in 2024 for active and moderate ETF portfolios, respectively.

As the management fee is deducted from fund assets on a regular basis and the value of a fund unit is calculated based on net assets, the nominal rates of return indicated below take into account the level of the management fee. The only fee that must be included (if applicable) when calculating after-charges returns is the upfront fee deducted from contributions paid into accounts.

From 2002 to 2024 employee pension funds (PFEs) showed rather positive returns up to 19.95% annually (see Figure 15.6). After-charges real returns observed in 17 of 23 years and the average return in this period is positive as well. These satisfactory results were obtained due to proper portfolio construction, high quality of management and low costs. Although in 2022 PFEs reported negative returns both in nominal and real terms, mainly due to the war in Ukraine, they were more than compensated with positive returns in 2023.

Voluntary pension funds (DFEs) have obtained extraordinary investment results from their start in 2012 (see Figure 15.7). The first years of their operation coincided with the time of the Polish financial market recovery and allowed the funds to maximise rates of return from the equity portfolios. The best DFEs reported more than 50% nominal return in 2013. But such returns were impossible to achieve in the next years. In 2014, some of DFEs even experienced slightly negative returns that were covered by returns in the following years. The worst investment returns were achieved in 2018 and 2022 when all DFEs made losses. Fortunately, 2023 brought high profits. The average nominal rate of return after charges in the years 2013-2024 amounted to 4.13%.

Employee capital plans (PPKs) that started to operate in the second half of 2019 reported positive nominal returns in the first two years of their operation (see Figure 15.8). Later, in 2022, they reported losses after the outbreak of war in Ukraine. However the losses did not fully erase the profits they generated in the first two years. Moreover, in 2023 they experienced the highest returns in their short history and continued to report positive real returns in 2024. The investment efficiency of PPKs since 2020 is presented in Figure 15.8.

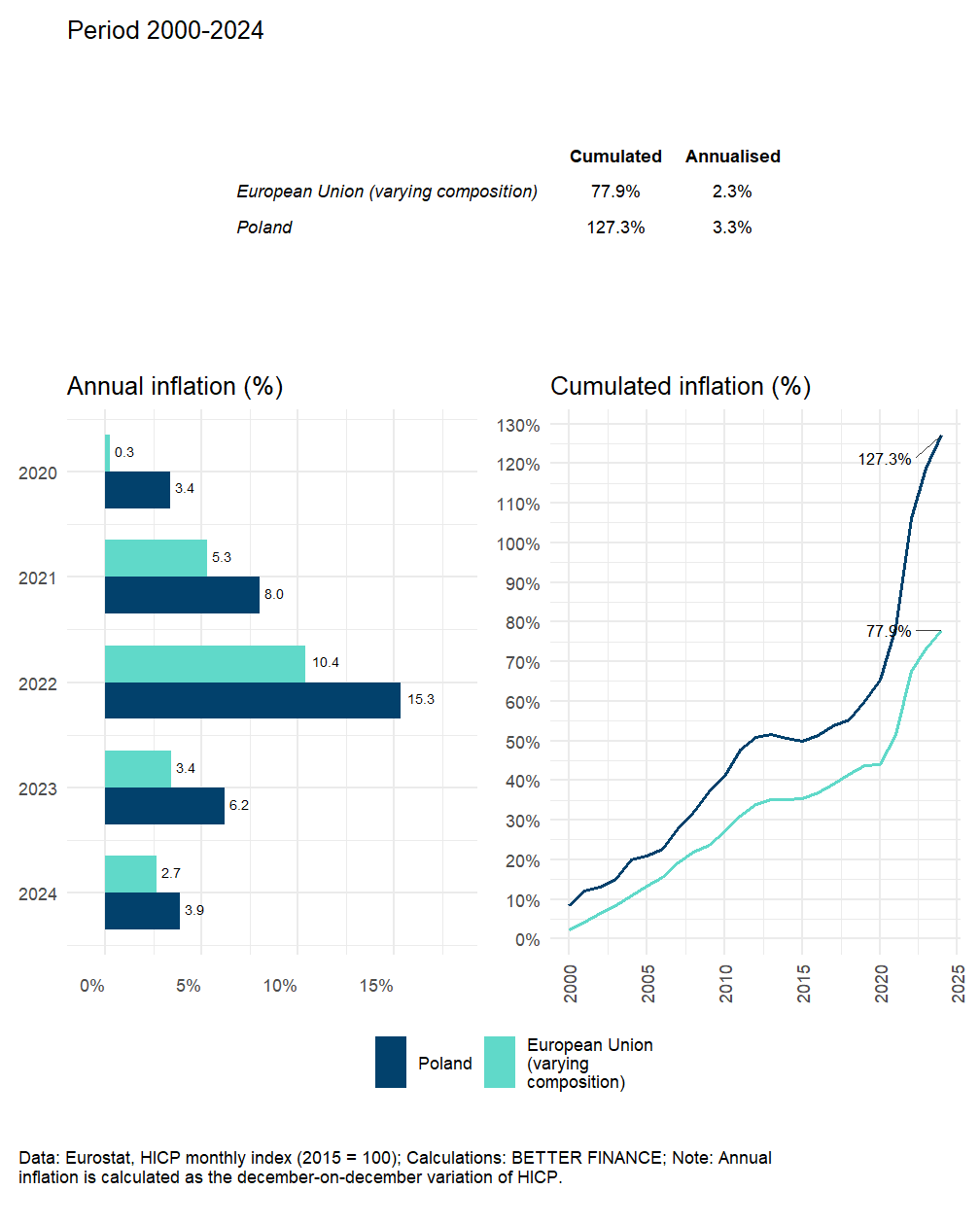

Inflation in Poland limited the profitability of pension plans significantly (see Figure 15.9). In the majority of years under analysis, it was much higher than the European Union (EU) average and has rocketed to much higher levels since 2019, mostly due to the COVID-19 pandemic and the war in Ukraine.

The annual real net returns of PFEs were reported to be much lower than nominal values, especially due to inflation in the last three years, and amounted to 2.4% for the period 2002-2024. The real returns of DFEs turned to be even lower, namely 0.6% annually. Similarly, PPKs showed only a 0.7% real profit on annual basis for the period 2020-2024 (see Figure 15.10 and Figure 15.11).

15.6 Conclusions

Starting in 1999, with next supplementary elements introduced in 2004, 2012, 2019, and 2023 the Polish supplementary pension market is still in its early stage of operation. The coverage ratios (3.92%, 24.46%, 5.44% and 3.34% for PPE, PPK, IKE and IKZE respectively), show that only a small part of Poles decided to secure their future in old age by joining the occupational pension plan or purchasing individual pension products. This could be due to low financial awareness, insufficient level of wealth or just the lack of information and low transparency of pension products.

The official information concerning supplementary pension products in Poland is limited. In the majority of pension plans financial institutions do not have any obligation to disclose rates of return, either nominal or real, nor after-charges. Published data includes generally the total number of programmes or accounts by types of financial institution and total assets invested in pension products. The Financial Supervisory Commission (KNF) collects additional detailed data about the market (the number of accounts and pension assets managed by every financial institution) but does not disclose the data even for research purposes.

Moreover, no comparable tables on charges, investment portfolios and rates of return are prepared or made accessible to the public on a regular basis. Certain product details must be put in the fund statutes or in the terms of a contract, but they are hardly comparable between providers. The Polish supplementary pension market is highly opaque, especially regarding costs and returns.

Among a wide variety of pension vehicles, there are only a few products with sufficient official statistics to assess their investment efficiency: employee pension funds (PFE) managed by employees’ pension societies, voluntary pension funds (DFE) managed by general pension societies (PTE) and employee capital plans (PPK). Other products are more complex because supplementary pension savings are reported together with non-pension pots. That makes it impossible to analyse the portfolio allocations and rates of return for individual pension products separately.

After-charges returns of employee capital plans (PPK), voluntary pension funds (DFE), and employee pension funds (PFE) were positive for the whole period of their operation, both in nominal and real terms, and offered the average annual real rate of return amounting to 0.7%, 0.6% and 2.4% respectively. The first year of OIPE’s operation ended with very positive nominal and real results, which also gives cause for hope. But other pension vehicles may turn out not to be so beneficial, especially when a wide variety of fees and charges are deducted from contributions that are paid to the accounts.

To sum up, the information policy and the disclosure policy in the supplementary pension system in Poland are not saver-oriented. Individuals are entrusting their money to the institutions, but are not getting clear information on charges and investment returns. Keeping in mind the pure DC character of pension vehicles and the lack of any guarantees, this is a huge risk for savers. All this may lead to significant failures in the pension market in its very early stages of development. In the future, some changes in the law should be introduced, such as imposing an obligation on financial institutions to disclose rates of return to pension account holders. Moreover, there is an urgent need for a full list or even ranking of supplementary pension products, both occupational and individual ones, published by independent bodies. This would help individuals make well-informed decisions and avoid buying inappropriate retirement products.

Acronyms

- AuM

- assets under management

- DC

- Defined contributions

- DFE

- dobrowolny fundusz emerytalny

- EET

- Exempt Exempt Taxed

- ETF

- exchange-traded fund

- EU

- European Union

- IKE

- indywidualne konta emerytalne

- IKZE

- indywidualne konta zabezpieczenia emerytalnego

- KNF

- Komisja Nadzoru Finansowego

- NDC

- notional defined contribution

- OFE

- otwarte fundusze emerytalne

- OIPE

- ogólnoeuropejski indywidualny produkt emerytalny

- PAYG

- pay-as-you-go

- PEPP

- Pan-European Personal Pension

- PFE

- pracowniczy fundusz emerytalny

- PPE

- pracownicze programy emerytalne

- PPK

- pracownicze plany kapitałowe

- PTE

- powszechne towarzystwo emerytalne

- PrTE

- pracownicze towarzystwo emerytalne

- TDF

- target-date fund

- TEE

- Taxed Exempt Exempt

- TFI

- towarzystwo funduszy inwestycyjnych

- VAT

- value added tax

- ZUS

- Social Insurance Institution

- p.a.

- per annuum

Two years after the change in 2014 that made OFE’s voluntary the insured could again decide about opt-out. After 2016 “the transfer window” is open every four years.↩︎

It started to increase in 2013 and was planned to reach 67 for both men and women (in 2020 for men and 2040 for women), but this reform was canceled three years later. Hence, since October 2017, the statutory retirement age in Poland is again 60 for women and 65 for men. It may result in a situation where a significant proportion of women will get a minimum pension when retiring at the age of 60.↩︎

Money gathered on individual accounts in an OFE is systematically transferred to the ZUS during 10 years prior to retirement (before reaching the statutory retirement age).↩︎

The coverage was calculated according to Statistics Poland (GUS) data on the number of economically active people at the end of 2024.↩︎

Since 2021 there is also a special limit of IKZE contributions for self-employed that amounts to 180% of the average wage (PLN 14 083.2 — EUR 3294.32 in 2024).↩︎

In the unit-linked insurance product, the contribution is divided into two parts: insurance part and savings part. Only the latter is treated as IKE/IKZE, so the insurance cost has to be clearly stated and covered from the former.↩︎